Cryptocurrencies are electronic decentralised currencies that use encryption techniques to enable global financial transactions without the need for a central authority. Following the recent surge in popularity and price, major corporate investors have started to take an interest including Tesla, which acquired $1.5 billion of bitcoin (BTC) in January 2021, or business-intelligence software company MicroStrategy, which holds an aggregate of $2.2 billion of BTC.

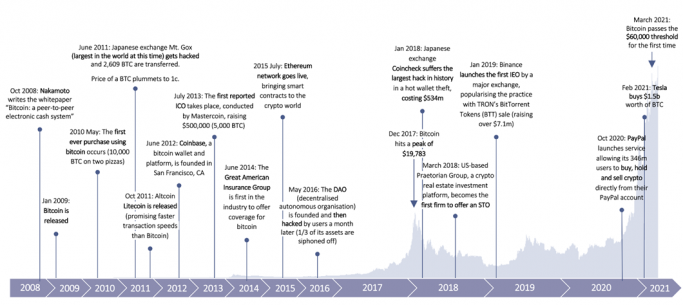

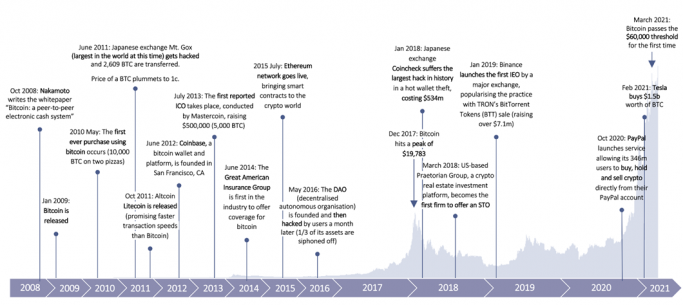

Figure 1 - Evolution of the Cryptocurrency Market

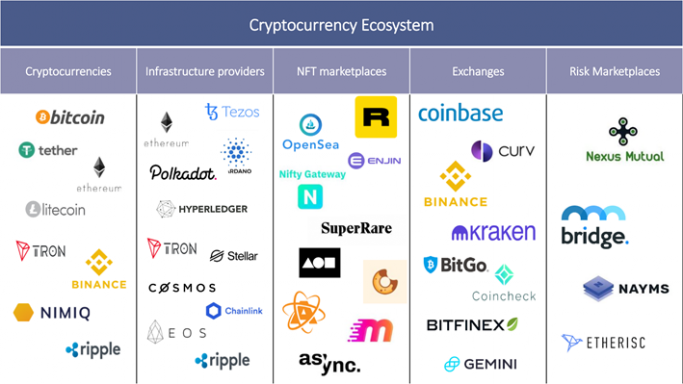

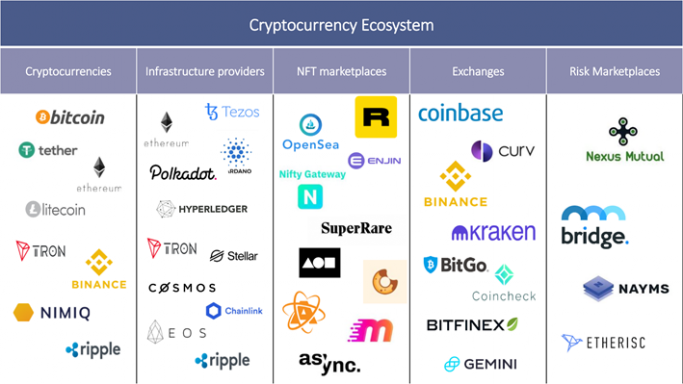

The fast growth and success of cryptocurrency projects has been accompanied by the booming ecosystem of supporting products and services. For example, crypto infrastructure providers such as Ethereum, the leader in this space, Polkadot and Chainlink have set up to provide the rails on which crypto and blockchain (see other Oxbow Partners blockchain articles) businesses can be built. Alongside these sit crypto trading platforms, such as Coinbase and Binance, which allow corporate and retail investors to trade a range of digital assets.

In our crypto market map, we identify the five main elements of the crypto value chain and their associated key players.

Figure 2 – Cryptocurrency Ecosystem

Crypto currencies such as bitcoin, initially seen as a facilitator for potentially shady transactions, are now a generationally relevant version of gold, drawing in more and more corporate and regulatory interest. Regulators have taken different positions with no consistent global view. China, for example, is considered one of the most anti-crypto governments, banning initial coin offerings in 2017. (Initial coin offerings, or ICOs, are the crypto equivalent of IPOs.) In the US, the Securities and Exchange Commission (SEC) regulates ICOs to ensure that any offering of securities is either registered or exempt using a framework to determine whether a particular ICO is an investment contract and therefore considered a “security”.

The UK has taken a lighter-touch approach. For example, the FCA just generally monitors crypto firms to ensure compliance with AML and counter terrorist financing. This more relaxed approach may be changing given news of the FCA banning the retail sale of derivatives and exchange-traded notes (ETNs) that reference certain types of crypto assets, including BTC and Ether (ETH, the cryptocurrency that powers the Ethereum platform). The UK may also be maturing faster than others in the crypto banking space, shown by the FCA issuing its first Authorised Payment Institution license to a crypto firm back in January 2020.

Crypto 2.0: Non-fungible tokens

The most recent crypto trend has been in the non-fungible token (NFT) market, much of which is centred around collectibles and the expanding digital resource economy. An NFT is a token certifying that a specific digital asset is unique and not interchangeable. NFTs are largely bought and sold in marketplaces like NiftyGateway and SuperRare, which use the Ethereum blockchain to streamline the process of physical asset exchange and remove the need for intermediaries. For comparison, the NFT trading volume for February 2021 alone exceeded all of 2020 combined ($340m vs. $200m).

Examples of NFT transactions range from digital artist Beeple’s “Everydays” setting a record for a digital artwork sale at $69m in February 2021, to an NFT of Jack Dorsey’s first ever tweet selling for $2.9m in March 2021.

Insurers are starting to take an interest

Insurers have been slow to enter the crypto world, which presents a range of risks from cyber attacks on exchanges and users to price volatility on transactions. Despite being a growing, multi-trillion dollar industry, it remains 96% uninsured.

But as crypto moves away from a HNW user base (‘Bitcoin whales’), some early insurers are making moves.

Our analysis shows that there are three main ways that (re)insurers are playing in the cryptocurrency space.

Figure 3 – How (re)insurers are participating in crypto

1. As crypto-market underwriters

There are two ways in which insurers can underwrite crypto-related risks. First, they can provide cover for the crypto assets themselves in the form of crime and custody policies, for example against theft, hacks or cold-storage key loss. In mid-2014, Great American Insurance Group was the first to do so with its crime product, which covers bitcoin holders for forgery and computer fraud amongst other things. Since then, other players have begun to emerge: Nexus Mutual, founded in 2017 by a former Munich Re executive, is a decentralised insurance fund operating on the Ethereum blockchain and offering “discretionary cover” with community-driven management.

Alternatively, insurers can provide coverage for crypto businesses. Only a handful of providers are able to offer these kinds of cover to crypto companies. Evertas is one example: “the world’s first cryptoasset insurance company”. D&O is a specific cover in short supply generally but particularly in crypto, where insurers are still concerned about the lack of legal and regulatory clarity. As law makers and regulators provide more certainty it should become easier for insurers to provide cover.

2. Accepting crypto as a payment form

A small but growing number of insurers are accepting crypto as a payment form. Benefits of doing so include verification transparency and payment tracking. In cases where insurers are underwriting crypto assets, accepting premium in the risk currency eliminates FX volatility. Examples include boutique US insurers Premier Shield Insurance and InGuard which both now accept BTC as payment for premiums. More recently, AXA Switzerland became a forerunner by announcing in April that BTC payments would be accepted for nearly all products (except life insurance due to regulatory barriers). Time will tell whether crypto is really becoming accepted as a valid form of payment or whether most are in it for attention from policy and bitcoin holders alike.

3. Holding crypto as a balance sheet item

Given the volatility of crypto assets, very few insurers have looked to invest directly. The only major example of an insurer holding crypto as a balance sheet item is American insurance and financial services giant MassMutual. In 2020, it invested $100m into Bitcoin along with a $5m equity investment in NYDIG, a crypto custody provider.

The situation could change as insurers and investors seek alternatives to the historically low yields of fixed income investments. Other factors encouraging this movement include the recent approval by U.S. financial regulators of the use of public blockchains by established banks back in January, as well as talk of Bitcoin’s diminishing implied volatility (or expectations for price turbulence) which has declined from a peak of 145% in mid-January to 75% in March.

Some crypto marketplaces such as Nexus Mutual and Nayms do hold crypto but avoid the exchange rate risk by keeping everything in base currency (i.e. assets, premiums, claims, balance sheet, etc.). At Nexus Mutual for example, members contribute liquidity (in ETH) into a shared pool of funds and receive NXM (Nexus Mutual) tokens in return. Nexus members can purchase cover as well as participate in the mutual governance system by assessing claims through voting or assessing risks by staking NXM tokens against specific risks. But all the interactions in the Nexus Mutual space are done through NXM, essentially a cryptocurrency, without passing through fiat currencies.

Various other insurance related projects have been introduced during the NFT boom, including proposals to issue insurance policies in unique NFT form (e.g., yInsure, underwritten by Nexus Mutual) and platforms where NFTs can be used as collateral to borrow other crypto assets (e.g. NFTfi on the Ethereum blockchain). In the latter scenario, lenders can find an NFT they are willing to lend against and make an offer to a borrower, locking in the NFT in a smart contract (see explanation) as collateral for the borrower being unable to repay the loan. These projects have little to do with the ‘hype’ surrounding NFTs and exemplify the permanent tools and possibilities that blockchain allows for insurers.

Benefits and challenges for insurers

The insurance market is moving cautiously to engage with crypto, and rightly so. On the one hand, crypto has great potential for attention and returns, which will only grow along with its use cases. On the other hand, its intangible and hackable nature still proves difficult to understand, insure and regulate.

We see four benefits for insurers from being involved in cryptocurrencies:

- A new market opportunity to match the supply side of the crypto insurance market to the demand

- A wide range of business models to cover with crypto which may help ease the concentration risk

- A better investment alternative, as yields on fixed income investments are at historic lows

- Significant media and customer attention for major insurers engaging with crypto

However, we also see five challenges:

- A difficult technical underpinning, as crypto is still nascent and the risk profile not well understood

- Volatility affecting premiums – some believe it may be levelling off, but this will only become clearer in hindsight

- Concentration risk as many cryptocurrencies are reliant on a few platforms (e.g. Ethereum)

- Regulatory uncertainty and the very high rate of change in regulation that we expect in the near term

- A hard insurance market means insurers are less focused on accessing new risks as existing lines of business become more profitable

What the future holds

Clearly crypto is still a volatile market – the average price of NFTs plummeted almost 70% from a peak of around $4,000 in mid-February to around $1,400 last week – but this shouldn’t be an excuse for inaction. Whether or not you believe crypto is an attractive long-term investment, cryptocurrencies already play a role in the global economy and are likely here to stay. We believe insurers need to take a role too.

In the short term, we see an opportunity for larger corporate and speciality insurers, who are set up to understand and underwrite a market with such uncertainty and volatility. In the longer term, given uncertainty around how the crypto boom will evolve, insurers should look to test, learn and get familiar with the structures surrounding crypto.

To speak to a member of the team about cryptocurrency, the future of crypto insurance propositions, NFT related projects, or any other topic, please contact us here.

See our collection of 12 startups to watch in the crypto space

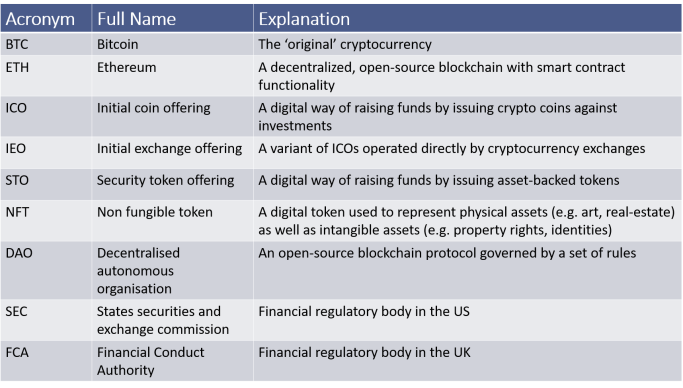

Crypto Glossary