Making big strategic choices

17 March, 2025

In October we launched our 2024 paper about ‘Strategic Imperatives for P&C Reinsurers in 2025’. The paper is based on our work with numerous reinsurers and analysis of our Reinsurance Market Model, which contains detailed performance data on 19 of the largest P&C reinsurers accounting for nearly $400bn of premium.

Despite an outstanding 2023 market result for reinsurers and likely strong 2024, the market equilibrium feels fragile: traditional reinsurance capital is estimated to be up 10% in 2024; well-capitalised challengers are manoeuvring; some startups are lurking; and third party capital is steadily increasing. The outlook for 2025 is uncertain.

In section 1 of the report we briefly reflect on 2023 market performance.

In section 2, we consider two challenges that P&C reinsurers need to navigate in 2025.

In section 3, we consider four areas where reinsurers need to act in 2025:

1. Making big strategic choices: Determining the role of P&C reinsurance, L&H reinsurance and Direct in the business model

Of the 19 reinsurers in our Reinsurance Market Model, eight write P&C reinsurance, L&H reinsurance and Direct business and nine are non-life only (P&C and Direct). Only RenaissanceRe and R+V Re are ‘pure-play’ P&C reinsurers.

With the combined impact of significant excess capital on balance sheets and challenges in some existing parts of the portfolio, notably US casualty, reinsurers need to consider either which of their divisions to expand and contract as market conditions change, or whether to enter one of the business areas they are not currently in. Our Reinsurance Market Model provides three insights.

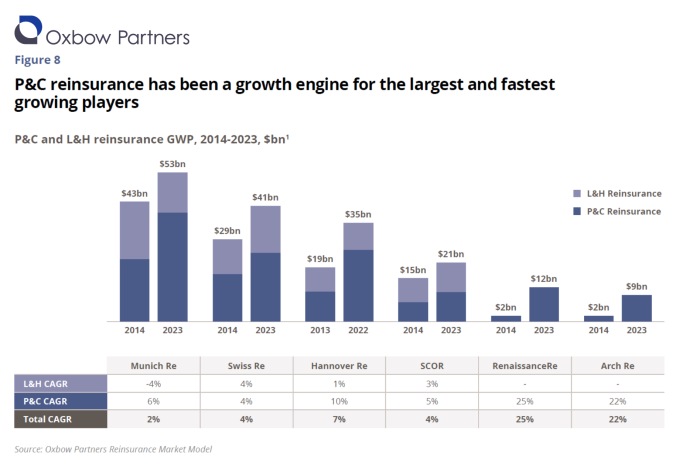

First, we observe that challenger reinsurers have been able to grow P&C reinsurance rapidly over the past decade. For example, RenaissanceRe and Arch Re have grown at 25% and 22% CAGR respectively.

There is plenty of headroom for challengers and we believe this will continue to be true in the next market cycle. We expect growth will continue to be driven by the US due to the combination of superior economic performance, a challenging casualty claims environment and climate-driven volatility in property reinsurance. With the US’s mature broker distribution infrastructure, challengers will continue to be able to access risk.

Second, we observe that the largest reinsurers have been pushing into Direct business in the last decade. For example, Munich Re has grown its Global Specialty Insurance division at a CAGR of 23% from 2019 to 2022, and it now represents around 29% of P&C GWP. Swiss Re has pushed hard with its Corporate Solutions business, and of course the CEO who led it from 2019 to 2024 is now the Group CEO.

Third we observe the ongoing conundrum about what to do about L&H reinsurance. Is a composite proposition a strategic differentiator or simply a capital diversifier? Should it be managed alongside P&C, or in a separate division? Is it an interesting growth opportunity as the P&C market becomes more challenging?

Data from our Reinsurance Market Model suggests that it is a solid diversifier but not a growth engine: our selected reinsurers in our sample grew at 7.8% overall, but the L&H portfolios grew at just 3.2%. (It is important to remember that our Model does not include L&H reinsurance specialists who have exhibited greater growth.)

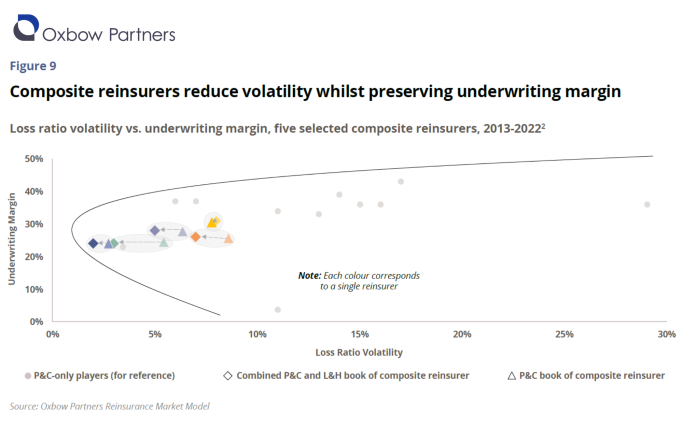

However, our analysis shows the diversifying impact of L&H against P&C reinsurance for composite players. Looking at data from 2013 to 2022, we observe that composite reinsurers achieve Markowitz-style portfolio diversification with two relatively uncorrelated asset classes to minimise volatility whilst preserving return. The loss ratio volatility of the composite P&C and L&H book is 1.4 percentage points lower than the weighted average of the two books with no deterioration in underwriting margin for the composite result compared to the weighted average of the separate L&H and P&C books.

We observe that some of the reinsurers writing only P&C business (Reinsurance and Direct) have much more volatile loss ratios than their composite peers. On average, they have a loss ratio volatility of 13.7% compared to 4.8%, but higher underwriting margin (33.9% compared to 26.3%).

Whilst likely not a long-term growth engine, writing an opportunistic L&H portfolio against the market cycle could be a useful diversification play for some P&C reinsurers.

Questions for management:

- Can we fulfil all our growth ambitions and volatility requirements with P&C reinsurance or do we need to push L&H reinsurance or Direct?

- What is the limitation of the pure-play P&C reinsurance model?

- Wherever we want to push, should we be considering M&A?

- If L&H reinsurance is attractive, what is the right strategy?

- Can we win with a niche organic growth strategy?

- What other synergies can be achieved with existing P&C?

- If Direct business is attractive, what is the right strategy?

- Should we build a business in the single risk specialty market, or extend our portfolio underwriting capability into program business?

- Can our reinsurance expertise be applied to some of the emerging ‘smart follow’ business models in the direct market?