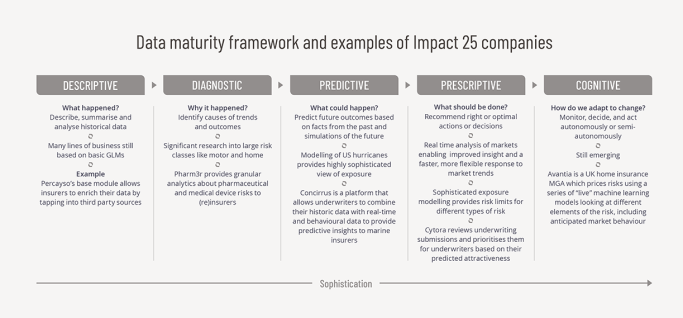

The maturity of data and analytics in insurance is hard to describe. Insurers have world-class expertise in some areas such as motor and hurricane risk modelling; in other areas such as specialty underwriting or casualty aggregation, capabilities are still evolving. When it comes to optimising underwriting and claims processes many corporate and specialty underwriters are flying on instinct.

Insurers need to develop their capabilities at all levels of this maturity framework.

What does this mean for insurers?

Companies need to rethink how they make use of these new sources and techniques and succeed in the digital decade. They will move from large internal databases to ecosystems of interconnected data sources and analytics platforms. The impact will be a transformation in the underwriting and claims functions.

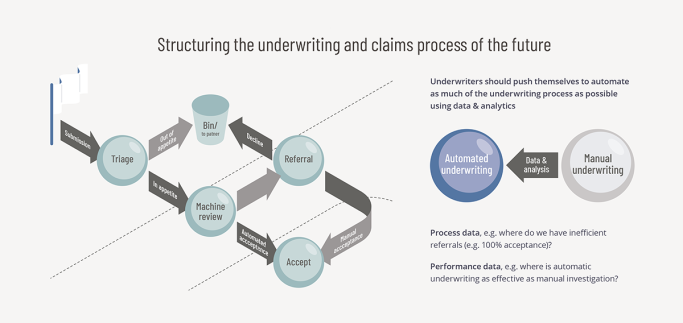

First, companies will need to rethink their underwriting submission and claims notification triage process. The level of maturity varies across the industry, with volume lines underwriting being relatively advanced but specialty underwriting and all claims lagging behind. For example, many claims triage processes are still a basic queuing system. Technologies like AI and Natural Language Processing can create transformational change here.

Second, companies need to automate as much of the underwriting and claims handling process as possible. The ambition should be a no-touch model across the business – recognising that for some risk classes or types this is likely to remain an unattainable goal.

For complex risks and claims, the starting point is collecting robust data about the process and outcomes. For example: How are we applying discounts? How does our conversion rate vary depending on which policy sections are included? Where are our claims handling costs high? Companies like Optalitix help in this area by moving the underwriting and pricing process from Excel spreadsheets to web-based models, allowing a wide range of data to be collected for future analysis.

Over time this should lead to a higher rate of automation. This will bring with it a shift of power from experienced underwriters or claims handlers to data-driven portfolio managers and technologists. And rightly so – it is surprising how many underwriters and claims handlers have escalation processes with near 100% acceptance rates, the sort of finding where a data-driven manager will quickly spot and eliminate.

Finally, insurers need to determine which capabilities they build in-house and what they outsource. For example, data-driven MGAs are well placed to develop underwriting and claims processes in niches requiring only portfolio oversight by the carrier. Hokodo allows merchants to offer ‘buy now – pay later’ payment terms to SMEs. It conducts its own credit risk assessment and is backed by a credit insurance policy from SCOR. Flock develops rating schemes for novel risk classes and is currently focused on drone and fleet risk.

Whilst delegating underwriting is nothing new to the market, the landscape is evolving fast and insurers are faced with a complex array of decisions to become the underwriters of the future.

Download the 2021 InsurTech Impact 25