Set out a strategy for Delegated Authority / MGAs

23 January, 2025

In October we published our annual Lloyd’s and London Market CEO Agenda for 2025 – “Leading through uncertainty”. We look at the current market conditions and set out six transformation topics that we believe CEOs should address in 2025:

2. Set out a strategy for Delegated Authority (DA) / MGAs

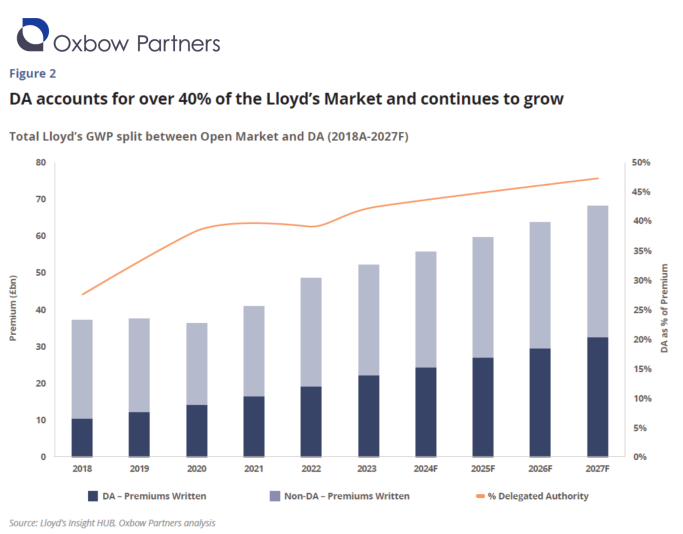

Delegated Authority business has grown significantly over the last decade in both absolute and relative terms. Our analysis shows that DA business has more than doubled from £10.4bn in 2018 to £22.1bn in 2023, increasing its share of the Lloyd’s market from 30% to over 40%. As the market softens, this trend is likely to accelerate and we expect DA to exceed 45% of market premium by 2027.

The target state of DA seems clear. We expect coverholders to operate as digital ‘front ends’ for underwriters, creating a seamless digital journey from brokers to capacity providers. This will allow the reporting relationship between distributors and underwriters to move from periodic performance reviews to ongoing dashboard-based monitoring. This will give carriers a live view of their portfolio, enabling short-term optimisations that should lead to lower volatility, lower loss ratios and lower costs.

This is not another pie-in-the-sky innovation idea. Some managing agents are already running similar business models, for example AEGIS’s OPAL platform and Convex Digital. Canopius VAVE is a fully digital MGA that allows brokers to distribute white-labelled products. However, it is important to recognise that this digital model is not yet widespread. The dominant approach in the market today remains bordereau-based, and coverholders continue to send often poor-quality data in numerous different formats to underwriters for processing at considerable operational effort and therefore expense.

Significant barriers to mass adoption remain, and carriers have limited control over many of them (as is the case in other distribution channels). Most notably, carriers cannot influence the overall technological capabilities of coverholders or their ability to support API connectivity. Indeed, incentives are not aligned: much of the benefit of digital DA accrues to underwriters whereas coverholders might be disinclined to raise transparency of their performance data.

Given the relative lack of focus on DA over the last few years, many carriers have built up operational and technology debt in their businesses.

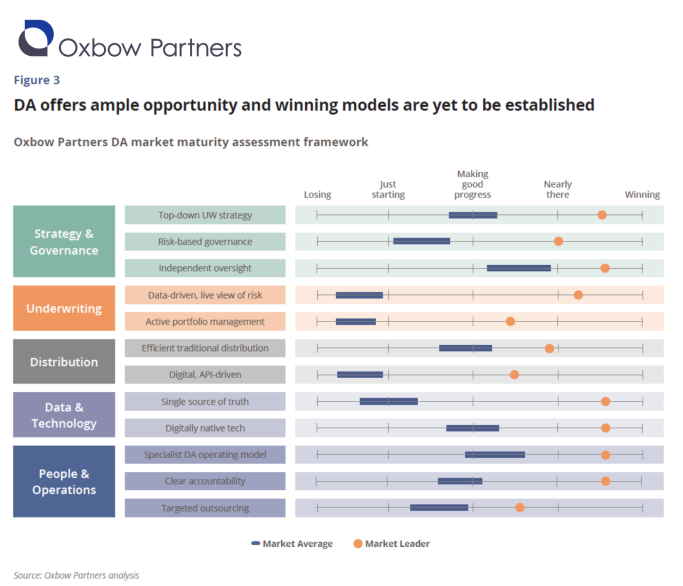

It is difficult to excel across all capabilities and carriers need to identify which capabilities are mission-critical to their business plan and which are hygiene factors. In other words, where does the business want to outperform and where does it just need to be good enough? The answer will be different for each player depending on their lines of business, target market segments, brand messaging and current level of maturity.

We see a broad spread of current capability across the market.

Imperatives for 2025

As DA grows and peer group models mature, carriers need to have a deliberate strategy for DA with appropriate capabilities. Those treading water in the market risk anti-selection as market conditions tighten.

The first step is to set a commercially robust DA strategy. This must cover the ‘north star’ ambition for the business, a view on where to play, how to win, and the enabling capabilities required.

The second step is to define the DA operating model, and the third is to establish a technology backbone to deliver the business. This should include a single data repository, coverholder onboarding and management workflow, bordereaux ingestion and management, and an API Gateway.