There were some tangible deliveries in Q1 which mainly concentrated on the Digital Processing, Open Market Placement and Claims workstreams. This represents an important step for Lloyd’s as they transition from market engagement to delivery.

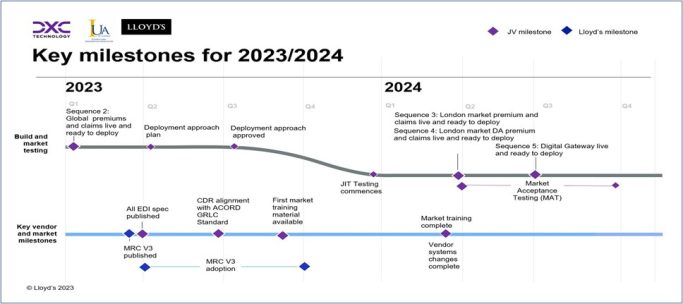

Lloyd’s also released an updated version of the Blueprint Two Roadmap focusing on the 2023/2024 milestones.

Workstream overviews

Digital processing

Recap – what is it?

Digital processing is the digital service to manage the movement of premium and claims orchestration for singleton non-complex business. Delivery has been phased over five Sequences – Sequence One activities were completed last year and Sequence Two has been delivered in the last quarter.

What was achieved in Q1 2023?

- The Global Premium and Claims Service went live and ready for deployment to market participants.

- The JV released technical specifications for Electronic Data Interchange (EDI) messages.

Open market placement

Recap – what is it?

Open market placement now largely focuses on the establishment of data standards. The London Market Group (LMG) Data Council released the latest iterations of the data standards items:

- Market Reform Contract (MRC) – the form used to capture risk data in a digital-first marketplace.

- Core Data Record (CDR) – the data standards governing the critical transactional data used in the placement process.

What was achieved in Q1 2023?

- MRC v3 released March 29th to reflect ongoing work with ACORD and incorporate feedback from last year’s market consultation period.

- CDR v3.2 released to align the CDR with the latest version of the MRC.

- Completion of the LMG Data Council’s Process, Roles, and Responsibilities (PRR) market consultation period; the purpose of this period of market engagement was to:

- Understand market views on the creation and approval processes for the CDR.

- Identify when this data should be uploaded to the Market Gateway.

Delegated authority (DA) placement

Recap – what is it?

Lloyd’s are defining a DA-specific data strategy to complement the open market placement initiatives.

What was achieved in Q1 2023?

- Guiding principles upon which the DA data strategy will be built were released to the market; these principles include:

- Using common standards wherever possible for DA and Open Market business.

- Use of APIs to create a data first environment.

- Enabling optionality for participants on technology choices.

- Confirmation the DA data strategy will be announced in Q2 2023.

Claims

Recap – what is it?

The claims workstream centres on driving adoption of the Faster Claims Payment solution and understanding what how the Lloyd’s Claims Scheme can be improved. The Faster Claims Payment (FCP) solution is a funding and payment tool created by Lloyd’s to increase the speed with which customers’ claims are paid using the Vitesse payment platform. The Lloyd’s Claims Scheme sets out the process for leaders to follow once a Claim arises.

What was achieved in Q1 2023?

- FCP solution celebrated a significant milestone with over half of all managing agents now using the solution representing between them more than 70% of total DA GWP written at Lloyd’s.

- Vitesse began to offer their FCP accelerator solution – helping managing agents with FCP adoption via support such as third-party software integration.

- Lloyd’s Claims Scheme has a new name – Lloyd’s Claims Lead Arrangements. Lloyd’s are also targeting a more efficient Claims process for brokers where they only need to interact with a single managing agent.

- Lloyd’s announced the full set of proposals for the Lloyd’s Claims Lead Arrangements will be made public by the end of Q2.

The Oxbow Partners view

We will publishing our latest views later this week. You can subscribe here to receive it first.