Learning from asset management to gain the full benefit of portfolio management

17 April, 2025

In October we launched our 2024 paper about ‘Strategic Imperatives for P&C Reinsurers in 2025’. The paper is based on our work with numerous reinsurers and analysis of our Reinsurance Market Model, which contains detailed performance data on 19 of the largest P&C reinsurers accounting for nearly $400bn of premium.

Despite an outstanding 2023 market result for reinsurers and likely strong 2024, the market equilibrium feels fragile: traditional reinsurance capital is estimated to be up 10% in 2024; well-capitalised challengers are manoeuvring; some startups are lurking; and third party capital is steadily increasing. The outlook for 2025 is uncertain.

In section 1 of this report we briefly reflect on 2023 market performance.

In section 2, we consider two challenges that P&C reinsurers need to navigate in 2025.

In section 3, we consider four areas where reinsurers need to act in 2025:

3. Learning from asset management to gain the full benefit of portfolio management: Getting more comfortable with diversifying beta business and being able to write it efficiently

Portfolio management has moved up the agenda of many reinsurers over the last decade. Whilst this is a mature capability for the very large players, many others are still transitioning from building portfolios of the best risks to building the best portfolios of risk, as Kathleen Reardon, CEO of Hiscox Re and ILS, eloquently puts it.

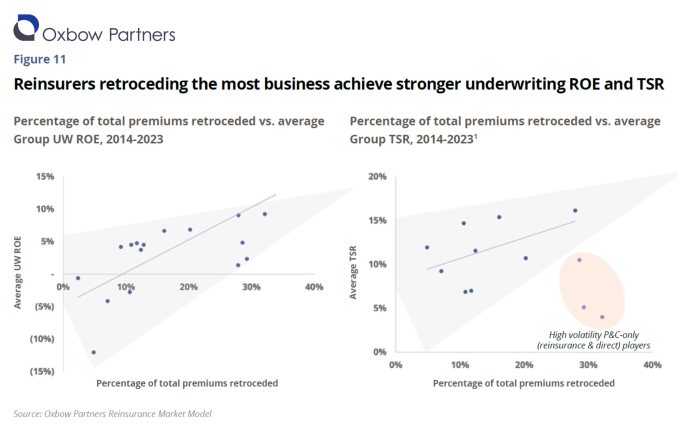

For many, portfolio management is a risk-driven activity, providing non-binding guidance on target portfolios, assessing exposures and driving the gross-to-net strategy. Data from our Reinsurance Market Model shows a clear link between the use of retrocession and underwriting ROE and, to a lesser degree, TSR.

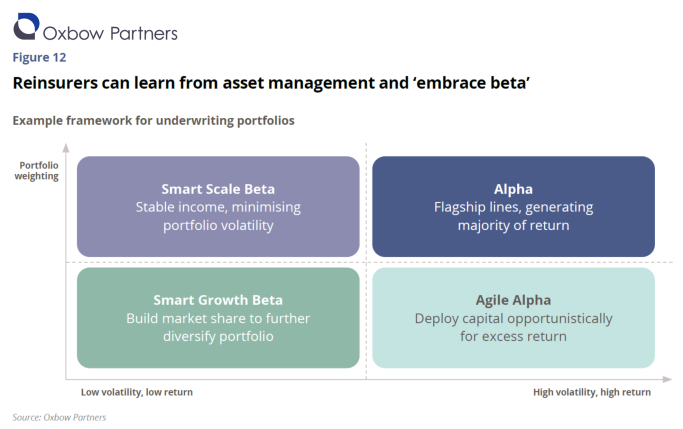

We believe there are opportunities for reinsurers to use portfolio management more actively as a tool for growth. They can, perhaps, take inspiration from the rigorous discipline of certain asset managers, who are also in the business of balancing risk and returns. Critically, reinsurers need to be clear about where they are seeking ‘alpha’, and where they are deliberately and unashamedly writing ‘smart beta’.

This will require change across the full underwriting operation. The strategy needs to be clear about where it is looking for ‘alpha’ and ‘smart beta’, and writing ‘beta’ portfolios efficiently needs to be valued more highly than it is today in most organisations. Many companies would benefit from shifting their thinking from superior risk selection to superior underwriter leverage.

The direct specialty market is making significant progress in this area and could serve as a useful blueprint for reinsurance. Various forms of follow model with differing levels of human intervention have been set up since the start of the decade and some have achieved considerable scale. For example, Brit Ki’s algorithmic syndicate, which provides ‘smart follow’ capacity into the market, expects to grow to $1bn GWP in 2024 having been founded in 2020. (Our report, in partnership with the Lloyd’s Market Association, on Enhanced Underwriting will be published in November 2024 – register your interest here).

Questions for management:

- Do we have a clear portfolio management strategy and objectives?

- Are we clear about the role of portfolio management vs. underwriting?

- How do we communicate our portfolio management strategy to our staff, clients and shareholders?

- What is our approach to ‘alpha’ vs. ‘smart beta’ as an organisation?

- Do we value beta? Should we?

- What is the balance between ‘alpha’ and ‘smart beta’ in our portfolio strategy?

- What makes beta ‘smart’ and how do we build those things, e.g. efficient underwriting, culture?

- What structures, capabilities and processes do we need to deliver robust portfolio management?

- Is our portfolio management and underwriting interface clear?

- How mature is our current portfolio management capability? Where is our current operating model not fit for purpose?