Emerging technology ‘s-curves’ in insurance

April 16, 2018 Chris Sandilands

Followers of the broader tech scene might be familiar with Andreesen Horowitz’s market analyst, Englishman Benedict Evans. (If you don’t know him, you might like to subscribe to his weekly newsletter linking to interesting tech stories.) He recently gave the keynote at the annual ‘A16Z’ (because I’m not the only person who has to look up how to spell Andreesen Horowitz) ‘Tech Summit’, and you can watch it here on YouTube. It’s a brilliant 24 minute watch.

The talk looks at the state of tech today and what is likely to happen in the next decade: “mobile, Google / Apple / Facebook / Amazon, innovation, machine learning, autonomous cars, mixed reality and crypto-currencies.”

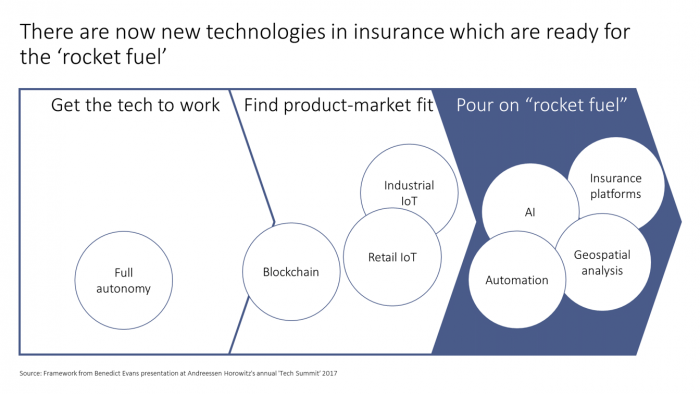

It’s also interesting to listen with an insurance perspective. On that point, this slide caught my attention:

Source: Ben Evans, Ten Year Futures

Source: Ben Evans, Ten Year Futures

Some context on ‘s-curves’

Ben argues that tech adoption follows an s-curve, which he divides into three phases. First, one has to get the tech to work, then figure out what customers will buy (‘product-market fit’ in the jargon of agile product development), at which point the technology “explodes” with the addition of “rocket fuel”. He illustrates the curve with data on iPhone and iPod sales: these devices took 3 and 5 years respectively to find their product-market fit.

The curve flattens out as the technology matures. Ben makes an interesting observation that, rather than going ex-innovation, these technologies then spawn sub-s-curves of their own. For example, the mobile internet has spawned s-curves around ride sharing and Instagram (arguably proposition curves rather than technology curves).

Ben highlights four emerging s-curves on his framework, shown on the slide above: autonomy, mixed reality, crypto-currency and AI. In other words, autonomy doesn’t work yet as a technology, whereas AI is ready for the rocket fuel.

What are technology s-curves in insurance?

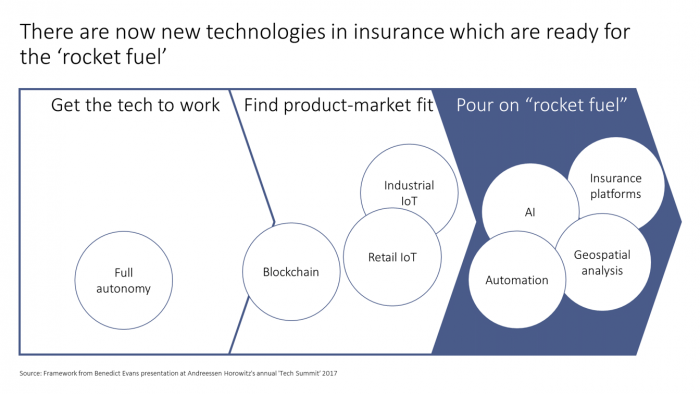

I was wondering what the equivalent s-curves for insurance would look like, and some people who have seen us present at conferences recently might have seen the slide below.

The context in which we show this slide is that we think InsurTech will move from hype to impact in 2018. 2016 and 2017 were all about headlines. Many insurers set up new teams and launched PoCs (proofs of concept), but there were few real success stories.

The context in which we show this slide is that we think InsurTech will move from hype to impact in 2018. 2016 and 2017 were all about headlines. Many insurers set up new teams and launched PoCs (proofs of concept), but there were few real success stories.

Things are different in 2018.

Some insurance technologies and InsurTech businesses have found their product-market fit and are ready for the rocket fuel. We identify four areas, described below, with some examples of InsurTechs drawn from our InsurTech Impact 25.

Note that we are not suggesting that all of the InsurTech companies listed are ready for rocket fuel; only that they are operating in technology areas that are.

- AI: If AI works as a technology, it will have an impact in insurance given that insurance is a ‘data industry’. Indeed, data & analytics was the category with the most Members in the Impact 25 suggesting considerable InsurTech activity. Atidot, Carpe Data, Cytora, Digital Fineprint and Flock are making progress in customer analytics, distribution, proposition and pricing, whilst Friss, Shift and Tractable are specialised in claims AI.

- Geospatial analytics: We noted in our Bitesize profile of Betterview that companies in this area are separating into two groups: image collection (e.g. drone flights, satellite images) and image analytics. Image collection is already a commodity, and could be described as the established s-curve. Image analytics is the sub-s-curve and ready for rocket fuel. Companies such as Cape Analytics, Geospatial Insight and Insurdata are doing interesting work.

- Insurance platforms: Insurance platforms are the digital infrastructure assets that sit behind insurers. We believe that this infrastructure will increasingly be modularised (an ‘ecosystem’) to give insurers more autonomy over their propositions (e.g. design, speed to market). This would imply an opportunity for niche vendors to provide components. For example, we are using our insight into over 200 InsurTech policy admin systems to help several insurers build digital insurance platforms. Instanda, Kasko and Qover were our picks for the 2018 Impact 25, as well as a specialised trade finance platform, TradeIX.

- Automation: Automation (as opposed to autonomy) works. The current generation of automation InsurTech uses AI to learn processes, and improve them. Impact 25 Members Cognotekt, Kryon Systems and Risk Genius are examples, whilst Rightindem and 360Globalnet specialise in claims. What is not yet possible is full automation (see below).

We put three areas in the ‘find product-market fit’ phase.

- Industrial IoT: Industrial IoT (i.e. use of sensors in industrial and commercial processes) is much discussed in the industry. The volume of data generated will explode and this data will be valuable for managing risk (and will create new risks). However, it is not yet clear what role insurers will play in the industrial IoT value chain. In short, insurers have not yet created the compelling reason why insureds should give them access to this data: what is the product-market fit that means insureds will want to trade their data?

- Retail IoT: Similar challenges exist in retail IoT. There is no doubt that consumers will increasingly have sensors in their home, nor is it in dispute that many consumers would value being issued with sensors by their insurers (e.g. Aviva’s Leakbot proposition). However, the economic case is not yet clear: what is the loss ratio benefit, and will this cover the additional costs? Neos is our Impact 25 pick.

- Blockchain: Blockchain technology works, but (as we discuss in a recent post) it is far from clear that it is the best solution for many of the insurance industry’s problems. A recent 11:FS podcast outlined this nicely – “but you don’t need blockchain to do that” was a regular refrain.

What this means for insurers

Understanding the maturity of an s-curve is critical. Not only does this help companies understand what opportunities fit into their innovation ‘risk appetite’, but it is also instructive to the organisation of innovation. For example, opportunities which require rocket fuel should scale quickly and should arguably be run from (or at least very close to) the core business. Where the product-market fit is still unclear, an innovation team might be best placed to push initiatives forward.

It is important to have clear objectives for an innovation strategy. Only when companies know whether they are ‘pioneers’ or ‘followers’ do they know on which technologies and opportunities they should be focusing – something we discuss in a related blog post.

How Oxbow Partners can help

- Innovation Strategy: We help insurers, reinsurers and brokers develop and execute innovation strategies. In 2016 we advised Munich Re on its Digital Partners (Bitesize profile) strategy and helped build the technology architecture and processes using our Agile Strategy methodology. This allowed us to help them launch the business in under 8 months.

- Market insight: We provide insurers and brokers with regular market insight. Our quarterly reports are used by several insurers as Board and ExCo meeting preparation. For some clients we provide a focused InsurTech and innovation product.

To get in touch, email a Partner direct or use our office email address.

SaveSave

Source:

Source:  The context in which we show this slide is that we think InsurTech will move from hype to impact in 2018. 2016 and 2017 were all about headlines. Many insurers set up new teams and launched PoCs (proofs of concept), but there were few real success stories.

The context in which we show this slide is that we think InsurTech will move from hype to impact in 2018. 2016 and 2017 were all about headlines. Many insurers set up new teams and launched PoCs (proofs of concept), but there were few real success stories.