Underwriter workbenches are gaining traction in the London Market. Workbenches allow more efficient and effective underwriting, and support data and technology-led processing with the depth of market expertise for which the London Market is known.

In this article we look at the key features of an underwriter workbench, bringing to life the value a workbench provides. An accompanying infographic post provides an overview of the lessons we have learnt from workbench implementations across the market. You can see Collections of underwriter workbench vendors on our Magellan insurance technology navigator.

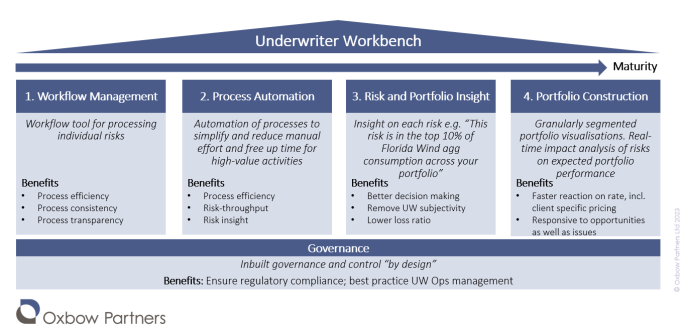

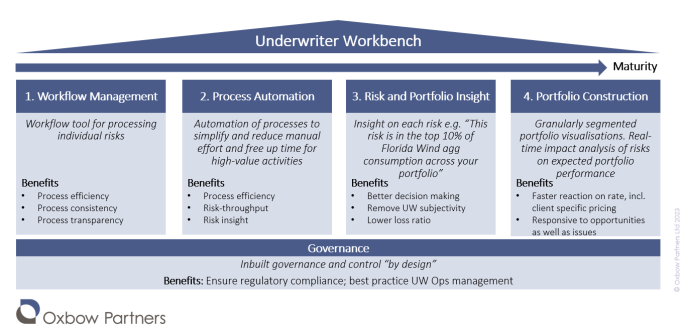

Underwriter workbenches comprise four main components. Workflow management is at the heart of any workbench and more mature workbenches include process automation, risk insight and portfolio management capabilities. Given that the level of maturity in the market is still relatively low, underwriter workbench and workflow management are sometimes incorrectly understood to be the same thing.

Figure 1 - Core components of an underwriter workbench

1. Workflow Management

A workbench allows underwriters to take new business and renewals from opportunity through to submission and bind. Workbenches drive consistency across classes of business making process improvement easier, although there need to be modules to cater for class specificities (for example, a workflow for the cleansing of schedules of values (SOVs) for property classes).

Digitised workflow eliminates messy, inconsistent spreadsheet-based approaches traditionally used in the market and instead creates a transparent, manageable deal and task flow. Advanced workflow directs underwriters towards the most important thing at any one time. Underwriters using sophisticated workflow report feeling more in control of their workload and underwriting management teams can use operational MI to spot issues and drive process efficiencies.

The value: Efficient and consistent processes; underwriter time freed up to focus on more valuable tasks; data availability and quality for operational, risk insight and risk management tasks.

2. Process Automation

Process automation can be applied to repetitive and dull tasks. Simple use-cases include things like sanctions or other compliance checks and submission capture, usually because these are stand-alone tasks that do not need to be integrated with up- or down-stream data. More mature workbenches can automate submission flow to third party outsourcers, offer advanced pipeline management and automate data flows between, say, exposure management and pricing systems.

Process automation also enables digital distribution opportunities, where less complex risks are quoted and bound without underwriter involvement.

However, process automation is not as simple as it sounds. Data extraction and ingestion has been the next ‘big thing’ for some years now. While increasingly sophisticated (and London Market specific) tools are available, few players have so far successfully implemented full pre-bind data capture, particularly at the level of granularity underwriters really need like sub-limits and deductibles by coverage or region, fully automated SOV extraction, and so on. However, by pushing targeted use cases and making third party outsourcers more effective, carriers can make iterative improvements and drive down cost and increase both speed to capture and data quality.

The value: Process automation frees up underwriter time to focus on risk selection and broker engagement; better data quality; process consistency; for high-volume business, opportunity to move towards automated underwriting.

3. Risk & Portfolio Insight

Data, analysis and insight is what underwriters really want. The workbench of the future might be best thought of as a cockpit, with dashboards to plan your flightpath and levers to manoeuvre the plane.

Every insurer has a range of dashboards and reports. Indeed, most have too many. The role of the workbench is to consolidate reporting and generate data from accurate, well-understood sources of data at the right time. Data includes both internal and external data sources pulled via APIs. Workbench design provides an opportunity to rationalise the data and insights provided to underwriters, and to be deliberate about where different lines of business merit a deviation from a single standard.

This insight can then be fed to underwriters at point of underwriting to allow for better decision-making. The most mature players combine multiple risk attributes into a single overarching risk score.

This also forms the start of the AI and machine-learning journey. Once insight processes are robust, algorithmic and analytical techniques can be overlaid and generate significant competitive advantage.

The value: Consistent, rationalised MI; greater insight for decision-making.

4. Portfolio Construction

Underwriting performance is a combination of portfolio construction and risk selection. A mature workbench should actively guide underwriters’ decision-making based not only on their view of the individual risk, but also on centrally-set targets. For example, the workbench can help underwriters understand the impact of a single risk on overall portfolio construction like, say, real-time analysis of the impact of a risk on California quake agg consumption.

The underwriter workbench also offers opportunities for active portfolio management. Carriers who identify portfolio issues quickly can immediately change their risk appetite or update their gross-to-net strategy. Conversely, CUOs can spot opportunities and write more of a certain type of risk.

The value: Active portfolio construction; active portfolio management; both improving portfolio performance and long-term performance.

5. Governance

Workbenches offer opportunities to improve governance and underwriting controls.

Operational data allows management to make changes to processes, organisational design, training and more. Consistent activity and portfolio data can be used to monitor underwriters’ performance, ensuring, for example, that only risks within appetite are being bound and that pricing is determined appropriately. More sophisticated workbenches can stop bad things happening (e.g. avoid that risks are bound without a sanctions check, prevents pricing from being retrofitted after the event), rather than just spot where they have happened.

When implemented well, governance and control gives management the confidence to delegate more and underwriters the freedom to focus on doing the best job they can in their field of responsibility.

Workbenches can also provide a framework for enhancing your underwriting processes. For example, you could insist on underwriters completing a structured set of underwriting notes, demand justifications for quoting below a modelled technical price, and ensure documentation is uploaded and tagged before closing out a risk. Whatever you decide, an audit trail provides you with the data you require to steer the business.

**

An accompanying blog post provides an overview of the lessons we have learnt from workbench implementations across the market. You can see Collections of underwriter workbench vendors on our Magellan insurance technology navigator.

View all posts in this series:

- Underwriter workbenches: More than just workflow

- Underwriter workbenches: Lessons from the road

- Underwriter Workbenches: Decoding the vendor landscape