This is the first of three articles in a ‘mini-series’ about the reinsurance post-bind operating model.

Post-bind has not historically been high on the agenda of many reinsurance management teams. After all, “if it ain’t broke, don’t fix it”. But many companies have scaled significantly over the last ten years and increased in complexity, for example moving from a property cat to multi-line proposition, adding locations or diversifying from captive to third party business. Reporting requirements have increased, too, for example for alternative capital providers or ESG.

The system is still not broken: companies are closing the books and paying claims on time. Many companies have ‘thrown bodies at problems’ to make this happen.

However, the system is becoming increasingly strained and management teams are acutely aware of operational risks, knock-on impacts from poor data quality, and scalability challenges. CFOs are asking why cost is going up in lockstep with business volumes. CUOs are asking why the service their underwriters are enjoying is becoming less personalised and sometimes less timely. Operational risk leaders are asking why there is only one person who knows how a critical spreadsheet-based process works.

All this has moved the post-bind operating model to the forefront of many management teams’ minds. Some reinsurers have already acted on these concerns, whilst others continue to assess their options.

In this series, we explore what is driving the increased focus on the post-bind operating model and what to do about it. The three articles are:

We define ‘post-bind’ as the value chain immediately after acceptance of a risk. The main functions involved in the post-bind process are operations, technical accounting, financial reporting and claims.

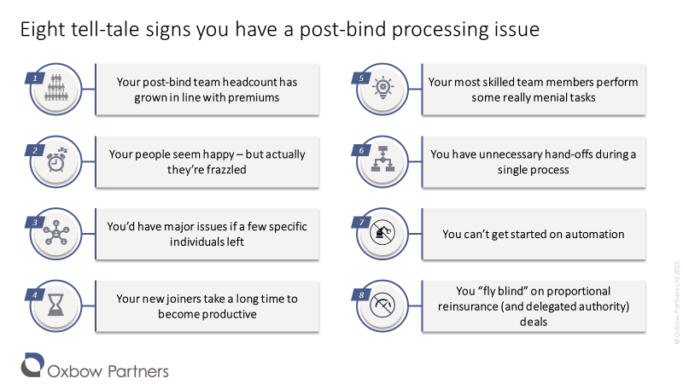

Our work with numerous reinsurers has helped us identify several common traits of companies with a post-bind processing issue. We explore these below.

#1 Your post-bind team headcount has grown in line with premiums

Best-in-class post-bind functions are scalable: volumes can increase without needing to add cost (normally people) in proportion. Processes are clearly defined and optimised for quality and efficiency. Automation technology is used for simple processes such as ingesting data from the large brokers (who have themselves standardised and automated some of their data exchange interfaces) or executing payments.

If your cost base rises in line with your transaction volume, then you’ve probably got a post-bind problem.

#2 Your people seem happy – but actually they’re frazzled

We are often impressed by the huge dedication with which post-bind team members apply to their work. It is easy for executives to pretend to themselves that everything is working fine.

But that is not necessarily the case. Often we observe individuals working unsustainably hard to get jobs done. Surprisingly, this often leads to grumbles rather than poor staff engagement scores – testament to the solid cultures that many companies have built up over time. Staff turnover KPIs are often stable.

However, we also speculate that part of the reason that there are not more staff departures is because most companies have the same issues. This will change – and laggards will undoubtedly see frazzled colleagues heading down the road to competitors who are shouting about their new digitally enabled process.

Don’t be fooled by your staff engagement scores and don’t underestimate the criticality of your post-bind team to business performance. If you think the team is frazzled, it’s time to invest in your post-bind operating model.

#3 You’d have major issues if a few specific individuals left

Reinsurance operating models have generally grown organically rather than deliberately. That means many processes have emerged and have not been designed as part of a broader system. A consequence of that is that organisations can be dependent on some critical individuals. Is there one person in your operations team who everyone always talks to about a certain cedent report? Is there one colleague who knows how a particular spreadsheet works? Is there a lifer in your claims team who understands the process and gets pulled into each and every problem case?

More often than not, reinsurers have critical individuals and COOs are getting increasingly concerned about it.

If you recognise this problem, you have a problem with your post-bind operating model.

#4 Your new joiners take a long time to become productive

A company’s operating model should allow administrators to become productive very quickly. This requires documented processes and ideally digitally enabled workflows, for example the administration portal of an underwriting workbench.

But the reality is that it takes a long time for people to become productive in many companies because they need to learn idiosyncratic processes. The implication is that companies have too much of its IP with its administrators and not enough in their own operating models.

If it takes a long time to onboard your new joiners, you need to standardise and document your processes.

#5 Your most skilled team members perform some really menial tasks

We observe that even the most skilled team members perform some of the most menial tasks in a post-bind operations team – sometimes more than anyone else. That is because with tenure comes great knowledge of process idiosyncrasies. In the best case these quirks are time-consuming to teach a new joiner, but in reality it is quicker for senior people simply to do menial tasks themselves.

Post-bind team should be organised in ‘pyramids’ whereby senior colleagues direct and teach junior colleagues. The operating model should be structured in a way that allow junior members of the team to become productive quickly and work their way up as they gain experience. A stratified team is also important for governance so that the senior team member can check rather than just ‘do’.

If your senior staff are doing rather than directing and spending time on menial tasks, it is a sign that your post-bind model needs assessment.

#6 You have unnecessary hand-offs during a single process

Processes that have developed organically often circulate around various post-bind functions before being completed. This may be because a team, which has not been designed deliberately, does not have the right skill sets in it. This creates bottlenecks as tasks sit in in-trays and often reductions in quality.

This issue often exacerbates process indiscipline. For example, every case sitting in an inbox is an opportunity for reprioritisation and it is often the case that this occurs informally depending on which ‘user’ shouts loudest. This is unsatisfactory for both post-bind colleagues and underwriters.

If you find that transactions bounce from in-tray to in-tray more than feels sensible, you should think about your team structures and interfaces.

#7 You can’t get started on automation

Everyone knows the saying about teenage sex – everyone’s talking about it but nobody’s doing it. Amongst reinsurers, it’s not dissimilar with automation.

In many cases, the issue is not a lack of desire or budget, but a lack of standardisation and transparency of underlying processes. Automation is hard in reinsurance because many processes have relatively low unit numbers and variation is high. But automation is impossible when processes have grown organically and vary, say, in each location and for each line of business.

If you don’t know where to start on automation, you probably have a process standardisation issue. The chances are that you should look at processes and the operating model before you look at the technology.

#8 You “fly blind” on proportional reinsurance (and delegated authority) deals

Bordereaux provide crucial information to underwriters on how their deals are performing throughout the year. Delayed and insufficiently detailed bordereaux processing can mean that underwriters do not have sight into trends and cannot make informed decisions regarding their deals, like what conversation to have with the broker at renewal.

If “flying blind” is a common complaint from the underwriters in your business, it is likely that you have problem with your post-bind operating model which needs addressing.

What it means for you

It’s 2023 and the world has changed. Post-bind has become a key enabler of value creation for many reinsurers who have reached the limits of scalability through informal operating models. This is true no matter how the market develops: an effective, efficient post-bind operating model is essential both to thrive in a continuing hard market and to ride out the future market.

A first step after reading this article could be to benchmark your operations across the dimensions outlined in this paper. If you would like help doing this, or if you would like to access Oxbow Partners insight into how you compare to the market, please get in touch with us.

In our next article we will explore ways to take action to address post-bind processing issues identified through these tell-tale signs.