Rethought a post-bind operating model

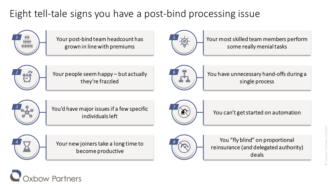

A leading reinsurer identified that their post-bind operations had developed organically leading to challenges with scalability. We supported the client to develop a new, deliberate global operating model. This led to improvements in both efficiency and quality, which are the foundations to support future scale.

Developed a digital readiness operating model

A leading Lloyd’s syndicate wanted to evolve its operating model to respond to emerging digital trends and market initiatives. We helped our client develop a pragmatic approach to digitise its existing operating model, taking a phased approach to a multi-year roadmap.

Designed an FS operating model for a leading retail brand

Our client is a prominent UK retail brand. The client was undergoing a strategic reorientation of their retail financial services business and asked Oxbow Partners to advise on how to set up their insurance operating model optimally. We were then asked to support on the broader retail financial services set-up.

Redesigned management information

A leading reinsurer wanted to rationalise the information used in the business and build standardised reporting driven by ‘golden sources. We helped the client identify metrics to run the business, defined how to source the right data and developed the governance required to deliver the insight.

Set up Digital Partners for Munich Re

In 2015 we were asked by Munich Re to evaluate how they could play the InsurTech trend. We supported the team to set up Digital Partners, which grew to over $500m of premium over the next five years.

Supporting a carrier become truly data and digital first

A leading London Market syndicate wanted to put data and digital at the core of its strategy and operations. We worked with the underwriting teams and partnered with a systems integration consultancy to implement end-to-end underwriting infrastructure and processes organised around a new Underwriter Workbench.