InsurTech Insights Europe: Five key themes

26 April, 2024

Recently, InsurTech Insights Europe hosted the industry’s technology innovators. Unsurprisingly, Generative AI (GenAI) was the main topic of discussion with the potential for a step-change in digital business transformation. In this article we present five themes from the conference and our view.

1 GenAI hype is different

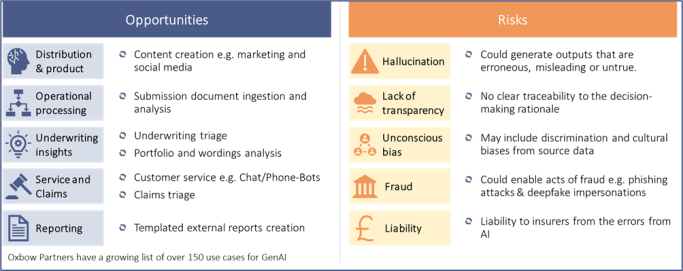

GenAI was the conference’s central topic; c.30% of main stage sessions had “AI” or “GPT” in the title. The buzz feels different to previous tech waves like blockchain, primarily due to the potential impact on today’s business models. During the conference, various panellists discussed both the potential use cases and risks of GenAI.

The Oxbow Partners view

Despite the hype surrounding GenAI, (re)insurers need to remember that it is not a universal remedy. The wide range of potential applications makes it hard to know where to start and important to consider how you organise the capability in the organisation. We are advising several insurers and reinsurers on this topic.

2 Key technology capability in 2024: Agility

We are in a period where both technology and risk are moving fast. (Re)insurers burdened by technological debt from monolithic systems, outdated programmes and tightly coupled components are at a significant disadvantage.

Panellists were in general agreement that the available technology will be significantly ahead of today in five years’ time. Therefore, being agile is a critical capability so that (re)insurers can do things like swiftly bring new products to market, change pricing models in real-time and integrate new technologies including GenAI.

The Oxbow Partners view

(Re)insurers that have not re-platformed onto modern architectures will struggle to keep up. Whilst we can be optimistic about the opportunities of AI and new technologies to support future business, many (re)insurers must undertake significant foundational work to ensure their technology, digital and data architectures are prepared. The challenge for management is always finding the right balance between foundations and differentiating technology investment.

3 Digitalisation requires more than technology or AI

Panellists in the session entitled “Breaking down silos: how digital transformation can unify your company under one vision” and “How to future-proof your business and digitalise your capabilities” discussed the importance of a clear vision for business-wide transformation. A business-led technology strategy will avoid building technology for technology’s sake and maximises business benefits.

The Oxbow Partners view

When attempting a large-scale transformation, common pitfalls are a lack of buy-in below the executive level and building technology for technology’s sake. By answering top-level questions, (re)insurers can identify areas of technology-enabled strategic differentiation. This can help direct investment in digitalisation efforts. Having leaders, delivery resources and end-users all aligned around a central vision can make or break a digital transformation. Effective communication is vital.

4 Digital talent in the insurance industry

The scarcity of digital innovation talent within the insurance industry remains a persistent challenge. A recruiter at the event suggested that (re)insurers may never be able to attract the same level of digital talent as InsurTech. If this is true, there is a necessity to partner to access best-in-class capabilities.

Additionally, the topic of a looming “great retirement” was raised with concerns that seasoned underwriters and industry expertise may be lost in the next few years. This increases the need to institutionalise expertise. Panellists discussed technology as an enabler for transferring knowledge into processes and models.

The Oxbow Partners view

Overall, the ‘war on talent’ continues to rage within the industry; senior leaders should ask some vital questions like:

- What is the target company culture? How is this tailored to specific parts of the business?

- Where do we want our people to excel? How does this impact how we set up our teams e.g., teams of “all-rounders,” teams with “mixed” skillsets or teams of “specialists”?

- Should we prioritise talent beyond the insurance industry to innovate?

5 People remain at the centre of our business

One of the concerns with emerging technologies is job displacement. This concern is heightened as AI is perceived to be “taking over”. The technologists at the conference suggested this is a myth that needs dispelling: GenAI should be a supporting assistant rather than a decision maker, and allows qualified professionals to focus on higher value activities.

The Oxbow Partners view

The role of the underwriter or claims handler may change as we move towards a “bionic” relationship with technology. AI assistants triaging low value activities should allow underwriters to focus on client relationships, business development and underwriting. Therefore, expertise to underwrite, handle claims and support customers effectively remains the critical differentiator in the industry.

About the author(s)

Matt Shipp is a Manager at Oxbow Partners. He has worked on engagements across strategy, operation and technology for domestic and global (re)insurers. Recently, Matt worked on a multi-year process to develop an end-to-end underwriting tech infrastructure for a London Market syndicate. He also has experience in retail insurance strategy and M&A.