Motor Claims 2040: Are Insurers Ready?

October 10, 2017 Greg Brown

We often write about InsurTech on this blog, looking at the impact of various technologies on insurance distribution and the insurance value chain. But as we point out to our clients regularly, “what is the impact of InsurTech” is a fundamentally different question to “what is the future of insurance”. The former is insurance-industry focused the latter considers broader trends. Motor claims is arguably the strongest case in point. Developments in automotive industry will fundamentally change the nature of the motor insurance and motor claims. It is not clear that the third-party liability product will remain a retail product in a world of autonomous vehicles with little scope for driver error; the frequency of motor claims will reduce; the nature and mix of claims will change.

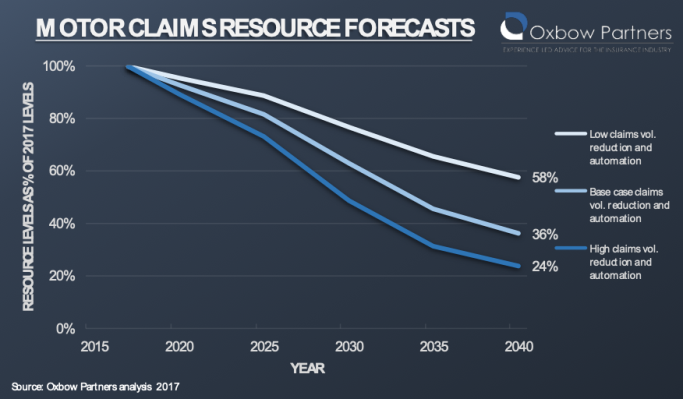

Recent research by Oxbow Partners suggests that these developments could lead to a reduction in the headcount of motor claims teams by up to 75% by 2040.

In this blog post we examine the drivers of claims frequency and look at how this could impact claims’ team sizes. We focus on driver assistance systems and autonomous vehicles as these will have the biggest impact but it is worth noting that there are many other factors involved in such a complex part of the industry.

Motor claims frequency could reduce by 65% by 2040

Human error is to blame at least in part for over 90% of road accidents. Advanced driver assistance systems (ADAS) such as collision warning and automatic parking have already helped to reduce accidents by 40% since 1997. The ABI has released similar research showing that UK motor insurance claims frequency has reduced by a third in this period. We expect this trend to continue. ADAS technology will continue to reduce claims frequency. The impact of ADAS on claims frequency will depend on consumer adoption of ADAS technology. This is a factor of both customers’ perceptions of value provided and the extent to which technology costs can be reduced.

The focus will move increasingly from ADAS to autonomous vehicles (AVs) over the next 20 years. It is hard to predict the speed at which AVs will be adopted. Legal, social and ethical issues remain unsolved – for example the commonly cited dilemma about how cars should respond when faced with a choice between multiple accident scenarios.

In theory, AVs will eliminate the vast majority of road accidents, leaving only those where the accident could not have been anticipated by the “driver”.

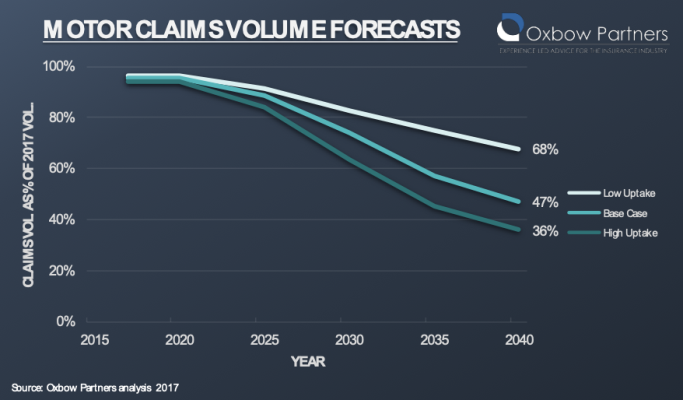

We have combined the effect of ADAS and AV uptake into a model to project future claims volumes. We believe that ADAS will have the biggest impact on claims until 2025 because of the long lead-times for automotive production and slow turn-over rate of the automotive stock (i.e. people don’t replace their car as soon as a new model comes out), meaning that it will take over 10 years for AVs to become common on our roads.

We have therefore proposed three scenarios:

- Low Uptake: Slow further uptake of ADAS. Despite the technological promise, legal, social and ethical issues around AVs remain unresolved. This is partly driven by lobby groups from industries such as trucking and taxis who have managed to stall legislation on the topic.

- Base Case: Steady uptake of ADAS. Adoption of AVs starts to gain traction from 2025. 15% of cars are fully autonomous by 2040.

- High Uptake: ADAS adoption grows quickly. Fast-track legislation in the late 2010s and early 2020s leads to accelerated adoption of AVs. 50% of cars are AVs by 2040.

Our analysis suggests that motor claims volumes could reduce c. 65% high uptake scenario. The claims that remain in 2040 are, therefore, primarily those which are independent of vehicle technology, for example non-liability claims such as theft, and non-driver fault liability claims such as pedestrians walking into the road.

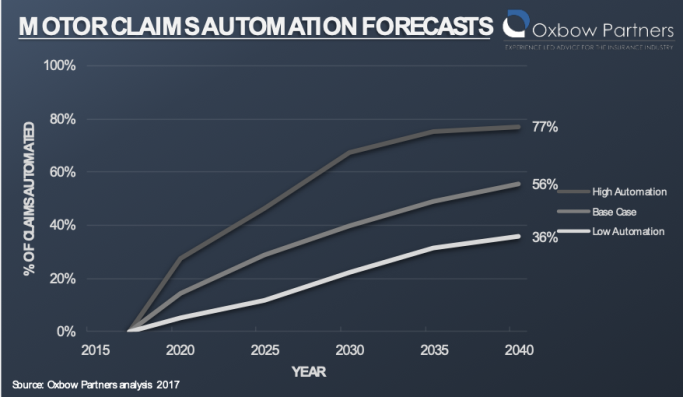

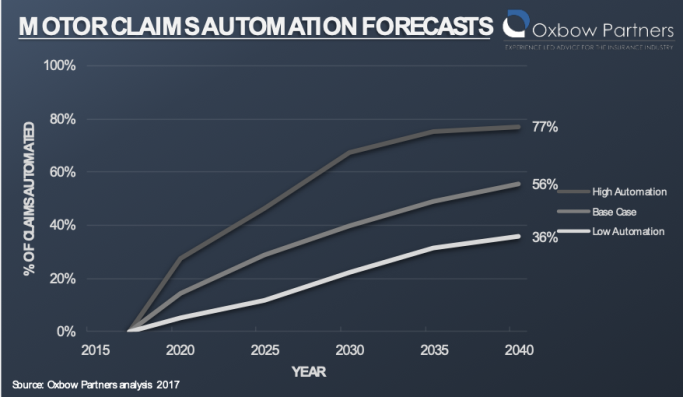

Over three quarters of motor claims could be automated by 2040

We are confident that automation will become more common in claims. Most insurers have only made limited progress in this area so far, but some of the nimbler players can point to early successes. For example, Inshared, a small Dutch motor insurer, claims to automate up to 70% of motor claims and Ageas announced earlier in the year that it had gone into full production with Tractable (Bitesize), a startup that uses AI to estimate motor losses.

We believe that motor claims are particularly suited to automation because the majority of motor claims are not emotional: customers just want to be back on the road quickly. Clearly there are complex and emotional claims where human contact is highly valued throughout the claim, but these are the exception and not the rule.

We again modelled three scenarios:

- High Automation: 80% of low and medium complexity claims, such as low speed side impact, are fully automated requiring no manual intervention by the insurer. High complexity claims remain manual but 15% of notification interactions (e.g. status updates) are automated.

- Base case: 70% of low complexity claims are automated in line with Inshared’s experience. Medium and high complexity claims remain manual but 15% of notification interactions (e.g. status updates) are automated.

- Low Automation: FNOL and progress updates are automated for medium and low complexity claims resulting in 40% of communication being automated. Otherwise manual processes remain in place.

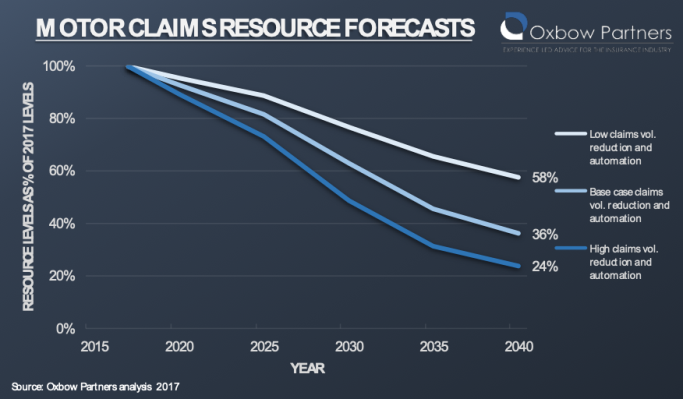

Motor claims teams will become significantly smaller and more expert

Taken together, reducing claims volumes and increasing automation will significantly reduce the headcount required in claims teams. Our combined base case suggests that headcount will reduce by c. 65% by 2040.

The skills required in claims teams will also change. Fewer administrative staff will be required to do things like FNOL recording and status updated; this will be done by customers themselves and automated tools respectively. Instead, staff will be required to adjust complex claims – not to mention the technology resources required to build, test and adjust AI-driven algorithms that sit behind automated processes.

Conclusion

The future is clearly uncertain. ADAS and AV uptake rates are very hard to predict, and it will remain unclear for at least 5 years as to whether motor insurance will remain a retail product. What is clear is that technology will have a significant impact on motor claims over the next 20 years. In the short term, the challenge for insurers will be understanding how and where best to utilise digital technology to automate elements of the claims experience. A ‘digital for all’ strategy whilst strategically simple risks disrupting the fine balance between customer experience, operational costs, indemnity spend and fraud. Whilst a ‘status quo’ strategy will likely leave insurers struggling to be competitive against more advanced peers. Insurers need to take a nuanced approached to building an omnichannel experience that customers will use and value. Any digital strategy will take time to implement, we believe insurers need to tackle this topic now to avoid being left behind.

Oxbow Partners has helped several clients to respond to the digital opportunity in the claims space. If you would like to know more please get in touch [email protected]