2020 was the year of many things, including clichés like “five years of digitisation in five weeks”. Restaurants swapped tables for delivery services and ecommerce grew its share of retail by 11 percentage points in the UK – close to the amount it had grown in the previous 10 years.

Data from Willis Towers Watson shows that investment in InsurTech has continued at pace. Total investment hit record highs in 2020 at US$7.1bn raised in 377 deals.

So was 2020 the year, and Covid the catalyst, that catapulted us into the future of insurance? We believe not, for two reasons.

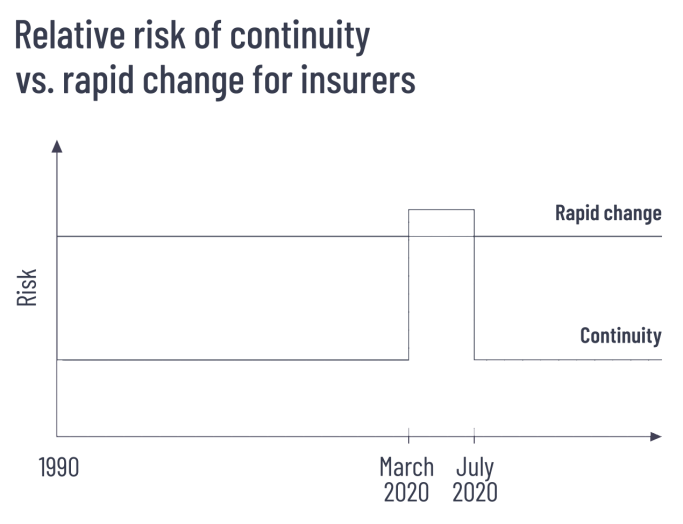

First, 2020 experienced an exceptional risk profile, where the risk of not changing exceeded the risk of moving fast and making some mistakes. But these risks have reverted back to the long-term norm and we see little lasting impact on insurers’ change capabilities or programmes. Of course, companies are continuing with their digitalisation and cultural change agendas, but in much the same way as they were pre-pandemic.

Second, we question to what extent real change has occurred in 2020. Steve Hearn, CEO of broker Corant Global, maybe put it best recently when he said that the insurance industry has so far “digitised its existing business model”, but not challenged it.

Back in March, digitisation was as simple as stocking up on laptops, implementing software, and updating processes and policies to facilitate remote working. Some of these changes have become permanent; for example AXA, Aviva, and Nationwide updated their remote working policies to some fanfare. But these policies merely impact how companies do things, much less what they do or what they offer clients.

In the UK, product sourcing has remained largely unaffected as (digital) price comparison websites already accounted for around 60% of home new business and 80% of motor. (Our interviews with European executives suggest that the impact is likely to be more significant on the Continent where agents continue to dominate, but that the trend is slow to show up in data.)

Similar observations can be made about product, where little has changed for the customer. Arguably the most obvious Covid impact was the rebate that many customers enjoyed from their motor insurer. Other opportunities, for example smart home propositions designed for the work-from-home era, remain untapped.

So what does this mean for the industry?

On the one hand, the industry has proven its resilience to disruptive change, but on the other Covid has created some vectors which innovative players – old and new – can exploit.

For example, we believe that Vitality’s entry into the UK motor market is a landmark move given Discovery (Vitality’s parent) has such a strong record of product innovation and partnership at scale. Continental Europe might soon start to feel the impact of Lemonade’s growing presence – now selling home, pet and life insurance. Market disturbance could be accelerated through trends like Open Finance, as we recently explained on our blog.

But change in insurance is slow. Even Lemonade – the posterchild InsurTech – had only US$213m of in-force premiums at the end of 2020 despite having raised US$480m of investment.

And this is exactly what should worry shareholders and management teams with a 5+ year horizon. As we explain in the report, it took years before UK insurers understood the impact of price comparison websites on their businesses and even longer to develop the capabilities needed to respond. Industry losses during this period accounted to many billions.

President Eisenhower noted that “urgent [issues] are not important, and important [ones] are never urgent.”

This is something that insurance executives should bear in mind. As the Covid crisis passes into history, the imperative for change might become weaker. But preparing for the future of insurance has never been more important.

Download the 2021 InsurTech Impact 25