Over the last 6 months COVID-19 has ripped through societies and economies. One small positive to emerge from this is a demonstration of humankind’s ability to adapt rapidly to changing environments. In Q1 the insurance industry saw an almost overnight transition to remote working and etrading even from the most stoically face-to-face parts of the market. For example, Lloyd’s electronic placing platform (PPL) saw a c.40% increase in logins in April 2020 vs. February 2020 which compares to a 9% increase over the previous 6 months.

In this blog we look at how the trading environment might evolve over the coming months and how this might drive (re)insurers and brokers to accelerate their digital strategies.

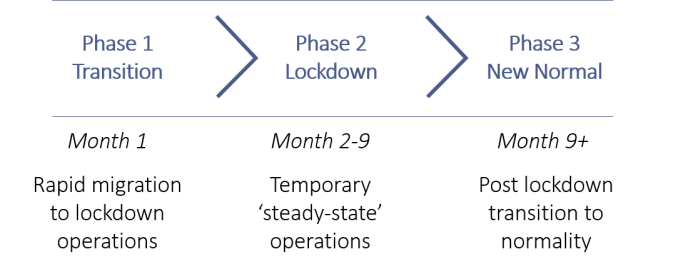

It is clear to us that COVID-19 is evolving over three phases.

It all started with the hurried transition phase, with businesses shifting to remote working and discovering the immediate impact on their sector. Most organisations were controlled by basic fight or flight instincts; there was limited strategic thinking.

We are now in the second phase – a sort of temporary steady state. For some sectors this phase remains punishing (e.g. leisure and retail). For others, the experience is neutral or even positive (e.g. motor insurers who have experienced limited short-term impact on premiums but up to 80% drop in claims).

The final phase will be the establishment of a ‘new normal’. We believe that social distancing – whether mandated by governments or simply a hang-over in society – and periodic temporary lockdowns will remain for some time. This will have a profound impact on society, work and insurance as we described in a recent blog post from 2022.

Many of our clients are therefore asking us the same question:

“Is it the right time to accelerate my digital transformation?”

Why now?

We believe customer behaviours will change forever. Lockdown has forced consumers to move online – for example, UK Office for National Statistics data shows that online retail sales increased 63% year-on-year in April 2020. Some argue that these digital behaviours are temporary. However, research would strongly indicate otherwise. A study in 2010 showed that behaviours take between one and eight months to become habits: much less time than the COVID-19 disruption is certain to last.

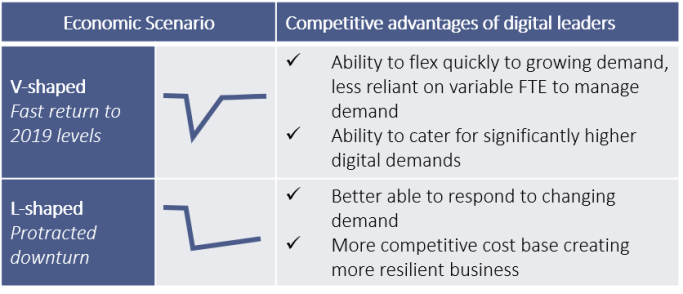

Second, digital leadership creates competitive advantage whether we see a V-shaped or a more protracted L-shaped recovery.

Therefore, we believe (re)insurers and brokers need to take advantage of the situation and take action on their digital transformation.

How to respond

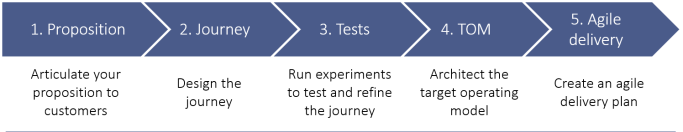

(Re)insurers and brokers need to take five steps in their digital transformation.

The first two steps are about articulating your offer to customers. Each business and brand is different and customer needs and expectations vary. Before you can build digital solutions you need to understand and define how you want to play.

The third step is about running experiments to test your hypotheses and refine the journey based on real-world customer need.

You then need to design and configure a digitally aligned operating model. Our post on building digital businesses provides more insights into how insurers should think about the components of a digital target operating model (TOM).

Finally, create an agile delivery plan that allows you to continue to learn and evolve as you deliver. You can read more on adapting agile for the corporate environment here.

Whatever you choose to do, now is the time to act to set your business up for the future.