Agile ain’t no religion

11 July, 2022 Chris Sandilands

When we founded Oxbow Partners in 2016 we might have been described as “agile evangelists”. We embraced this emerging new approach to strategy development, partly inspired by Eric Ries’s ground-breaking book, The Lean Startup. (We would still recommend every corporate executive reads it.)

We wrote a blog post about how to introduce agile methodology to strategy and change. We called our approach Agile Strategy.

We were ahead of our time in 2016. Executives found Agile Strategy a bit scary. How could you possibly start a project if you didn’t have the precise timeline scoped out on day 1? Why would you move to execution before tying up every loose end in the analysis?

It is amazing to think that in the space of six years agile has gone from being a novel concept to something of a cliché. Everything is now agile. Many insurance organisations are in the middle of an ‘agile transformation’.

Having spoken to several executives about their experience, our analysis is that agile has become a religion for its proponents. They preach the virtues of reorganising into scrums, tribes and chapters, and get to work turning the operating model on its head.

And, most significantly, the objective has in some cases shifted from adopting agile methodologies in strategy and change to making the ‘steady-state’ operating model agile.

Unsurprisingly, many insurers are struggling with their agile transformations, particularly when they are pushing beyond strategy and change. Some are a year or more into their preparation phase, whilst others feel nervous that they have unpicked an operating model that broadly worked and replaced it with something that seems to have just as many weaknesses.

Indeed, there are few case studies of successful agile transformations in large-scale financial services.

Does this mean that we no longer believe in agile? Not at all. We absolutely believe that agile is a valuable methodology for corporate executives. It provides challenge to traditional thinking, and tools for doing things differently. But it is not a religion.

Our advice for executives is to consider three things when considering whether to adopt agile methodologies.

1. Do we want to be an “agile organsiation” or do we want to use agile for change?

When agile hit the corporate world, it was broadly as a change methodology. However, some companies have taken agile further and tried to organise themselves as truly agile organisations. Gone is the Head of Motor insurance; welcome the Head of the Motor Tribe.

It is not at all obvious to us that moving the ‘steady state’ operating model to agile works for financial services firms. The simple fact is that agile was invented created in the software industry for product development – a form of strategy and change – and not for financial services firms who are, in many cases, delivering their fully-formed proposition.

We would urge caution about trying to become an agile organsiation – but using agile for change can be powerful.

2. What are the organisation’s motivations for considering agile?

As with any corporate initiative, understanding the problem well is the key to identifying an effective solution. Are colleagues not sufficiently motivated and feel constrained in their current roles? Are projects slow and not having the expected impact? Does the project portfolio feel too busy and lacking in direction?

All of these are common frustrations for corporate executives which can be solved with agile – but also in other ways.

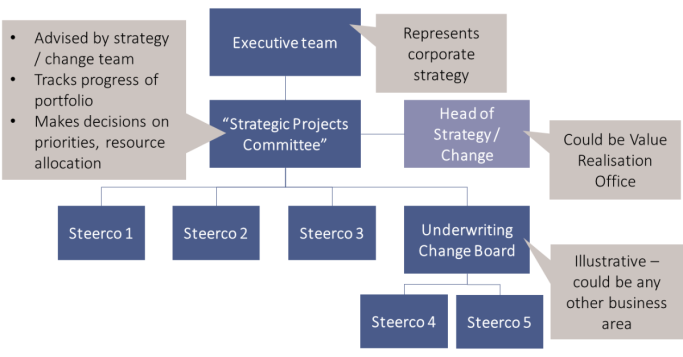

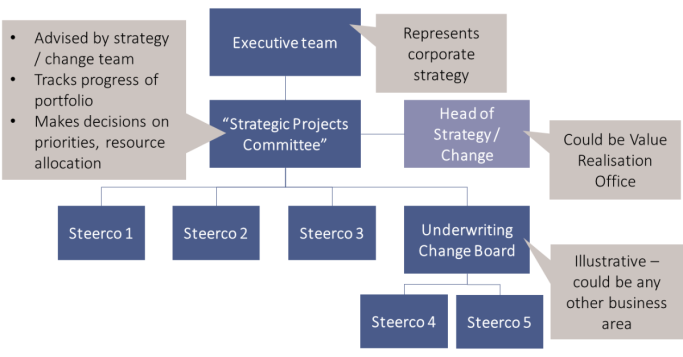

An organisation wants to improve the impact of its projects? What about establishing a transparent governance framework that ensures a direct line of sight from CEO to change resources? A Value Realisation Office could help streamline objectives and ensure that the right people are working on the right things.

Connecting strategy to change

Another popular approach is an Objectives and Key Results (“OKR”) project management framework, which ensures that projects are continuously goal oriented, and do not wander off into their own worlds. This is achieved by similar means: transparent project monitoring and a robust approach to continuous reprioritisation.

Any number of solutions could be tested to improve employee motivation.

In other words, there are many ways to solve corporate challenges and agile is just one of them.

3. What is the right mix of agile tools, ceremonies and organisational change?

Agile has evolved to be a corporate change tool since it was first launched in 2001. It can now be described as a comprehensive methodology comprising three things:

- Tools: For example goal-setting and reporting approaches

- Ceremonies: For example daily scrum meetings

- Organisational design: For example tribes, squads and chapters

Organisations are free to choose whatever combination of tools, ceremonies and organisational design principles they want. This should be aligned to their objectives.

It is important that organisations find a blend that works for them. Many, for example, have adopted OKR methodology but not undergone a full agile transformation. Scrum meetings have arguably become best practice for all project management these days.

Conclusion

Executives wanting to implement agile should read the agile textbook, and then consider what flavour of agile will work for them.

Executives should not be wowed by pitches that promise that their organisation will be “more like Facebook or Google” following an agile transformation. Instead, they should objectively consider their business priorities and establish their options for reaching them, just like in the old days.

For some, the right path might be a full agile transformation or full adoption of agile methodologies in transformation. In our analysis, most will realise huge value by selecting some agile-inspired tools and ceremonies, and refreshing their management structures and methodologies – but all within their current operating paradigm.

Agile is a valuable methodology for insurers – but only if you keep the high priests at bay.