2024 will bring a return to profitability in UK motor insurance

23 May, 2024

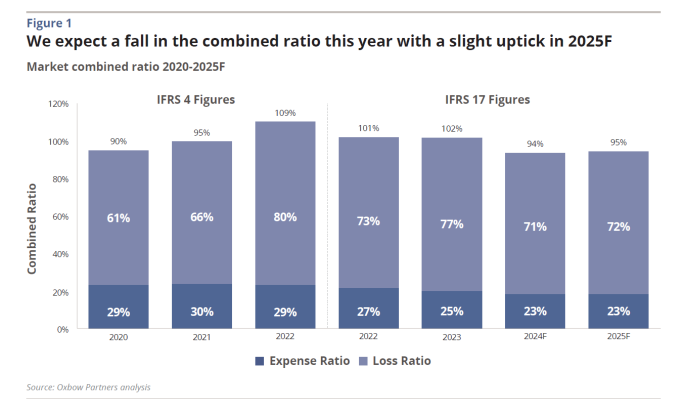

- We forecast a combined ratio for the market of 94% in 2024 increasing marginally to 95% in 2025 based on the results of our proprietary UK Motor Market Model™

- We are expecting GEP growth of 16% in 2024 driven by 2023 written premiums earning through and 7% growth in GWP in 2024

- Claims inflation will remain slightly elevated for much of 2024 as easing in damage claims is offset by increased bodily injury claims

- Expense ratio is set to improve due to premium inflation and cost cutting

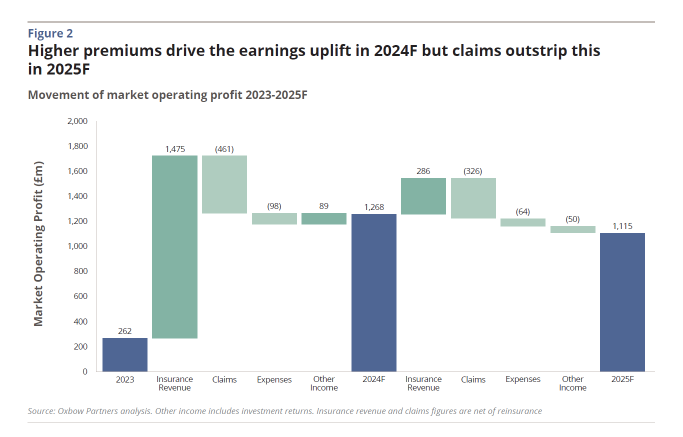

- Market profit is set to reach £1.25bn – an almost five-fold increase over 2023

2023 was a year of change for the UK motor market. We saw record price increases of 25%, ahead of our forecast of 16%, leading to an increase in earned premiums of 12%. Repricing was necessitated by claims inflation, which had not been priced in in 2023 and was higher and maintained for longer than we had expected in 2024.

At the same time, regulatory and legal changes impacted reporting (IFRS 17) and we saw a withdrawal of capacity in the market as some players gave up volume in return for better profitability while others exited the market entirely.

The IFRS 17 combined ratio for the market of 102% in 2023 was better than our 106% estimate, although this has been flattered by the change in accounting standards. Under the old IFRS 4 standards, the combined ratio would likely be closer to 110% in our view. In figure 1 we have shown both IFRS 4 and IFRS 17 figures, which we do for relevant charts throughout the report.

The market outlook continues to be uncertain. In the words of a CEO we recently met, “I should be happy but there are a lot of reasons not to relax.”

We have updated our proprietary UK Motor Market Model™ for 2024 and 2025. It covers individual company data for 19 of the largest insurers in the market, controlling c£13bn of GEP in 2023, which we estimate to be around 90% of the total market. In addition to company results we have cross-referenced our inputs and built our hypotheses through use of external market data (e.g. ONS, ABI, SMMT and multiple interviews with market participants.

In 2024 we expect the market to continue to increase written prices, slightly ahead of underlying claims inflation of 6%. Several key factors will impact this including the Supreme Court multi-injury judgement, whiplash tariffs and Ogden rate change.

As 2023 premiums are earned through, this will drive up gross earned premiums and generate better profitability in the market. We expect COR of 94% in 2024, rising to 95% in 2025 as volume targets come back into the minds of executives and shareholders causing rates to fall again.

With car insurance prices reaching all-time highs, one might expect the market to return to a price cutting race to the bottom in a search for volumes in 2024 and 2025. We do not think this will be the case as our interviews with market participants indicate to us that many players are nervous of being caught out by another inflation shock.

The improvement in combined ratio feeds into an almost five-fold increase in profit in 2024 as the strong underwriting result is backed up by solid investment returns due to interest rates remaining high, even if we factor in some base rate cuts later in the year.

Inflation could drive alternative outcomes

Our analysis above is, in our view, the most likely outcome for the market in 2024 and 2025. It does, however, depend on a variety of macro factors not least of which is inflation. As we saw in 2022 and 2023 inflation shocks can have a significant impact on both market behaviour and performance.

We have modelled two additional scenarios that assume either a rapid economic improvement (lower inflation) or an inflation shock (high inflation). In each scenario we have built a realistic view of how the behaviour of insurers, regulators and the government might change and the corresponding impact on the profitability of the market. Our scenarios provide a combined ratio range from 92% – 99% for 2024.

Register here to receive the report

About the author(s)

Paul De’Ath leads Oxbow Partners Market Intelligence team. Prior to joining Oxbow Partners Paul spent nine years as an equity research analyst covering all aspects of insurance across the UK and Europe. He started his career as an accountant at EY and also spent some time in industry at Standard Life.

The author would like to acknowledge the following for their editorial contributions to this piece: Chris Sandilands and Greg Brown.