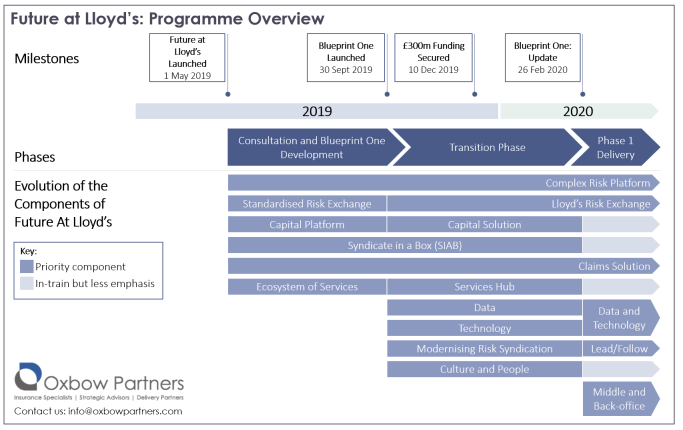

On 26 February Lloyd’s published an update to the Future at Lloyd’s: Blueprint One – the marketplace’s transformation led by CEO John Neal. Our summary of Blueprint One can be found here and our analysis of it here (both from October 2019).

This blog post looks at progress made in the transition phase (September 2019 to February 2019), how priorities have changed, and what the revised plans are for 2020.

In the five months since the original publication of Blueprint One in late September 2019, the Future at Lloyd’s programme has been in the transition phase and organised around the following workstreams.

During this transition phase the team has been focused on developing the solutions and building detailed plans for 2020. Progress has included:

- Building detailed project plans for Phase I delivery (2020)

- Prioritising workstreams

- Securing funding of £300m

- Engaging over 1,000 stakeholders

- Setting up programme governance

- Commencing early stage proofs of concept (e.g. Syndicate in a Box with Munich Re, claims solution prototype in collaboration with McKenzie Intelligence, an Oxbow Partners InsurTech Impact 25 Member)

The latest update confirms that the Future at Lloyd’s programme will focus on six workstreams.

1. Complex Risk Platform

This solution will build a digital platform to support the process from submission through to bind and renewal for complex risks. The 2020 focus is to improve the current PPL platform whilst in parallel designing a new solution using the latest technology. The replatforming partner will be announced at the end of Q1 (click here for the shortlist announced in December 2019). It was also announced today that the corporation will take a 40% stake in the platform.

Other activities in 2020 include:

- Building APIs to allow simple integration into the platform; Q1 priority is quote and bind

- Development of new capability for PPL covering endorsements or firm order (TBC)

- Usability improvements and defect fixes

- Commencement of replatforming of the current document-plus-data solution onto new technology

Work will also begin on the data-first solution, although there are no specifics on the outputs for 2020.

Change vs. Blueprint: The 2020 plan broadly aligns with the original plan although the data-first proof of concepts will be pushed back into 2021.

2. Lloyd’s Risk Exchange

The Lloyd’s Risk Exchange has refocused efforts to supporting delegated authority and coverholder business. The immediate focus will be to support and develop Chorus (the coverholder compliance and registration platform) and DA SATS (the coverholder data centralisation and distribution platform) to make progress towards a data-first technology. 2020 efforts will also include developing APIs to allow market participants to integrate seamlessly into the Lloyd’s technology ecosystem.

Change vs. Blueprint: Increased focus on developing and replatforming existing solutions to support delegated authority and coverholder business.

3. Claims Solution

In 2020 the claims solution workstream will focus on redesigning the claims operating model and processes. By the end of the year the plan is to have implemented some tactical process improvements (e.g. updated Lloyd’s Claims Scheme), pilots (e.g. automated small claims settlement) and be ready to start building the technology solution in 2021. The new platform would replace the current Electronic Claims File (ECF) platform.

Some work has commenced on prototypes – Lloyd’s recently created a video demonstrating a prototype of a claims platform in collaboration with McKenzie Intelligence Services for proactive detection and management of a fire claim.

Change vs. Blueprint: Focus on redesigning the operating model and processes. Less emphasis on technology redesign and implementation in 2020, technology will likely take the form of proofs of concepts rather than live pilots.

4. Data and Technology

Data and technology workstreams have taken an increasingly central role in the Future at Lloyd’s programme. As the complexity of the challenge becomes clear there has been increased focus on these ‘fundamentals’.

H1 2020 will focus on setting the strategy and designing the operating model for data and supporting the other workstreams (e.g. determining minimum data requirements for Lloyd’s Risk Exchange). H2 will focus on official launch of the Insights Hub (an analytics platform for brokers and coverholders) and a pilot for the shared data platform that provides a central repository of market data (e.g. policy and claims).

The Technology workstream will focus on defining central standards and building the core infrastructure to support the other priority solutions.

Change vs. Blueprint: Broadly in line with proposals outlined in the Blueprint.

5. Middle and Back-Office – New for 2020

The middle and back-office workstream was started only in February of 2020 so efforts so far have focused on mobilisation and scoping. The workstream’s remit will be to streamline processes such as accounting and settlement in support of the other workstreams.

In 2020 the workstream will design the future-state and identify and implement quick wins. No specifics as of end February.

6. Lead/follow (Modern Syndication of Risk)

The Lead/follow workstream will be led by the Lloyd’s Market Association (LMA). H1 will focus on defining standards for leaders and followers and running ‘model office’ testing for two pilot classes (confirmed by Lloyd’s and the LMA in January 2020 as marine hull and international casualty binders). In H2 the pilot classes will go live in the market.

Other areas

Whilst Future at Lloyd’s has focused 2020 efforts on the six workstreams outlined above, there is still significant effort happening in other areas. This includes, but is not limited to:

- Syndicate-in-a-box: Munich Re Innovation Syndicate 1840 is writing business as of 1/1/2020; multiple further proposals are under review

- Services Hub: A first version of the Services Hub will be released in H1 2020

- Capital: In December Brit announced the launch of its ILS fund ‘Sussex Specialty Insurance Fund’

The Oxbow Partners View

Overall the Future at Lloyd’s programme has shifted focus away from grand ambitions and the ‘shiny new’ towards a prioritised set of activities focused on the fundamentals. This would appear to be a combination of market pushback and the realisation of the magnitude and complexity of effort originally scoped for 2020.

Whilst some would see this as a scaling back of the ambition, we believe it is a prudent move. First, based on our analysis, the amount of change seemed too great for the market to handle. This prioritisation feels like a sensible reset of the ambition. Second, Lloyd’s has clearly been listening to the market and has focused on what will drive immediate value, an important factor in keeping market participants onboard through the journey.