Shanghai Global Reinsurance Platform

12 December, 2023

On 26 October the Shanghai Insurance Exchange launched its reinsurance platform, the Shanghai Global Reinsurance Platform – just four months after the National Administration of Financial Regulation and the Shanghai government announced its development in June.

The first deal transacted on the platform was between AXA Hong Kong Property & Casualty (cedent) and AXA Tianping Property & Casualty (reinsurer). The business was cross-border motor insurance in the Guangdong-Hong Kong region.

The platform is a natural next step for the Chinese government and its ambitions in financial services. Chinese banks are now well embedded in Western financial services (and insurance professionals will note that China Construction Bank was at the centre of the recent Vestoo fraud). Chinese insurers, on the other hand, have not made inroads into Western direct markets (without investing in local brands like Chaucer) and the Chinese market is heavily reliant on Western players for “professional” reinsurance capacity.

A senior member of the national regulator appeared at the announcement of the platform, which demonstrates a level of priority for the government.

What is the platform?

Details are opaque but Oxbow Partners has been able to glean some insight from interviews with local executives.

A total of eight companies have been accepted onto the platform, of which six are local players plus AXA and a Japanese insurer.

We understand that the Shanghai Global Reinsurance Platform has ambitions to become a digital hub, but that this functionality is not yet available.

We also understand that transacting on the platform provides some tax benefits over other placement routes.

What does it mean for Western reinsurers?

Shanghai clearly has ambitions to build a reinsurance hub in the East, perhaps taking inspiration from Lloyd’s or Bermuda.

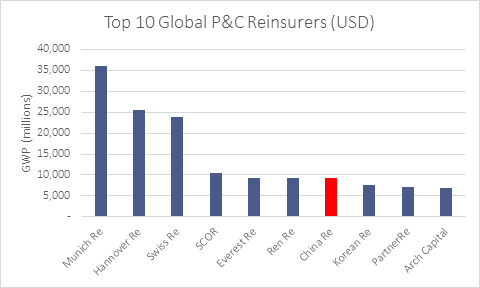

Despite the capital available in China – China Re writes $9.2 bn of P&C GWP, making it the seventh largest P&C reinsurer in the World – it is hard to envisage the Shanghai hub rivalling established Western trading centres or individual players in the foreseeable future: for that China will need to fundamentally transform its regulatory environment, level of expertise, and business culture.

However, we could imagine that there is a credible medium term play here focused on the local market and China-oriented economics. The latter includes some Asian countries, but also other emerging economies associated with the Belt and Road Initiative.

In the immediate future, we therefore see this as a topic for local companies looking to optimise their Chinese balance sheets rather than as a topic for Western reinsurers looking for growth.

About the author

Chris Sandilands is a Partner at Oxbow Partners. He leads engagements across strategy and transformation, focusing most of his time on global reinsurance and UK & Ireland retail insurance.