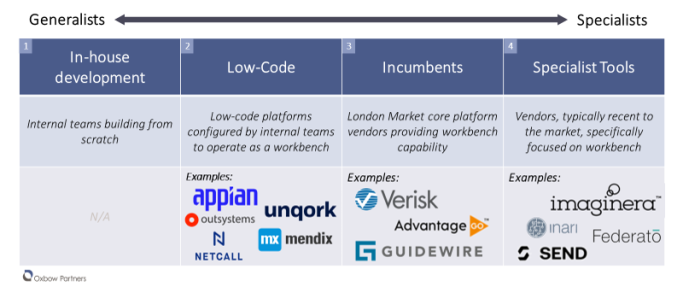

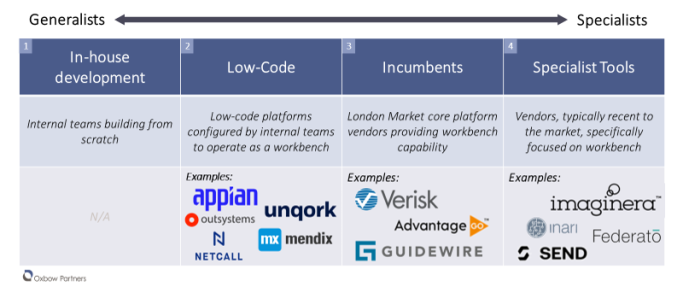

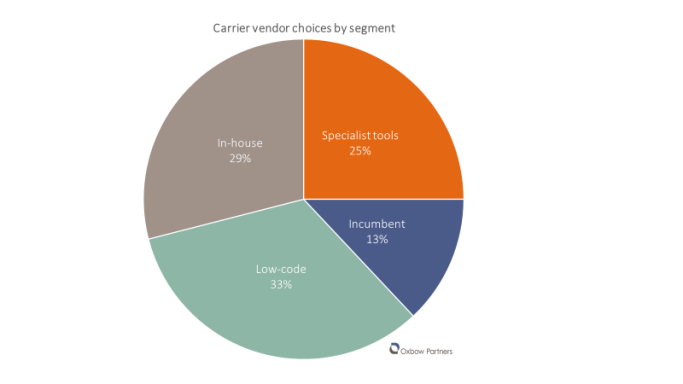

Figure 1: Vendor landscape segmentation

1 In-house development

In-house teams generally build their own tools using a combination of pure code development and industry-agnostic development tools (e.g., Amazon Web Services, .NET, etc.).

Why choose this option?

If you have a large tech team with a broad range of development and product management skills, then in-house may still be the best option. Clearly, a bespoke build will create software most aligned to your needs – but in-house development costs are typically much higher than other vendor solutions. There are also significant risks of ‘reinventing the wheel’ and of creating long-term maintenance issues in terms of both cost and management focus.

If this is you, consider an in-house build:

- “I have a strong technology team with a track record of complex in-house development”

- “I believe I will get a competitive advantage from owning the development roadmap”

- “I want – and can deliver – instant and bespoke support if a problem arises”

- “I am in a part of the market that I believe is poorly served by the market solutions (e.g., treaty reinsurance)”

2 Low / No-code vendors

Low-code vendors offer flexible platforms that can be configured by businesses to build their own tools (e.g., workbenches). Typically, low-code platforms are market agnostic, but many have some pre-configured components that accelerate implementation (e.g., an exposure management reporting module).

Why choose this option?

Low-code vendors often promise that non-technical executives can configure their own tools, but this is rarely the reality. In our experience, there is always a need for tight change management and governance around delivery, and sometimes even a need for bespoke coding.

Low-code vendors are a good solution for businesses that want a mixture of control and the benefits of pre-made capability. However, the functionality is not out of the box so stand-up times are typically longer than vendor-built tools and they do have restrictions on what can be developed which is where bespoke code would come in.

If this is you, consider a low / no-code vendor:

- “I value the competitive advantage I believe I will get from full control over the development roadmap”

- “I have a robust change management capability to support a form of in-house development but not necessarily good experience with technology-led change projects”

- “I have the internal knowledge and experience to develop market-leading workbench capability”

- “I value the simplicity of a configuration tool and believe it has all the capability I need to build a workbench”

- “I am in a part of the market that I believe is less well served by the market solutions (e.g., treaty reinsurance)”

Example vendors:

Low / No-code providers: Case Study

Who? A Lloyd’s syndicate wanted to deliver an underwriter workbench that enables data-driven underwriting, drives process consistency across the organisation and enhances the operational MI available for reporting.

Problem statement

- Reliance on spreadsheets for critical underwriting activities such as workflow tracking and pricing

- Process inconsistency across underwriting classes of business leading to lack of proper governance and business control

- Significant manual data entry burden preventing the underwriting community from focusing on value-add activities

Results of implementing a workbench

- Consistent, clearly defined process and underwriting workflow with the ability to monitor and report on a risk-by-risk and underwriter-by-underwriter basis

- Single pane of glass to surface portfolio management and risk performance metrics

- Single user interface for underwriters to access all third party tools and solutions used within the underwriting process

3 Incumbents

Incumbent software providers such as policy administration systems (PAS) providers are increasingly offering workbench functionality, which can either be accessed through the core system or standalone.

Why choose this option?

These large vendors are industry experts. They often have decades of experience, which has some obvious pros and cons (e.g., market knowledge vs. some biases about how to do things best). Unlike low-code vendors, these vendors come with capability out of the box.

If this is you, consider an incumbent vendor:

- “I value the tight integration with other tools I’m using”

- “I feel that larger vendors are likely to be around for longer”

- “I may need capabilities beyond pure development, which I’d be keen to access from the same vendor”

- “I want to access off-the-shelf capability”

- “I am excited by the investment roadmap of a larger vendor”

Example vendors:

Incumbent vendors: Case Study

Who? A tier-1 commercial insurer working in the mid-to-large commercial market wanted to improve its underwriter experience and performance. The client also wanted to improve the customer experience, for example reducing internal referrals for submission-to-quote by empowering underwriters in branch offices.

Problem statement

- Reliance on ageing legacy technology environment and historic underinvestment in mission-critical systems and processes

- Significant business leakage caused by delays arising from slow internal referral processes between request submission and quote

- Underwriter attrition arising from the impression that poor processes hindered success, and poorly targeted reward measurement

- A Group target to double GWP over a 3-year period

Results of implementing a workbench

- Accurate data provided to underwriters at the point of decision, drawn from a single data source

- Large decrease in decision-making time for risk acceptance leading to a quadrupling in submissions being converted to quotes and a subsequent doubling of quotes being converted into written business

- A well-incentivised workforce with greater job satisfaction, better management of under-performers and targeting of training, with lower unwanted attrition

4 Specialists

Specialists are often newer start-ups that focus solely on building workbenches.

Why choose this option?

These businesses enjoy the perception of being more cutting-edge, unlocking untold benefit in their clients’ businesses. Specialists – as the name suggests – often have a narrow focus and expertise (e.g., insurance vs. reinsurance) that needs to be considered, and there is usually a need integrate, for example with the PAS.

However, specialists are typically smaller than their incumbent competitors, which can spark concerns about longevity, experience and capabilities to support major transformations for enterprise clients who are used to ‘full service’ partners.

If this is you, consider a specialist:

- “I want a partner who has done exactly what I need before so that they can advise me on what I need”

- “I want a workbench that is constantly evolving and being updated so that I remain at the cutting edge”

- “I worry that larger vendors will pivot away from workbenches at some point, leaving me exposed”

- “I value working with scale-up businesses and the nimbleness this provides, and am comfortable with the downside risks too”

Example vendors:

Specialist Tool: Case Study

Who? A global insurer wanted to find a way of becoming more agile, accurate and profitable by tackling legacy challenges and bottlenecks in its underwriting system.

Problem statement

- Data sprawl making it hard for underwriters to quickly access intelligent data

- Reliance on slow, inefficient manual processes to manage huge volumes of complex data for pre-bind activities

- Over-reliance on Microsoft Office tools for tracking and managing work

Results of implementing a workbench

- An insight-driven organisation that made better decisions faster

- An efficient data operating model, collecting data just once with seamless ingestion

- Standardised underwriting journeys enabling a clear understanding of risk, allowing focus on core work that drives growth

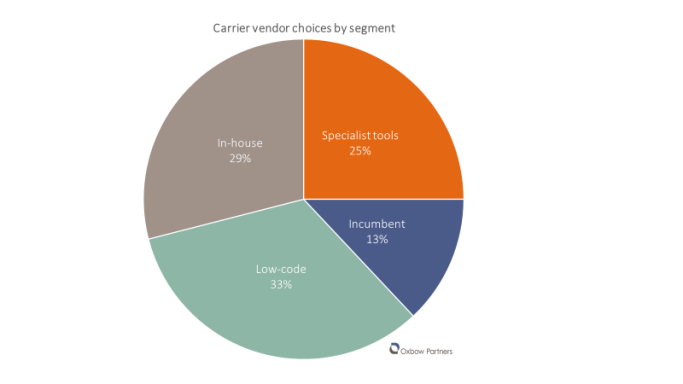

Which vendors are carriers choosing for their workbench?

In our experience there is no one right answer for selecting a vendor. The choice comes down to the business and functional requirements, taste and risk appetite.

In our view the key considerations are:

- Strategic objectives: What are you aiming to achieve from an underwriter workbench (e.g., operational efficiency, increased MI and performance capabilities)? And, how does this tie into your broader underwriting, technology and digital strategy?

- Capabilities: What is your current maturity across people, process, technology & data and change? Where are you trying to get to and what is a realistic timeframe?

- Delivery: How much are you willing to invest and what is your appetite for delivery complexity and risk?

Our analysis shows that most carriers have chosen either in-house or low-code tools. As specialist tools and low-code platforms mature we are seeing these becoming the most popular choices. We are also seeing a slight increase in enthusiasm for incumbents recently. We believe this is down to a gentle thawing of relationships between core vendors and market participants after a tough few years over covid where some vendors struggled with resources.

Figure 2: Oxbow Partners' analysis of vendor choices by London Market carriers 2023

Over the next 2-3 years we expect specialist tools to overtake in-house as at least the second most popular choice.

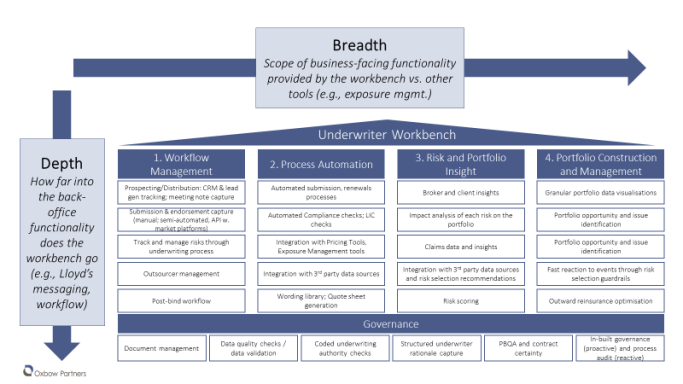

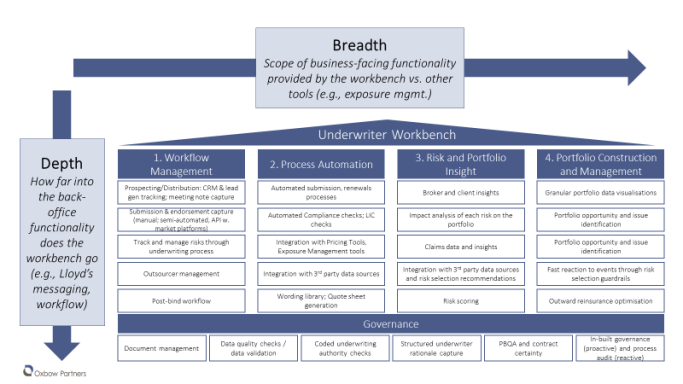

What architectural choices are people making?

Underwriter Workbenches are often integrated into an existing and complex technology architecture. This means the workbench either relies on existing tools for functionality or is taking over responsibilities from others. This can sound like the sole domain of the technology team, however we believe underwriters need to be involved as the decisions can have an impact on the carrier’s ability to compete.

When looking at the architectural choices there are two dimensions:

- Breadth – which business functionality is the tool taking on vs. relying on other tools (e.g., exposure management, pricing etc)

- Depth – how far into the back-office does the underwriter workbench go. For example, are you still relying on the PAS for the policy lifecycle management or just as a policy ‘system of record’ and regulatory reporting?

Figure 3: Workbench architectural choices

Assessing the breadth and depth of the workbench requires a set of architectural decisions to be made. This includes considering various factors. For example:

- Strategic focus of the workbench: Is it the single pane of glass for u/w vs. a portfolio management tool?

- Strength of existing specialist tools: How mature are the existing specialist tools and to what extent can you rely on them to provide the breadth of functionality?

- Integration-readiness of existing architecture. How integration-ready is the existing tooling?

- Strategic view of the PAS: Is the PAS considered a strategic asset on which you rely for core capability (e.g., workflow) or is it seen as a system of record that you want to ‘hollow out’?

- Technology delivery maturity: how mature is your capability to deliver technology and change programmes? Would you be better off running a ‘light’ workbench which requires less delivery effort?

Given the strategic nature of some of these factors, we strongly believe that underwriting and technology teams need to work together to systematically assess the options.

What’s next for carriers?

Underwriter workbench implementation is currently one of the most prominent technology decision carriers are making. Given that the vendor landscape and the architectural decisions are complex, we believe that clients need to consider carefully and strategically which option best suits them.

If you are looking for help understanding your options and selecting the best tool for your needs, please get in touch.

View all posts in this series:

- Underwriter workbenches: More than just workflow

- Underwriter workbenches: Lessons from the road

- Underwriter Workbenches: Decoding the vendor landscape