Transforming the operating model

24 April, 2025

In October we launched our 2024 paper about ‘Strategic Imperatives for P&C Reinsurers in 2025’. The paper is based on our work with numerous reinsurers and analysis of our Reinsurance Market Model, which contains detailed performance data on 19 of the largest P&C reinsurers accounting for nearly $400bn of premium.

Despite an outstanding 2023 market result for reinsurers and likely strong 2024, the market equilibrium feels fragile: traditional reinsurance capital is estimated to be up 10% in 2024; well-capitalised challengers are manoeuvring; some startups are lurking; and third party capital is steadily increasing. The outlook for 2025 is uncertain.

In section 1 of this report we briefly reflect on 2023 market performance.

In section 2, we consider two challenges that P&C reinsurers need to navigate in 2025.

In section 3, we consider four areas where reinsurers need to act in 2025:

4. Transforming the operating model: Elevating operational strategy and change capability in the business to build a future-fit organisation that can scale efficiently

We observe that many reinsurers’ operating models have evolved ‘organically’ over the last decade or more. Management focus has been on the front office and operations have had to be ‘good enough’ to enable the underwriting organisation. The result is underinvestment in technology and processes by many.

The operating infrastructure is beginning to creak. People are working harder and harder and key-person dependencies are increasing in manual processes. Many reinsurers are beginning to take a more robust approach to their back offices.

Reinsurers now have access to tools that were not available to them even two years ago. Some InsurTech vendors have survived the shake-out of the last five years and can help reinsurers digitise different elements of the value chain. Generative AI could have a transformational impact on reinsurance operations. In our recent report on the maturity of Generative AI, we identified over 100 use cases that have the potential to transform the reinsurance industry.

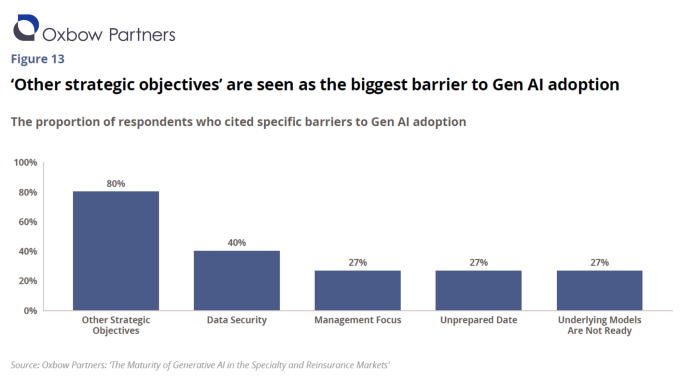

An interesting finding in that report, which included in-depth interviews with 22 reinsurance and specialty players, was that conflicting priorities was one of the major impediments to making progress on Generative AI.

Thinking about this insight more broadly, we observe that many reinsurers have very limited change capacity and in some cases capability. Change is often viewed as a ‘side-of-desk’ activity for colleagues, and strategic decisions risk not being translated into delivery roadmaps with adequate resourcing and governance. As organisations grow, it is essential to create a clear link between corporate objectives and the change roadmap, and to elevate the change capability to be able to deliver results in an increasingly large and complex operating environment.

Questions for management:

- Is there clear strategy architecture that allows the organisation to cascade corporate objectives into a change roadmap?

- Are we clear on our corporate transformation objectives and how they relate with each other?

- Are we clear about which capabilities are required to allow us to outperform and which just need to be ‘good enough’?

- Are we clear about what unlocks value – do we need to focus on our data and technology foundations or are we ready to embrace the latest technologies and tools?

- Do we have the right change capability and capacity for the current phase of development?

- Do we have the right skills in the organisation to create change where it is needed?

- Do we have an approach to resourcing that ensures that the right people are working on the right things, and not just on the things that interest them most personally?

- What is the organisation’s posture towards Gen AI?

- Is the objective to lead or follow?

- In what areas should efforts be made, and how should this R&D activity be organised?