What is London Bridge 2?

2 June, 2025

London Bridge 2 (LB2) was set up in 2022 to enhance the accessibility of Lloyd’s for new investors and with the objective that institutional capital becomes a more meaningful source of capital for the market.

It provides greater flexibility and risk transfer options than its predecessor, London Bridge 1, allowing Members to raise corporate member capital to support Syndicate underwriting plans, and/or to include collateralised reinsurance in Syndicates’ outwards reinsurance programs.

LB2 is a protected cell company domiciled in England and regulated by the PRA and FCA and provides:

- Access to capital: LB2 is licenced to reinsure Lloyd’s business and issue securities (debt or equity) to fund those transactions.

- Segregation of risk: A new cell is used for each transaction meaning that the liabilities of each cell are ringfenced for insolvency purposes.

- Easy set up: LB2 has enhanced regulatory permissions allowing new transactions to be set up without the need for further regulatory approval (subject to compliance with the scope of permissions).

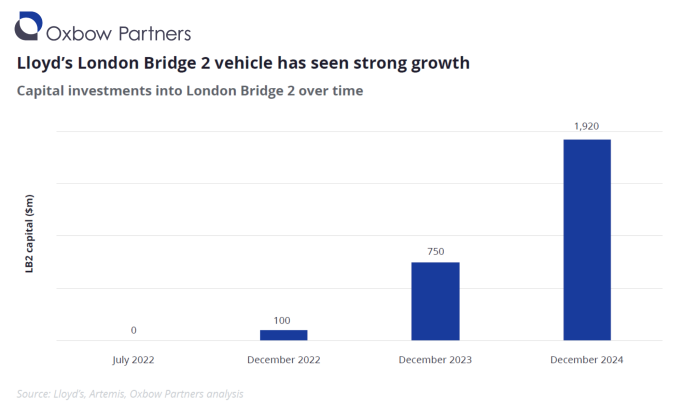

Passive investment in the London Market is set to increase through the use of London Bridge 2. The launch of LB2 in July 2022 as a way of packaging collateralised reinsurance has boosted the flow of institutional capital into the market. LB2 has written $1.9bn of capital with more than $1bn of that in 2024 alone showing an increasing appetite for London Market risk within the institutional space.

At its heart, passive investment into specialty insurance (either in London or elsewhere) allows for noncorrelated risk and return compared to ‘traditional’ investments. Underwriting returns on specialty risks are not generally aligned to interest rate or equity market movements and therefore should provide returns when other asset classes come under pressure. The returns are generally good but the risks can be severe in the worst case scenario, leading to many investors only placing a small proportion of their assets in insurance linked securities. We expect this to remain an attractive asset class over the coming years as more investment houses understand the risks and benefits that it can deliver.