Risks and opportunities for insurers from the ESG wave

30 July, 2021

ESG continues to be a major topic for insurers and reinsurers around the world. According to BlackRock, 78% of insurers believe COVID-19 has accelerated their focus on ESG, and the launch of the ESG guide by the Principles for Sustainable Insurance initiative in June 2020 has highlighted the growing importance of integrating sustainability practices into global insurance.

We spoke to Julian Richardson, CEO and founder of specialist energy and climate risk finance company Parhelion, about the opportunities and risks ESG presents for the insurance industry. Founded in 2006, Parhelion offers both advisory and insurance services for the renewable energy and climate finance sectors. Julian agreed that ESG momentum has been building for several years in insurance and argued that the industry (and society at large) had now reached a key inflexion point where the question is no longer, “what should our response to ESG be?” but “how do we pay for it?” Firms can no longer get away with simply Greenwashing their financials (making unsubstantiated claims used to deceive consumers into believing a company’s products are more environmentally friendly than they are) and now recognise the need to build not just “a new normal after COVID-19 but a new better.” Julian also highlighted that “Insurance often forgets its own capacity for social utility and has an enormous amount to contribute to the fight against climate change in terms of both capital and underwriting.”

Taking inspiration from this discussion we have laid out our views on the various risks and opportunities associated with integrating ESG which firms ought to think about.

The ESG opportunity and risks for insurers

ESG is here to stay and the insurance industry has been keen to get involved and sign up to net-zero commitments but what are the real impacts for insurers? There are a number of opportunities and risks for insurers to manage as the wave of ESG washes over the industry which we set out below.

ESG as a rating factor

Effective risk analysis is key to delivering a positive underwriting result, and a central source of insurers’ competitive advantage. Until recently, little work had been done on investigating the potential to incorporate ESG ratings into existing risk analysis frameworks. However, recent research by Allianz has found that ESG information can be of relevance in assessing a company’s risk management performance. Perhaps unsurprisingly, the research found that higher rated ESG firms were less likely to suffer incidents such as workplace-related accidents, reputational damage, or fines.

Whilst this correlation confirms that ESG indicators are measuring the factors they intended, the relationship was identified at a broad level across the three pillars of ESG, making it of little use in policy specific risk analysis. Where insurers can unlock a real advantage is in the identification and application of specific predictive ESG indicators. For example, the Workforce Health & Safety score, which is a constituent of the broader ‘Social’ dimension of ESG, was identified by Allianz’s research as a superior predictor of future workplace fatalities than the use of a historical accident rate. The identification and application of these more specific indicators will allow insurers to improve their risk analysis and pricing. In addition, by monitoring these indicators throughout the relationship, insurers will be able to provide insight to their clients on where potential risks may be emerging before they result in a claim. For example, Parhelion’s underwriting process is supported by extensive ESG data which allows them to identify emerging risks and support clients in their risk mitigation efforts.

Investing for positive returns and environmental benefits

The relationship between the ESG rating of a given security and its market value is currently ambiguous. Whilst Fidelity International has found that higher ESG rated stocks outperformed weaker rated stocks nearly every month in 2020, research undertaken by Allianz Global Investors has concluded that higher ESG ratings on their own do not lead to a positive returns delta. Therefore, skewing an investment portfolio towards higher rated ESG stocks is unlikely to deliver out-performance. The discrepancy between these findings stems from the absence of a universal way to assign ESG ratings. Major ESG ratings providers such as MSCI ESG Research and Sustainalytics often assign very different rankings to the same securities because they use different criteria, creating an inconsistent picture of how highly rated ESG securities perform.

However, it is clear that securities with consistently low ESG ratings have an increased chance of being exposed to idiosyncratic tail risks that can have catastrophic impacts on a security’s price. VW and BP clearly illustrate this: both firms experienced major events (the emissions scandal and Deepwater horizon explosion respectively) shortly after more minor ESG issues that had resulted in them being awarded below average ESG ratings.

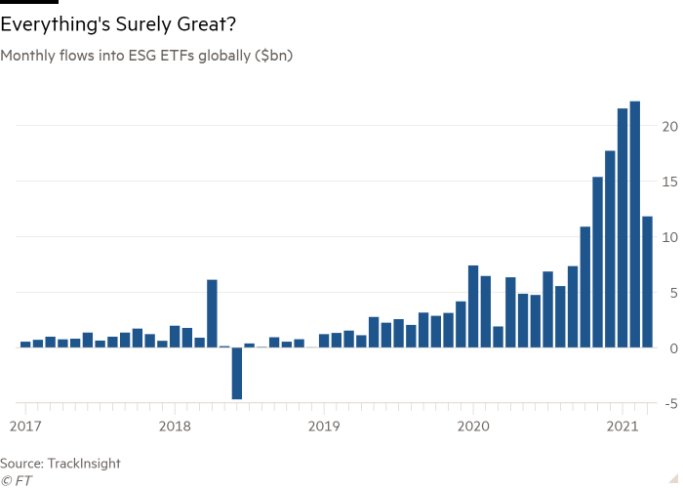

Even if the link between performance and ESG is not entirely proven, there is no denying the popularity of ESG as an asset class at the moment with fund flows into ESG ETFs increasing to over $20bn a month around the start of 2021.

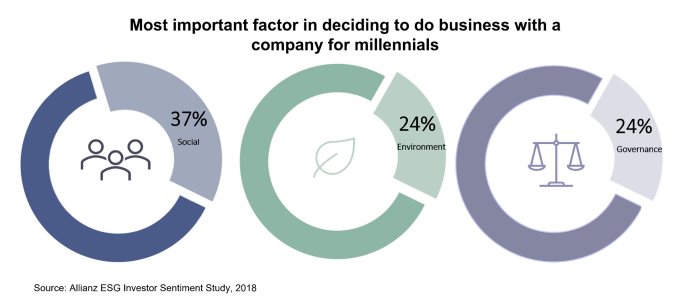

There is also strong evidence that mid-term demographic shifts will create a consumer base willing to pay more to ensure the ESG credentials of their investments than previous generations: 64% of millennials are likely to invest based on ESG factors in comparison to 42% of ‘baby boomers’. This is likely to result in existing highly rated ESG stocks seeing a permanent jump in demand that is not based off business fundamentals.

As a result, nearer-term opportunities will emerge if insurers can focus less on current ESG ratings and instead focus on ‘ESG momentum’. Investing in ESG is not purely a matter of performance. Aviva’s commitment to being a Net Zero carbon emissions company by 2040 means that they will divest from all companies which make more than 5% of their revenue from coal by the end of 2022 unless they have signed up to the Science Based Targets initiative. As major investors, insurance companies have the ability to promote environmental considerations across many other industries.

Reputational risk and opportunity

For those that do it right, ESG can present an opportunity to create a closer and more engaged relationship with customers. Lemonade has managed to strike a chord with many millennial renters who appreciate the “insurance with a conscience approach” taken by the business. The charity donations that Lemonade make as part of its business model are front and centre of its marketing. The reality is that only a very small proportion of premiums actually get paid to charity but this (currently) doesn’t really matter as the marketing is sufficient to attract customers. We would expect more insurers to highlight their ESG credentials in new products and marketing, particularly to the younger echelons of society.

ESG factors are not just an opportunity for insurers. Those that are seen to be missing the mark on subjects such as climate change can feel the wrath of customers and activists. Lloyd’s of London has been targeted more than once (most recently in the last few days) by Extinction Rebellion protestors, angry at the fact that Lloyd’s continues to insure fossil fuel companies. Despite its commitment to “accelerating its transition towards a more sustainable insurance and reinsurance marketplace”, having “set out specific actions and commitments to align with the goals of the Paris Agreement”, Lloyd’s has come under pressure to move faster and stop insuring any fossil fuel companies and projects. This is just one example of how even when insurers are doing the right thing they can be impacted by negative publicity around ESG. In the case of Lloyd’s, it is unlikely to have a major impact on its new business or profitability but other insurers may see more significant damage.

The Oxbow Partners View

We believe ESG considerations will continue to become more central to the strategies of all firms – both public and private. There will also be increased regulatory pressure in the space for insurers. Whilst initiatives such as the Principles for Sustainable Insurance (PSI) have focused on providing guidance rather than ‘hard’ regulation, the recent introduction of the EU’s Sustainable Finance Disclosure Regulation (SFDR) is likely a taste of further regulation to come. The SFDR means institutional investors marketing products in the EU must disclose how sustainability risks were incorporated into investment decision making.

With these trends in mind, it seems clear that the quality and quantity of ESG data available to insurers will only increase; how insurers use this data to derive proprietary insight will determine the competitive advantage that they can reap. Based on this, there are three key steps for insurers to take:

- Insurers should conduct a strategic review of their data infrastructure and governance to ensure that they are well positioned to efficiently ingest and process these new sources of data

- Senior managers must engage with both the investment management and underwriting sides of their business to make sure that the rich source of data that ESG represents is fully appreciated and utilised by the business

- Insurers need to decide if they are going to be leaders or followers on ESG. Leaders need to fully commit the time and resources to embedding ESG into the culture of the organisation in order to reap the potential benefits to reputation and connectivity with customers

Please get in touch to find out how we can help your firm navigate these emerging ESG trends. Furthermore, subscribe to UK Market Intelligence to receive this insight straight to your inbox.

Get market insights straight to your inbox