The Four Ages of Insurance Technology

16 May, 2020 Greg Brown

Insurance technology has evolved significantly over the last 40 years. The role of technology has shifted from subservient record keeper to becoming the beating heart of (re)insurers and brokers.

In this post we explore how technology has evolved over four ages and how technology leadership must evolve to maintain relevance in the current age.

The evolution of insurance technology

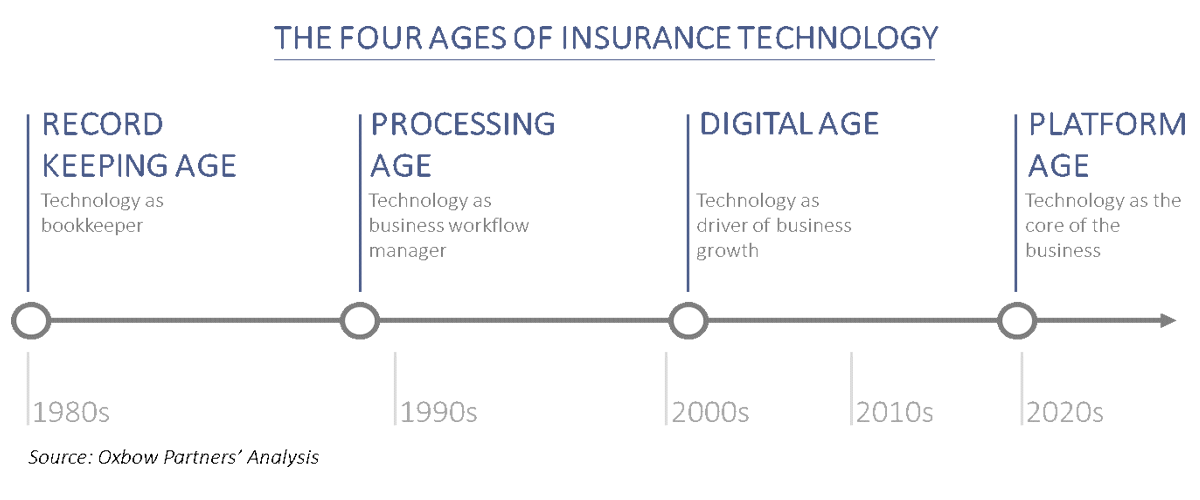

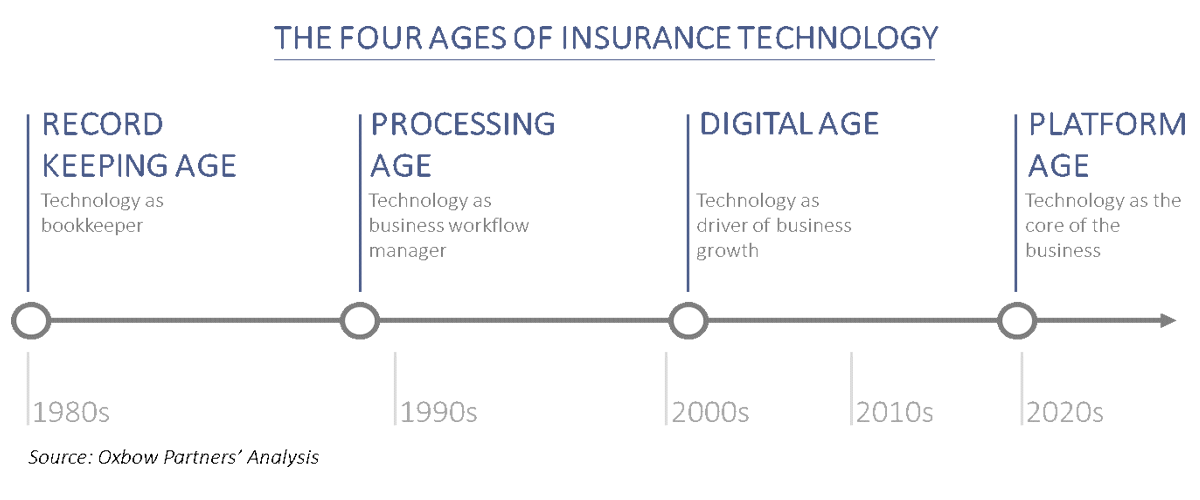

Our analysis shows that insurance technology has evolved over four ‘ages’ from the Record-Keeping Age from the 1980s through to the modern-day Platform Age.

At a macro level you could argue that the insurance industry is making the transition from the Digital Age to the Platform Age. Although examples can still be found of companies that remain in earlier ages – for example, small owner-managed local brokers.

The role of technology has changed drastically over these phases. In the Record-Keeping and Processing Ages, technology was predominately a back-office function. Technology was typically backward looking, recording the days takings. The technology team’s efforts were focused on ensuring the base infrastructure is up and running – ‘keeping the lights on’. IT was seen as a cost by the business – something that is at best invisible and at worst a reason for frustration.

The Record-Keeping Age evolves into the Processing Age as personal computing becomes ubiquitous in the workplace. Technology moves beyond data repository and starts to manage core processes. The link between technology investment and business value becomes much clearer – although technologists are still some way from having a seat at the top. Technology leadership is typically at the ‘Head of’ level and reporting into finance or operations.

As we move into the Digital Age technology takes a fundamental shift. It now sits front and centre as a driver of business value. Brokers and insurers are increasingly reliant upon business originating via the online channel. In the UK, we see aggregators gain dominance in personal lines and the growth of eTrading in commercial lines. Technology teams are becoming much more integrated with business teams.

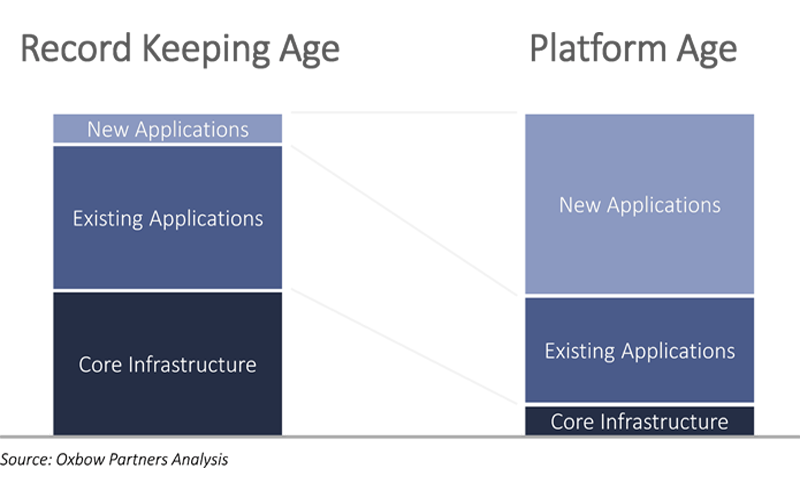

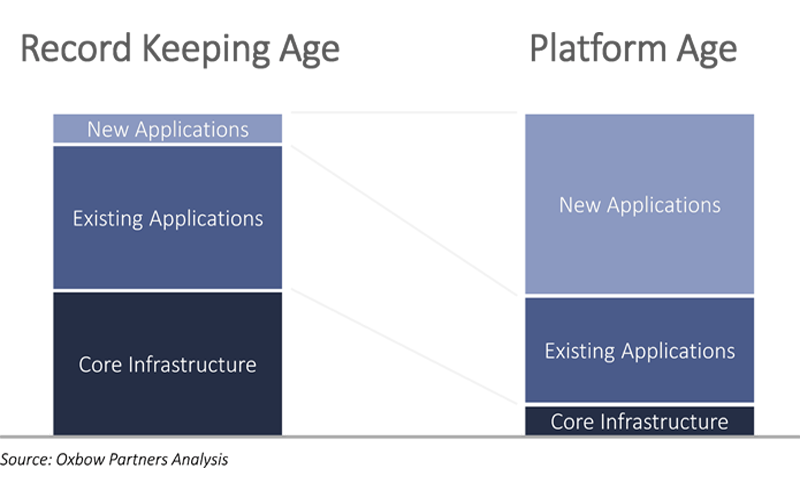

In the Platform Age, technology and the business become fundamentally inseparable. Cloud technology is a given and APIs have allowed technology to be much more easily componentised. This means technology teams can focus their time and effort on new customer and colleague facing functionality and application development – core infrastructure and commodity components are handed over to other technology providers (e.g. Stripe for payments and AWS or Microsoft Azure for infrastructure).

In the Platform Age, Artificial Intelligence (AI) and Machine Learning (ML) start to play a key role. Whereas previously AI / ML technology was the slave, programmed to enact a predefined set of rules (i.e. ‘if the quote value is above £1,000 then route to specialist team’), now the technology is used to make ‘conscious’ choices on behalf of the business (e.g. Lemonade’s claims robot ‘AI Jim’ which used AI to spot a fraudster using disguises to make multiple insurance claims). Technology is no longer a lesser partner to the business; technology is the business.

Outside of insurance, players such as AirBnB and Uber are leading the way in the Platform Age. Without the technology these businesses fundamentally do not exist. In insurance Lemonade and Bought By Many are two obvious examples of businesses built in the Platform Age.

Evolution of technology leadership

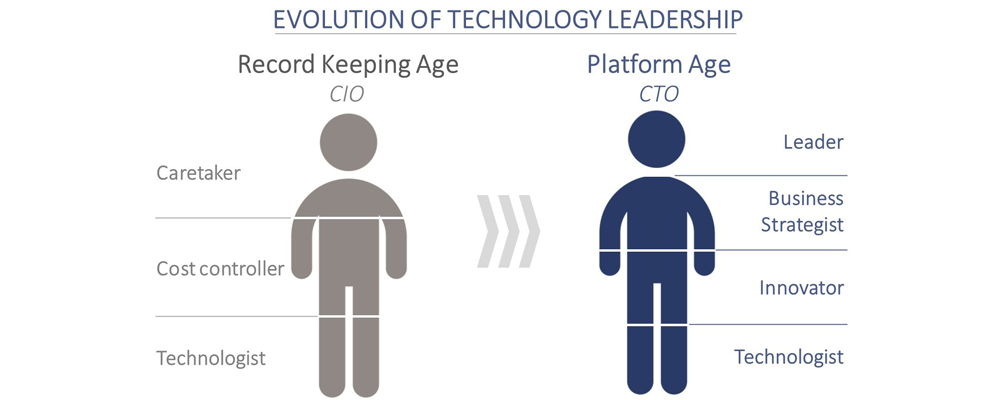

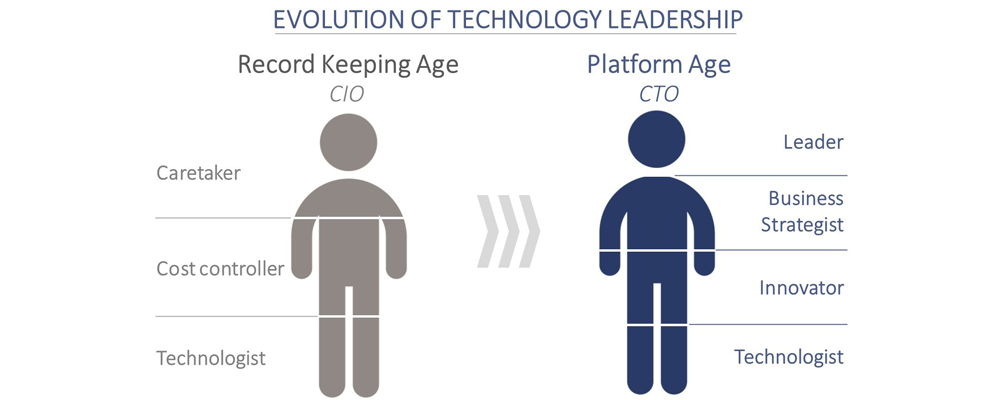

The evolution of technology naturally requires an evolution in technology leadership. In the early Ages, technology leaders were chosen for their ability to keep the ‘lights on’ and keep a tight rein on costs. Over time, as technology projects grew in scale and complexity, the value provided by leaders narrowed towards their ability to manage large scale ‘big bang’ implementations. In some organisations the focus was so much on the scale of projects that, counterintuitively, technology experience was valued less than implementation experience.

In the Platform Age, ‘big bang’ implementations are anathema and cloud technology means infrastructure is taken care of. Technology leaders can, therefore, focus their time on the business and its desire for innovation and evolution. Individuals are once again valued for their technology experience.

The decision-making role of technology leadership also changes. In earlier ages, technology teams are delivering large-scale waterfall projects. These projects have a few major milestones. The IT decision-making has to sit at the top of the organisation (i.e. with the CIO).

In the Platform Age, and arguably the Digital Age too, due to the decentralisation of the technology and speed at which technology can be implemented, technology leadership can no longer have full control of the decision making. These decisions are delegated into the cross-functional delivery teams. The role of the CTO becomes about setting up the technology part of these teams and putting in place the right framework to allow them to be self-organising and to have the right skills to identify, design, prioritise and implement new initiatives without the need, in most cases, to seek approval from ‘on high’.

The CTO’s relationship with the business also changes. The CTO and CEO are equals at the board table, albeit with different and complementary skills. Strategic decisions are made collaboratively. To be truly valuable, CTOs must have a holistic view of the business and understand what makes the business ‘tick’ commercially speaking.

Identifying Platform Age Technology Leaders

Barring a few exceptions, most (re)insurers and brokers are some way from entering the Platform Age. However, the change does not happen overnight and managing through the transition will be critical.

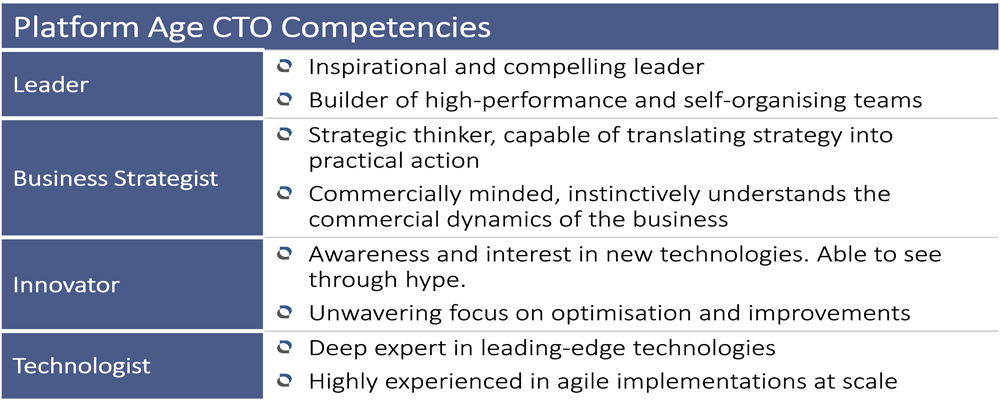

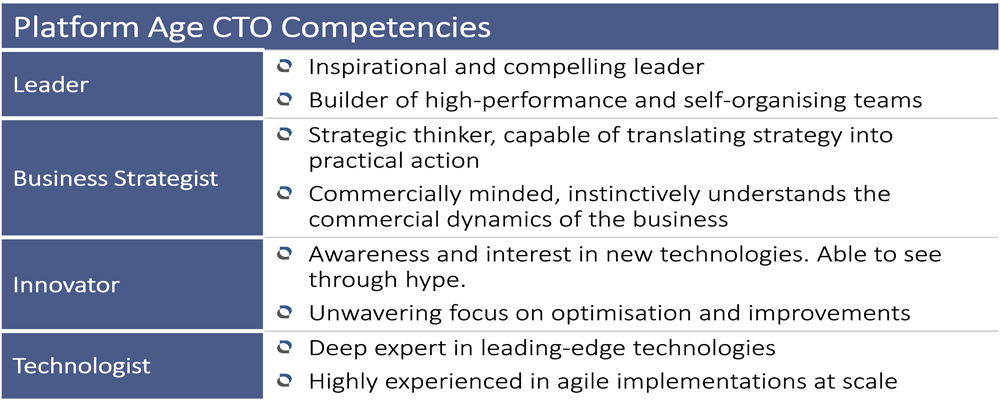

A key part will be identifying and putting in place the leadership. The following identifies the four core skills that a CTO needs to have to be successful in the Platform Age.

Selecting the right individuals will be challenging, particularly for traditional insurers and brokers with no direct experience of ‘Platform Age’ technologists.

Conclusion

The Platform Age is upon us. Insurers and brokers need to embrace the change to remain relevant. Putting in place the right leadership is critical. Poorly chosen leadership will hold the organisation back, whether through trying to maintain the status quo or possibly worse, overestimating the pace and relevance of technology evolution and as a result distracting the business with uncommercial flights of fancy.