Vitality has joined forces with Covéa to launch a new motor insurance product in the UK. While new insurance brands in the motor space are not necessarily ground-breaking, we believe that this is a proposition that many in the industry should be watching closely.

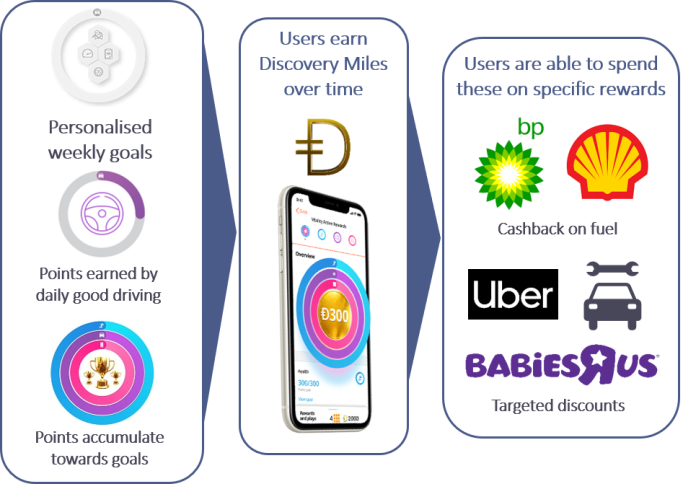

While we do not know exactly what the proposition in the UK will be, we have a good idea based on Vitality’s parent company, Discovery, which already operates a motor insurance business in South Africa. Discovery Drive uses nudge theory and telematic technology to positively modify policyholders’ behaviour through app-based rewards.

These rewards are provided on a weekly and monthly basis to the users who can then use them for such things as 50% cash back on fuel, 25% off Uber trips and 20% off car servicing. The rewards scheme acts as a useful hook for attracting new business as well as getting customers actively engaged with their insurance product on a regular basis. The added benefit for the insurer is customer self-selection, as only those who think they are good drivers are likely to apply.

UK launch in Spring 2021

Vitality life and health is already an established brand in the UK market with over one million customers using its platform of rewards and incentives that encourage healthy behaviour. The idea is simple: give customers rewards for doing things that could reduce their insurance risk. In the current model this is most obviously summed up by the headline-grabbing free Apple watch but also includes discounts on active wear such as trainers (I got some half price running shoes) or healthy shopping from Waitrose.

The launch into motor insurance is being done in conjunction with Covéa and will most likely initially target the life and health customer base of Vitality. Indeed, the advertising has already started in earnest in the app, online and via the Vitality magazine. At launch Vitality guarantees it will beat its customers’ renewal quotes and give them an Amazon gift card of up to £50.

The UK motor market is currently dominated by aggregators which lead customers to the lowest price. We don’t yet know if Vitality is planning on distributing via aggregators but we would expect that the nature of the product would suit a more direct approach in order to highlight the benefits. The combined impacts of the FCA Pricing Fairness rules and COVID could make this a great time to enter the market with a differentiated product. Pricing Fairness could reduce price competition and make customers think more about the value of the overall offering. The post-COVID landscape could see more home-working as normal for many customers, making a pay-as-you-drive model (or in Vitality terms – rewards for car-free days) more appealing.

Is this a game-changer for telematics?

Telematics have been around in UK motor for some time now and have largely not managed to move outside its established niche of young drivers. The fundamentals of the Vitality Drive product are similar to many other telematic policies but the fact that it is selling to an engaged customer base already focused on behavioural rewards could see the business getting strong traction in the market.

Looking back at the South African business for a moment, Discovery Insure has delivered a 6% market share from nothing since 2011. Over the last five years the premium growth rate has been significantly in excess of the local market leader with growth of 15% even in the testing conditions of 2020.

Profitability has also been improving rapidly with a 59% increase in operating profit in 2020 and a combined ratio 2%pts lower than Santam despite still being significantly smaller in scale.

Should incumbents be worried?

It is easy to find reasons to dismiss the potential impact of Vitality entering the market. The UK motor insurance market is unlike any other in the world and customers are so focused on price that it is hard to make a value-driven proposition successful. That said, the fact that Vitality already has an established customer base makes it an intriguing prospect and one that insurers of all sizes should be watching closely.

The FCA’s impending regulations on pricing fairness could also change the insurance landscape in favour of brand and value providers boosting the case for Vitality’s launch being successful.

Our Market Intelligence team has recently published a comprehensive research note on Vitality’s entry into the UK motor market that is exclusive to our Market Intelligence subscribers.

Contact our Market Intelligence team for more information on how to gain access.

Contact Market Intelligence