Post-Covid insurance propositions: Suitability, transparency, certainty

May 5, 2020

On 1 May the UK regulator, the FCA, announced that it expects insurers to “consider whether and how Coronavirus may have materially affected the value of their insurance products”. It cites public liability insurance for hairdressers, bars and restaurants where the “insured events can no longer happen for any holders of the policy”.

As our Market Intelligence team has been reporting, US insurers have started rebating premiums to customers due to the reduction in car usage. In the UK, leading motor insurer Admiral became the first to follow suit by providing all customers a flat £25 rebate and LV has a more limited scheme.

However, premium rebates are a clunky and retrospective tool. In this blog post we consider how insurance propositions could evolve to meet post-Covid customer needs. We identify three criteria post-Covid insurance propositions will need to meet: suitability, transparency and certainty.

Suitability – usage based covers

The Coronavirus crisis – and the FCA’s announcement in particular – has put the suitability of insurance products for customers under the spotlight. An annual policy provides the convenience of being “always on” but is it reasonable to pay insurance for a parked car? We believe that Covid could be a catalyst for usage-based insurance, such as telematics.

ByMiles charges customers for the distance driven each month on top of a small fixed annual premium. Customers either install a small tracker in their car or, in the case of connected cars like Teslas, source data directly into their phone app. The mobile app also allows customers to track the cost of each individual journey and the cumulative monthly premium.

Cuvva provides time-based policies for people borrowing cars, with the policy duration ranging from an hour to several weeks. The temporary cover is fully comprehensive and does not require an underlying policy. Cuvva is also developing a cost-effective pay monthly insurance product that can be cancelled free of charge at any time, similar to the Aviva Plus subscription product launched last year.

Both models ensure alignment of the premium to the underlying risk, a key measure of ‘suitability’.

Certainty – parametric covers

The reporting around business interruption claims is likely to dent many policyholders’ trust in insurance. This issue came to a head this week when the FCA announced it is seeking “legal clarity” on the interpretation of clauses in the market. But for many policyholders the issue is not just legal but existential, and their main concern is being paid. This could be a boost for parametric models.

FloodFlash uses sensors to detect the water levels in a flooded SME properties. When the flooding level reaches the trigger depth they send a signal and the settlement is paid out, sometimes in as little as 24 hours. Both the trigger depth and settlement amount are determined by the customer at the point of purchase.

We have also written previously on our blog about the attractiveness of parametric triggers in total loss of personal lines. In traditional policies, insurers determine the value of a total loss after the event. Often they refer to indices but these are generalised and customers may be disappointed to find a gap to their expectations or replacement cost.

Parametric structures give the insurer and customer the ability to agree a settlement value upfront. This removes a key point of frustration in the claims process and leads to a rapid settlement for customers. Claims handling costs are significantly reduced for insurers, as are actuarial costs as there is no longer a difference between exposure and incurred losses.

In theory, a business interruption policy could allow customers to determine the days of interruption before the policy is triggered and the settlement amount. (We recognise that this is an oversimplification for pandemics because the challenge at present is whether the reason for closure is covered due to concerns about aggregation. This is not addressed by a parametric trigger.)

Transparency – new models

Finally, this crisis is testing the trust between insurers and customers and we believe that radical new models have an opportunity to flourish.

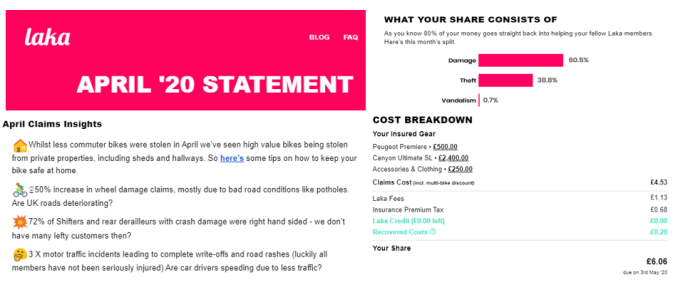

Laka has built a unique proposition by which the monthly premium is determined transparently by the cost of claims for all members that month. Laka charges an additional fee for the claims handling. Customers are protected against ‘outlier’ months by a maximum monthly premium cap (facilitated by ‘reinsurance’).

Laka’s monthly statements provide customers with the breakdown of their premium calculation. For instance, this month has seen a drop in commuter bike theft but an increase in wheel damage claims, potentially caused by the additional miles covered by cyclists logging their daily exercise.

For me, this month’s premium was £6 and far below my maximum cap (c.£25) or the market rate for standard policies.

The Oxbow Partners view

The Coronavirus crisis is challenging insurers on all fronts. The FCA statement has now brought attention to products.

Rebates and premium payment freezes are a clunky and retrospective tool. Rebates in particular are poorly aligned to the customer. As lockdown continues and the changes to people’s lives become embedded, insurers will discover that many of their products are fundamentally misaligned to their needs.

This is an opportunity for InsurTechs.

However, the customer acquisition challenge remains. Despite everything, an ABI paper has shown that April was a month of unusually low insurance switching suggesting that customers are not desperately looking for alternative insurance propositions. Most InsurTechs – as we have long argued – will struggle to acquire customers sufficiently fast with a direct model, even if their proposition is superior.

This is therefore a huge opportunity for insurers and brokers to revisit their innovation and M&A strategies. There has been no better time to reconsider the customer proposition and identify InsurTech and other partners to help accelerate their time to market.

Get market insights straight to your inbox