Q&A – Smart Contracts

28 February, 2020

In our latest guest blog, Nicholas Berry, a corporate partner specialising in the insurance sector at Norton Rose Fulbright LLP, provides answers to some topical questions on smart contracts.

Can you give us a quick explanation of what a smart contract is?

A smart contract is executable code (software) that does something automatically when the conditions for that software to run are satisfied (for example, the release of payment when the smart contract receives electronic confirmation that goods have been delivered).

A smart contract can be used to automate processes. Once it is initiated, the performance of a smart contract cannot typically be stopped.

When I buy a car policy online, I select my limits, excess and add-ons, and buy without any human-to-human interaction. Am I not also creating and executing a bespoke contract?

Yes, depending on the particular online terms, you may well be creating and executing a bespoke contract. A whole range of insurance transactions (B2B and B2C) have been entered into electronically for many years. Case law has confirmed that a contract can form when matters are transacted entirely electronically.

So what then is novel about a smart contract in an insurance context (or indeed, more widely)?

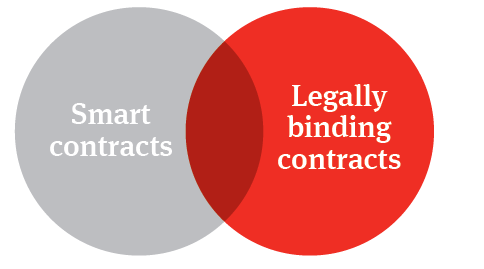

A smart contract, although it includes the word “contract”, may sometimes not constitute a legally binding contract at all. Simply calling something a contract does not make it a legally binding contract unless all the requirements for forming a contract at law are satisfied (for more information, see our publication, Can smart contracts be legally binding contracts?). We therefore see the position like this:

The characteristics of a smart contract that make it different from, say, a contract of insurance entered into on a website are that:

- it is hosted on distributed ledger technology;

- once initiated, it cannot generally be stopped; and

- it can automate processes.

Is a smart contract a digital or legal innovation?

Potentially both.

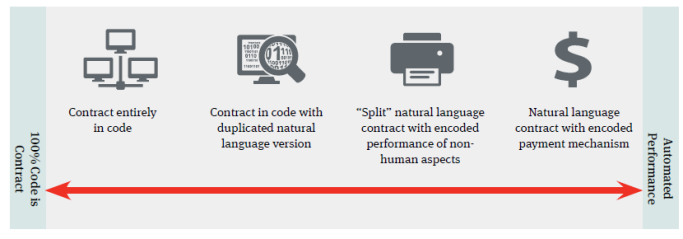

There is a wide spectrum of possibilities as to what a smart contract could be. On the one extreme, there is the “code is contract” school of thought. This school maintains that contracts can be fully expressed in code and that the code can completely replace complex natural language contracts.

On the other end of the spectrum, smart contracts could simply be the digitised performance of business logic (for example, payments). There is a range of intermediate possibilities in between these extremes, as illustrated in the following diagram:

For more information, see our publication, Smart Contracts: coding the fine print.

What is the nature of the digital innovation? Document builders that pull together text blocks and feed in data on things like portfolio value have been around for a long time.

Smart contracts are potentially disruptive, not because they are electronic, but because they are hosted on distributed ledger technology, which (by virtue of the requisite trust it engenders) facilities peer-to-peer interactions. The technology itself provides the trust which two parties, not known to each other, might otherwise seek via the use of an agent or broker. As the technology itself provides the trust, a smart contract may be used to disintermediate existing relationships (for example, brokerage).

Where do you see smart contracts being used in insurance? Are there any good existing examples?

There are a number of use cases in insurance for smart contracts. For example:

- Insurers are considering the use of smart contracting for simple policies – for example, flood or crop policies where automated claims payments are linked to a weather data feed or water level monitor, or for flight cancellation products where flights are automatically rebooked based on publicly available cancellation data. For now, smart contracting is confined to non-complex insurance risks where pre-contractual disclosures are not required and policy wordings are relatively simple with limited exclusions and conditions precedent.

- Industry consortia – many of which are high profile and made up of established insurance and reinsurance names – are developing platforms using distributed ledger technology and smart contracts to digitise information flows across insurance value chains. These platforms are focused on commercial speciality markets with a view to decreasing costs, increasing information accessibility and accuracy and allowing functionalities such as asset tracking, risk management and premium and claims adjustment. Some of these were foreseen in our publication, Digitizing the insurance value chain.

Other applications for the technology might include know your client (KYC), anti-money laundering (AML) registries, and digital identity (client identity passporting – see our publication, Identity use cases and privacy implications).

What is the relationship between smart contracts and blockchain?

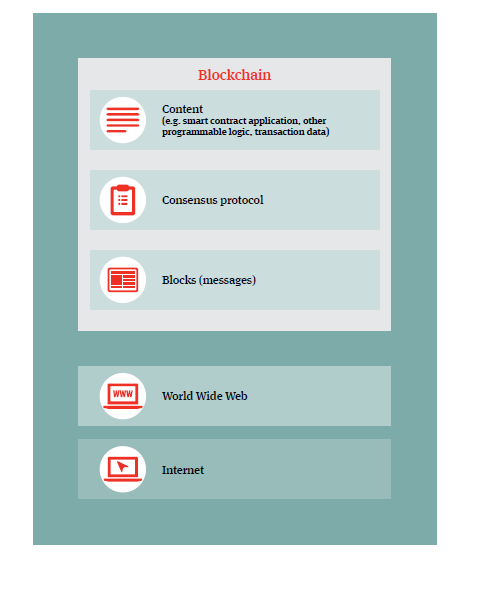

A blockchain is one type of distributed ledger technology (see our publication, An introduction to blockchain technologies). As mentioned above, a smart contract is hosted on a blockchain. Conceptually, one can visualise it like this:

Do you think smart contracts will be a mainstream or niche technology in 2030?

Smart contracts in the form of code to automate processes will likely be mainstream technology in 2030.

It is less clear whether smart contracts which attempt to apply the “code is contract” school of thought will be mainstream by then. Rather, it is likely we will see hybrids emerging. Some have already been proposed, such as smart contracts that refer out to traditional legal terms and conditions in a “split model”. For more information, see our publications, Smart Contracts: coding the fine print and Can smart contracts be legally binding contracts?

© Norton Rose Fulbright LLP 2020