It is no secret that the insurance industry is still heavily dependent on legacy platforms. Not only is it difficult to maintain these platforms, but building or integrating new functionality requires jaw-dropping investments. The rigidity of these legacy platforms continues to be a barrier to growth, pushing some insurers to break away from the single-platform model towards new technology ecosystems.

In this blog post we look at what a ‘technology ecosystem’ really is, why it has come about, how different insurers are responding to it, and what some of the pitfalls are.

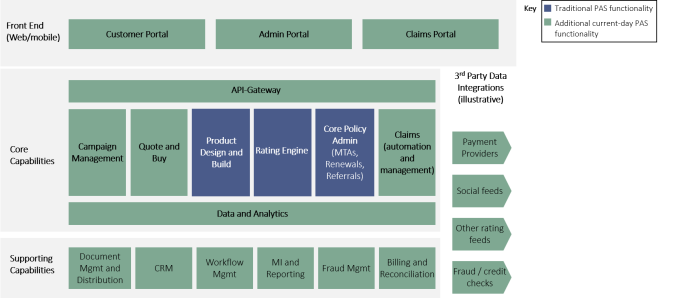

Historically policy administration systems (PAS) provided just three main functions: core policy administration, rating, and product design and build. PAS vendors continued to build upon this functionality over the years to include everything from digital claims management to customer portals on one ‘full stack’ platform (see figure 1).

In the last 10 to 15 years full stack PAS vendors, such as Guidewire and Duck Creek, have dominated the insurance technology market. These types of vendor promise to meet the full range of insurance technology needs but sometimes struggle to deliver new requirements. Updating them often requires significant effort and investment and they are not built to easily integrate with emerging service providers.

For this reason, insurers are starting to reconsider their technology approach. Rather than depend on one platform to provide full PAS functionality, IT teams are experimenting with technology ecosystems.

Technology ecosystems connect together cutting-edge, often niche, systems that specialise in specific functions to create a ‘perfect’ PAS. To build a true ecosystem model, insurers need to replace legacy platforms with a suite of interconnected systems.

Since full ‘rip-and-replace’ projects are not popular, insurers are instead testing ‘hybrid’ ecosystems. This model creates a layer of niche systems that sits on top of the legacy platform. The hybrid model is not as flexible as a true technology ecosystem but acts as ‘training wheels’ to allow insurers to migrate away from legacy platforms.

2) What’s driving the interest in ecosystem models?

There are 3 main reasons why the technology ecosystem is now gaining traction:

Growth of API-native technology: APIs are a type of digital ‘plug socket’ which allow systems to integrate quickly and exchange data seamlessly. This makes combining new systems into a technology ecosystem significantly easier than trying to add functionality to legacy and full stack PAS, which can lag behind in integration capability.

Growth of cloud-based platforms: Cloud-based platforms remove some of the headaches of getting multiple systems up and running. Historically a significant amount of a CIO’s time was spent thinking about core infrastructure (e.g. networks, server provisioning, system maintenance). With cloud-native architecture that headache is now handed over to someone else such as Microsoft or Amazon, leaving CIOs with more time to manage true value adding technology.

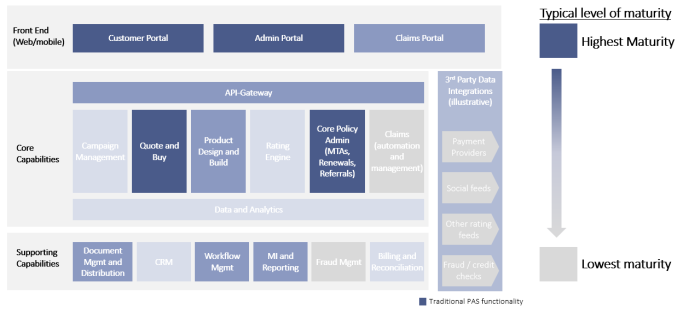

Maturity of insurance vendors: New tech players are immature. The majority of InsurTech vendors in the policy administration space are less than 5 years old. As a result their tech stack and functionality lack those of a ‘monolith’ system (see figure 2). This is not always down to design but due to the time available to build up their functionality. This means new technology vendors need to collaborate with other vendors to be able to provide a full stack.

The following diagram summarises how mature new technology vendors are for each functional area.

3) How are insurers responding?

Despite the rise of the technology ecosystem model, some insurers are not taking on the challenge of moving away from legacy and full stack platforms.

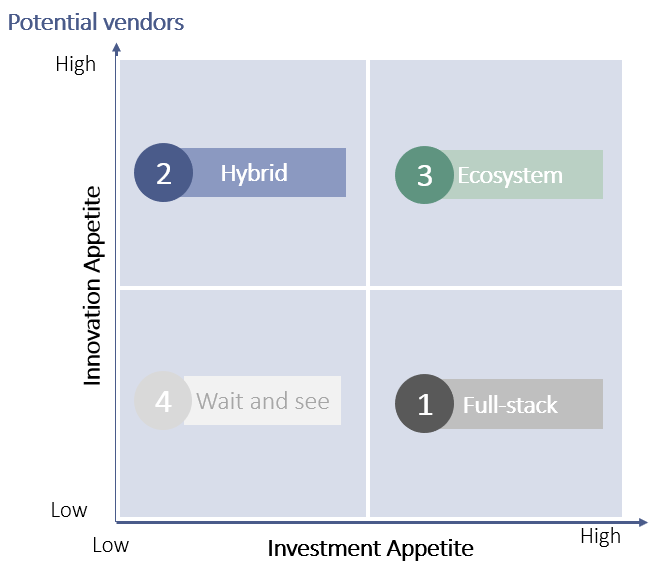

Our analysis shows that most insurers segment into 4 categories based on their appetite for taking on ‘innovation risk’ and their appetite for large-scale investment. The appetite for large-scale investment is often inversely correlated with recent investments in technology.

Figure 3: How insurers are responding to the rise in technology ecosystem models

Full stack: The full stack category comprises risk-averse insurers with significant investment appetite looking for ‘tried and tested’ technology stacks. It is a popular approach since it usually involves just one supplier providing the full policy administration system often with out-of-the-box and pre-integrated functionality. The industry experience that full stack suppliers have also plays in their favour.

Hybrid: This category consists of insurers with legacy systems that are adding API-based or digital layers over their legacy platforms. These insurers have often made significant investments in technology in the last 5 years. They want to maintain a leading position in the market but want to avoid the hassle of a full replatform. AXA, for example, found their legacy platforms couldn’t keep up with the demand for digital insurance distribution in Asia. They integrated a digital front layer on top of their legacy platforms to allow digital distribution partners to access AXA products.

Full technology ecosystem: Insurers with significant technical debt, investment appetite and a willingness to take risks are most likely to aim for the full ecosystem category in the hope of leapfrogging competitors. Argo and Talanx HDI are among some of the players making headway in this category. They have partnered with Instanda, an API-native core insurance platform built to integrate with the latest niche systems (see our Bitesize profile). Instanda allows insurers to quickly onboard new functionality at a much lower cost than traditional transformation projects.

Wait and see: Risk-averse insurers with recent investments in core systems fit into the wait-and-see category. These insurers have little innovation risk appetite and will typically wait for their core provider to release capability updates. If adoption of the ecosystem model picks up quickly, these insurers will struggle the most to keep up with competition.

The Oxbow Partners View

No one can predict how quickly insurance technology ecosystems will mature – consider the hype around InsurTech – but the clear benefits of the ecosystem model mean that even risk-averse insurers need to experiment. Those who do not risk being left behind.

If you are looking for advice on insurance technology ecosystems get in touch with us at [email protected]. We can help you navigate the technology market and use our database of over 500 insurance-relevant systems to help you find systems quickly and with confidence.