In the spirit of transparency, you can download our spreadsheet with the source data and our calculations here. Please note that this analysis is based on public data and has not been reviewed by Lemonade.

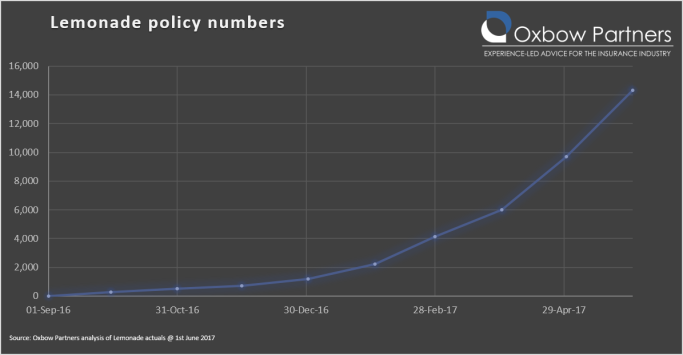

Lemonade is a startup insurance company currently selling two products: renters’ and homeowners’ insurance. The company launched in September 2016 in New York, but is now operational also in Illinois and California. They have licences in Texas, New Jersey, Michigan, Arizona, North Carolina, Virginia and Rhode Island. Expect more state launches soon. If you want to read more, see our previous Bitesizes here and here.

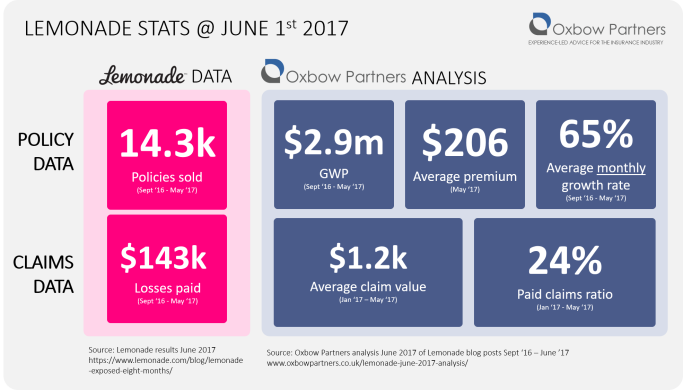

Lemonade reported their policy count and losses paid in their 1 June blog (pink boxes below). In the blue boxes you’ll see our estimates for what this means for other KPIs. See the spreadsheet to understand how we got there.

Claims

We calculate the paid claims ratio to be 24% for January – May 2017. This is above Lemonade’s estimate for 2016 (20%) but below the New York State market average of circa 50%. This could be helped by a lack of significant loss events so far this year. For example, losses from Hurricane Sandy in 2012 resulted in a doubling of claims costs for insurers compared with previous years. Fingers crossed for the second half of the year.

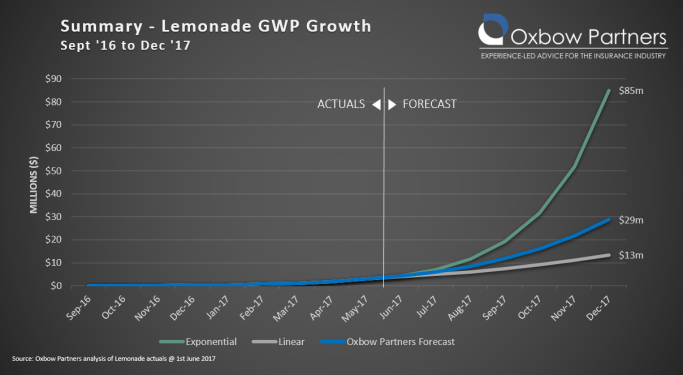

Lemonade’s growth potential – $30m GWP by end 2017?

It’s impossible to forecast GWP for such an early stage and high-growth insurer. However, we thought we’d try a few scenarios. Sticking our neck out, we’re going to predict that Lemonade will hit about $30m of GWP by the end of 2017.

We projected three scenarios for the company:

- True exponential growth (green line): assumes that the current average monthly growth rate of 65% is sustained to the end of 2017.

- Linear case (grey line): assumes that the current growth rates stabilise at ~4.5k policies a month (similar to our estimate for May new business sales).

- Oxbow Partners forecast (blue line): We think that $85m GWP feels more than a little punchy for 2017 so we have projected forwards using an exponential monthly growth rate, but declining 2pp per month as volumes grow; in other words, June m-o-m growth is 40% and December m-o-m growth is 28%.

For these scenarios we have excluded policies from the seven new states currently licenced but not live. These were left out due to negligible effect on volumes and GWP.

Conclusions

Lemonade is so far living up to the hype: it has moved from launch to an early period of rapid growth. It remains to be seen if they can disrupt the market.

For all its plaudits, Lemonade is “merely” an insurer with a well-designed proposition; it’s not what Uber was for taxis or AirBnB was for homeowners/hotels either in the distinctiveness or the network effects of its business model. But ultimately this may be academic. Direct Line was an insurance startup that innovated around the established product in the 1980s and is now a phenomenally valuable company. Doing something better than the market rather than something revolutionary is often not such a bad strategy.