Navigate Market Bifurcation

16 January, 2025

In October we published our annual Lloyd’s and London Market CEO Agenda for 2025 – “Leading through uncertainty”. We look at the current market conditions and set out six transformation topics that we believe CEOs should address in 2025:

- Navigate Market Bifurcation

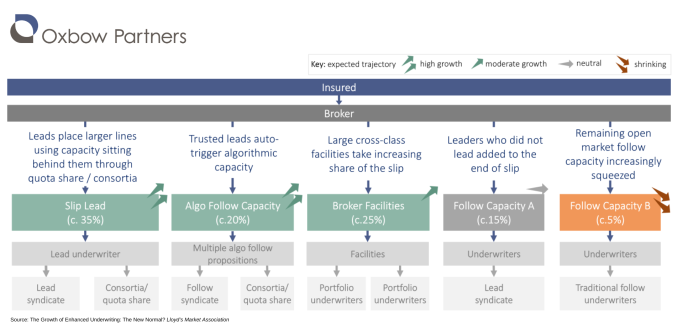

Carriers in the London Market have traditionally operated an integrated underwriting model. Teams have been organised by line of business. Some are led by prominent underwriters able to write portfolios of lead or influencing lines whereas others have been largely follow-oriented. We observe many underwriters taking a more structured approach to their underwriting operating models, a trend referred to as ‘bifurcation’. Where they have ambitions to lead, companies are investing in the best people, data and technology. Leaders will solidify their positions by originating additional capacity through, say, consortia.

At the same time, companies are redefining their approach to follow lines. Principally, this involves a shift from underwriting to portfolio management, and often the development of decisioning platforms. Sophisticated players can deploy different follow strategies from self-follow (i.e. using third-party capacity to follow your own business) to a full algorithmic follow proposition that assesses each individual risk based on real-time risk and pricing models.

The self-follow model highlights the close relationship between market bifurcation and third-party capital strategies. Companies typically see three benefits from their dedicated follow business:

First, they gain strategic flexibility as data-driven portfolio managers are able to quickly deploy capital to opportunities when market conditions change or distribution opportunities emerge.

Second, they can drive diversification benefits by gaining exposure to risk they would not have the confidence to underwrite in-house.

Third, they gain efficiency benefits. Follow models offer an expense ratio opportunity of 5-9 points. We see risks for carriers pursuing traditional follow strategies. Leaders will put down larger lines, potentially supported by consortium capacity. This will then trigger algorithmic follow capacity. Brokers will then place a portion of their business in their cross-class facilities. This leaves very limited space on the slip for other capacity.

Imperatives for 2025

We believe that companies need to have a strong house view on how market bifurcation will play out and where they want to play in the market. This should then seed a strategy about where to lead and follow, and how to play in different channels. They should also consider the impact that differential pricing across the slip would have on this strategy.

Companies then need to review their operating model and build a platform that allows them to win with their chosen models. Often this will require different operating models for the lead and follow businesses – as pioneered by Brit with its Ki syndicate.

We see an opportunity to front-run the market on this topic: early-mover carriers will get market access that allows them to build scale quickly, can create a revenue opportunity from third party capital, and will manage their overall costs.