Future At Lloyd’s Blueprint One: The Oxbow Partners View

4 October, 2019 Greg Brown

On 30 September 2019 Lloyd’s released ‘Blueprint One’. This 146 page document is the latest instalment of the Future At Lloyd’s – the marketplace’s transformation programme initiated by CEO John Neal. It follows the Prospectus, which was launched in May.

We recently published an article summarising the six solutions detailed in Blueprint One. In this post we provide the Oxbow Partners view on the Blueprint.

We agree with the direction of Blueprint One

Blueprint One is a comprehensive piece of analysis. Page 17 summarises the inputs: 300+ interviews, 500+ survey responses, 1,100 stakeholders engaged and so on.

The Blueprint is also a significant step forward from the Prospectus. The level of detail on each solution as well as the clarity on timeline have moved Future At Lloyd’s from thought piece to plan. That said, there is still considerable work to do in the next phase to March 2020, something acknowledged by John Neal in his Blueprint launch presentation.

Unsurprisingly, perhaps, there is no fundamental shift in strategy or emphasis since the Prospectus; the six solutions are unchanged. The emphasis is on digital trading, claims, capital deployment and a services platform. These seem like the obvious areas to transform Lloyd’s and press coverage and statements by industry groups such as the LMA confirm strong support for them. But given the lack of ‘magic’ in the Blueprint, one has to assume that success will be determined largely by execution.

The implicit assumptions in the Blueprint

However, we also have some questions about the Blueprint. This post outlines four implicit assumptions that are made in the Blueprint which, in our view, need to be explained by the Future At Lloyd’s team over the coming months.

Assumption 1: Lloyd’s must “control” the technology

The Blueprint makes clear Lloyd’s desire to have more control over technology. Ownership is one route, and the Corporation will be taking an equity stake in PPL, its digital placement system. The objective is to use PPL as the starting point for at least one of the digital trading solutions, the Complex Risk Platform.

We observe that digital placement is portrayed as a revolutionary step in the London Market – but is a tried-and-tested concept in other complex markets. For example, Swiss Re’s SwiftRe is a fac placement platform and Aon has just launched a digital placement platform for reinsurance renewals in 2020. Industry blockchain startup b3i will be launching its reinsurance placement platform this month and Tremor is an InsurTech (Bitesize profile) that facilitates the reinsurance placement through a digital auction platform.

We therefore wonder two things: a) will Lloyd’s strike the right balance between owning technology and partnering, and b) if this leads to Lloyd’s building new platforms rather than using existing market solutions, will the proliferation of platforms lead to interoperability challenges that just create new market inefficiencies?

To determine the right approach to technology, Lloyd’s must determine (amongst other things) whether the technology is a hygiene factor or a differentiator. If it is a differentiator, then Lloyd’s must reinvent itself as a technology business – like other financial marketplaces have arguably done. Our view is that the technology is likely less of a differentiator in specialty insurance / reinsurance (i.e. the Complex Risk Platform) than it is for marketplaces trading simpler asset classes (i.e. the Lloyd’s Risk Exchange).

Related to this, we wonder what the best route to controlling the technology might be. As an alternative to controlling the actual platforms, Lloyd’s might be well advised to control the standards to which technology must conform, but allow its Members to select or build the trading platform it uses.

Assumption 2: The technology investment will generate a cost reduction

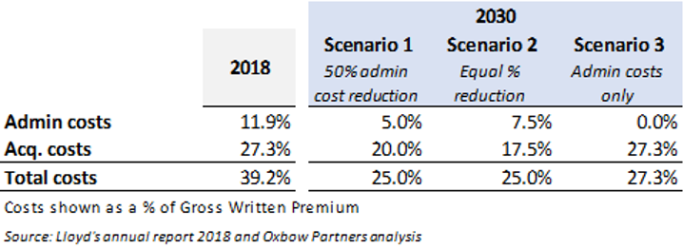

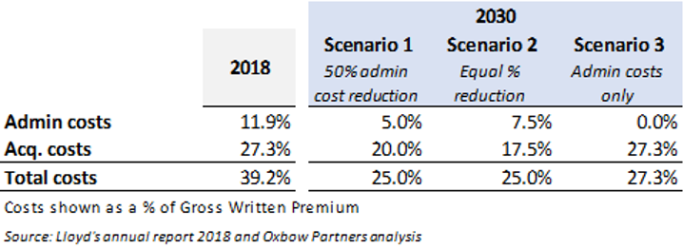

The Blueprint outlines an expense ratio reduction aspiration from 39% in 2018 to 25% in 2025. The document does not outline how the savings will be split between admin costs and acquisition costs. We assume that this is deliberate because our analysis suggests that the target is achievable only with significant cuts to acquisition costs, i.e. brokerage.

In 2018 admin costs were c.12% of GWP and acquisition costs were c.27%. There are limited routes to 25% and our table outlines two at a high level:

The equal reduction route (route 1 above) seems implausible because acquisition costs would have to reduce to 17.4%. Given a mix where delegated authority business is likely to continue to play a big role – and perhaps greater role given the technology enhancements planned – this feels low.

One must therefore assume that the Corporation believes that its admin cost ratio can be massively compressed – perhaps to half the current level (routes 2a and 2b above). This would leave the average acquisition cost level at just under 20%.

This reduction in admin cost will come partly through more efficient systems and management. In particular, creating greater formality around the lead and follow roles in the market will allow some syndicates to strip out huge amounts of cost.

However, we believe that this analysis highlights the need to grow significantly. In other words, the credibility of the ambition to double in size over the next decade is critical. As Route 2b emphasises, the Corporation can cut its admin costs in half (to 6%) through an absolute reduction of c.25% if it grows GWP by 50% by 2025. But given the huge change costs coming down the pipe, expect admin costs to split out by “trading” and “transformation costs” in future reporting.

There are many potential banana skins to market growth, for example Brexit, global overcapacity in many lines of business and the role of Lloyd’s in a world of digital marketplaces.

Assumption 3: Market participants will remain on board

The Future At Lloyd’s team has so far done a fabulous job at bringing stakeholders with them – no mean feat given the £250m investment in the London Market TOM project which preceded it.

However, it’s easy for stakeholders to nod through concepts. It is seldom an indicator of genuine support.

Indeed, there have already been some ominous statements from the broking community in particular. The Insurance Insider writes: “The London and International Insurance Brokers’ Association (Liiba) also cautioned that any changes to the marketplace should not be used to undermine the role of the broker in the insurance distribution chain.”

The fundamental challenge that Lloyd’s currently has is that it needs to force behavioural change but has limited control over those whose behaviour has to change. The uniqueness of the Lloyd’s market has eroded over the years as companies have moved into the specialty areas historically dominated or even monopolised by Lloyd’s.

On top of this, much of the news coming out of Lloyd’s over the last year or so has made for grim reading. Following poor market results, the PMD introduced its ‘Decile 10’ initiative which sought to remove poor performers from the market. This has led to syndicate business plans coming under unprecedented scrutiny and reports of syndicates missing out on attractive business as their underwriting flexibility is limited.

We therefore believe that it will be imperative for Lloyd’s to spell out its operational transformation in tandem with a compelling refresh of the Lloyd’s value proposition. Why should brokers suck up the short-term pain that Future At Lloyd’s will inevitably cause for a higher prize? What will Lloyd’s offer in the future that the companies market will not deliver

Assumption 4: Lloyd’s and the market can handle the magnitude of change

The Future At Lloyd’s will deliver six solutions each comprising four or five major components over 3 years.

This is an immense amount of change. We presume that the team reached the conclusion that this was a ‘do or die’ moment – but there is a risk of ‘do and die’.

Undoubtedly consultants like ourselves are queuing up at the Corporation’s door to help deliver the various components but there is a risk that the need for speed will lead to disjointed or sub-optimal solutions. Robust project management that can simultaneously focus on the build and dealing with a complex stakeholder landscape will be essential.

We have no doubt that many of these questions have been addressed by the Future At Lloyd’s team behind the scenes. However, there are no easy answers and no amount of preparation can eliminate the execution risks that Lloyd’s will see on the horizon. However, by partnering with providers of pre-built technology, for example, there may be opportunities for the Corporation to de-risk in certain areas.