Digital vs. insurance: The London Market’s hiring dilemma

5 September, 2022 Matt Shipp

Context

Digitisation has become a hot topic in the London Market. Most organisations are putting significant strategic and delivery effort into structuring themselves to support a digital market.

In 2021 we looked at the rise of digitisation and what market participants need to do across operations, technology and data. In this article we consider the people and skills side of digitisation. We have analysed the skills of over 120 digital specialists in the London Market. We test the myths around whether digital or insurance experience is seen as most critical, and look at how the talent pool is evolving and how carriers and brokers should build their digital teams.

Recap: The rise of digital in the London Market

The growth of digital across the London Market can hardly be said to be meteoric. However, over the last few years the market has started to take digital more seriously. Obvious examples include the likes of Brit with their digital follow-only syndicate Ki or Canopius with their digital MGA Vave.

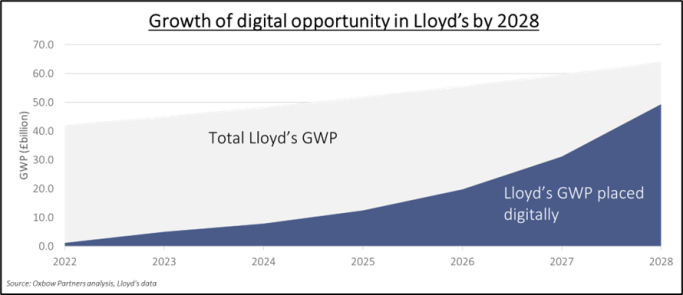

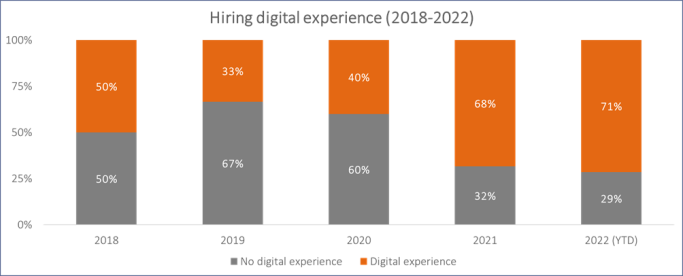

We do, however believe that digital will accelerate over the coming years. Oxbow Partners predicts that digital distribution will account for c.$50bn of GWP placement through Lloyd’s by 2028.

Figure 1 Growth of digital opportunity in Lloyd’s by 2028

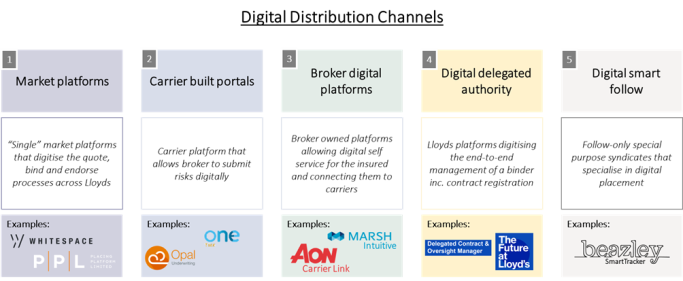

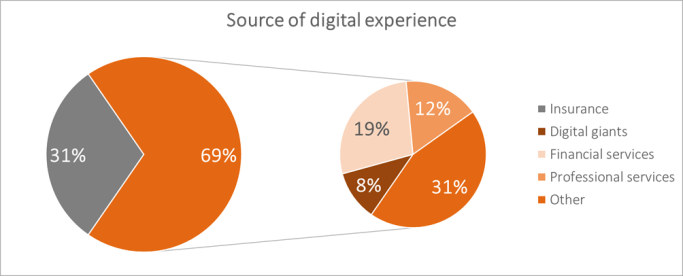

We expect digital growth to come from multiple sources across the market including broker and carrier built portals as well as market platforms such as PPL, Whitespace and InsurX.

Figure 2 Digital Distribution Channels

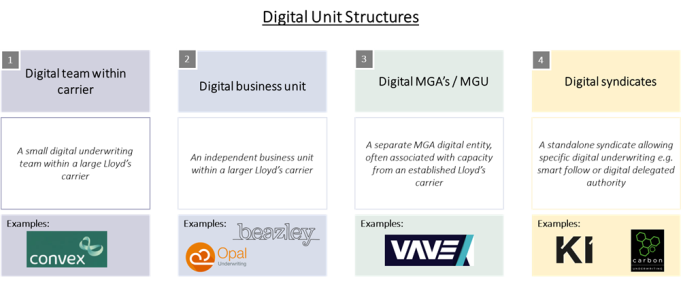

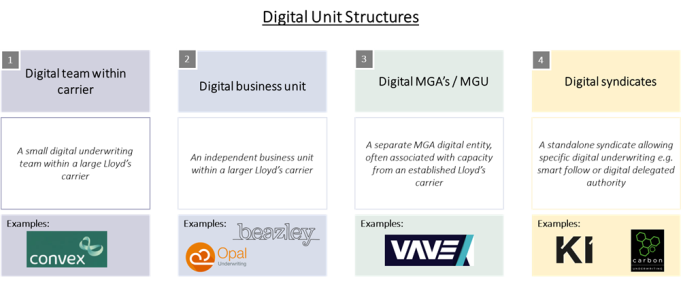

Carriers are taking different approaches to structuring their digital teams. Some are going for fully embedded teams, others are dispersing resources within the current model, and we are also seeing the emergence of separate MGAs or syndicates.

Figure 3 Digital Unit Structures

Sourcing digital talent: digital-first or insurance-first?

When forming a digital team, decision-makers face resourcing dilemmas. For example: is it better to bring in digital leaders who have no prior insurance experience, or to train up insurance experts? Both approaches have pros and cons.

Figure 4 Benefits of digital-first skills vs. insurance-first skills

To help understand the market view on resourcing of digital teams, Oxbow Partners has analysed 120 professionals working in digital London Market teams, business units, syndicates, and MGAs.

Methodology and assumptions

Approach:

- Analysis of profiles of 120 resources within London Market digital business units

- Run in Q2 2022

- Previous experience was considered from leaving education and all roles up to current digital insurance role

Definitions and assumptions:

- Digital business unit: a business trading through a carrier-built distribution platforms or a smart-follow platform

- Digital giant: features on the Forbes top 100 digital companies

- Digital experience: a previous role with overlapping digital, IT, data, or technology skills that we expect are needed in the current role based on Oxbow Partners’ expertise

From our analysis we have identified three big insights about digital skillsets in the London Market.

Insight 1: Insurance experience still trumps digital experience

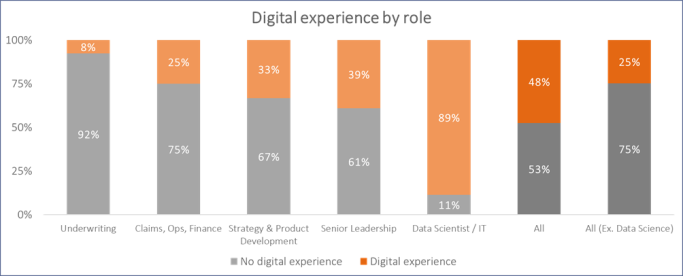

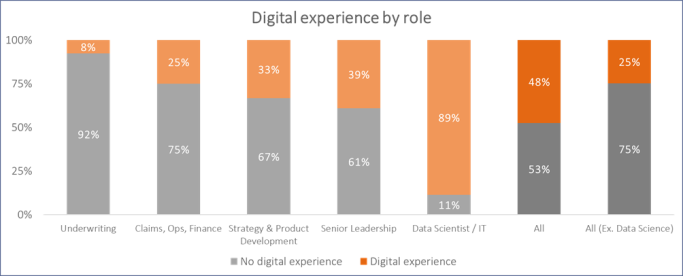

Our study shows that just over half of digital resources in the London Market had no digital experience prior to joining their current role (53%). This increases significantly to over 75% if you exclude data science roles where people, unsurprisingly, generally come from outside of insurance. This means the ‘core’ insurance roles in digital insurance units are dominated by resources with insurance but no digital experience.

Figure 5 Resource skill splits: digital vs. non-digital

The fact the resources come primarily from an insurance background is perhaps no surprise: insurance has a unique financial profile to other industries and balance sheet owners may be more reticent about hiring people who do not understand the industry’s idiosyncrasies.

Only 25% of digital underwriting heads had digital experience, largely due to people moving over from existing, non-digital, underwriting roles. Interestingly, the proportion of people with digital experience is second highest amongst senior leadership such as Chief Digital Officers (39%).

Insight 2: Digital experience is becoming more important

As digital underwriting enterprises mature, we see the balance shifting in favour of digital skills.

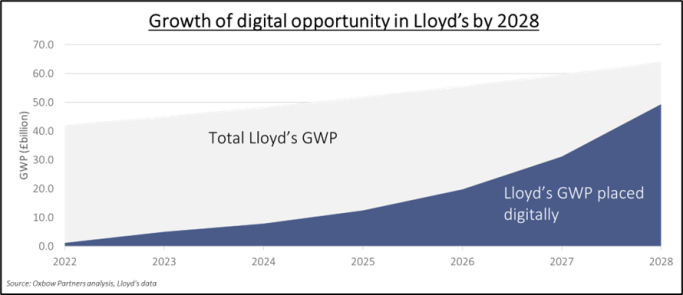

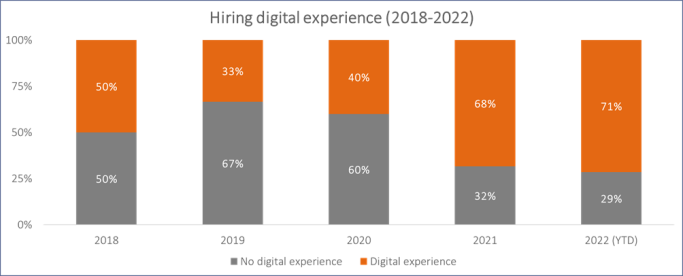

Figure 6 Hiring trends of digital vs. non-digital. Based on year individual was recruited into role.

From 2018 to 2020, there was a clear preference for hiring insurance resources over individuals experienced with digital. In 2021 and 2022 that changed significantly towards a preference for digital skills. We think this could be a function of teams maturing – armed with underwriting talent, they have the confidence to focus on digital ‘differentiation’. In one digitally focused syndicate, for example, the CTO joined one year after launch (rather than as a ‘founder’).

A second speculation for the shift links to scale: as there is less need to bring in underwriters if the digital infrastructure is good, shifting the balance of hires to more specialised technical resources.

The difference between insurance and digital resources will also become less stark in the future as more people become multi-skilled.

Insight 3: When people have non-insurance digital experience, it is generally from banks, not ‘digital giants’

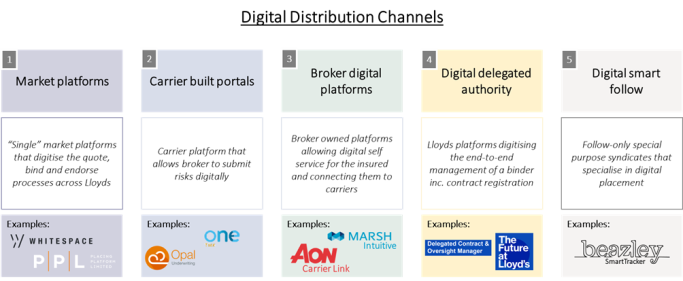

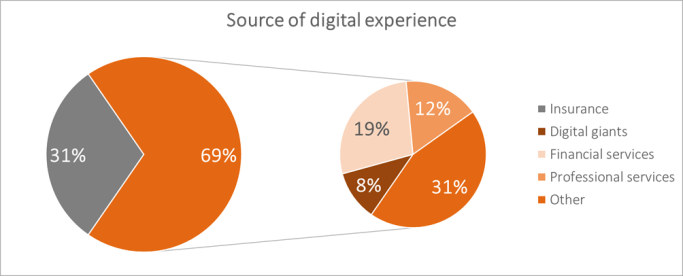

There is a perception that the majority of digital experience in the London Market is from innovative, digital giants (e.g. Microsoft, eBay, IBM and Intel). The reality, however, is rather different.

Firstly c.30% of digital experience comes from existing digital units within insurance companies (e.g. Canopius, Beazley and Brit). Those whose digital experience comes from outside insurance (c.70% of roles), only 8% gained their experience from digital giants. Interestingly, even Brit Ki, a Google partner and proponent of digital experience, had no ex-Googlers within its team (based on our analysis).

Figure 7 Where digital experience comes from

Experience comes from areas like financial services (e.g. HSBC, Lloyds Bank, Barclays, NatWest and Credit Suisse) and professional services (e.g. PwC, Deloitte, EY and Accenture). Again, this is unsurprising to us. Financial Services and Professional Services are more familiar to the insurance industry and professionals perhaps have a better blend of skills for insurance.

How London Market participants should respond

The digital insurance landscape in the London Market is a challenge to navigate. Unlike other parts of the industry (e.g.UK personal lines) the digital requirements of participants are not yet fully defined. This means that many participants are experimenting with multiple routes as the market matures – for example broker portals, carrier portals, or market platforms such as PPL and Whitespace. Therefore, defining resourcing profiles can be a challenge.

The winning factors for insurers in digital:

- Clear digital strategy: Winners need to set out a clear digital strategy and make bold choices about where they play and not; this will ensure focused effort in the areas believed to drive the most value

- Agile delivery model: Winners need to build elements of flexibility into their delivery; this could be using agile to allow plans to change and adapt as the market evolves or building technology that provides some element of flexibility, for example allowing digital connectivity into value-chain players

- Balanced skill-set: Winners will build balanced teams with skills from within insurance and from other more digitally advanced industries

If you would like to discuss how Oxbow Partners can help understand and navigate digital insurance in the London Market, then please get in touch with a member of the team.