Lloyd’s Blueprint Two Update: In a nutshell

31 January, 2022 Greg Brown

On 28 January 2022 Lloyd’s released the second edition of their Blueprint Two Interactive Guide. The release of the second interactive guide is the fifth major publication related to the marketplace’s Future at Lloyd’s transformation programme initiated by CEO John Neal. It follows the original Prospectus, Blueprint One, Blueprint Two and the first edition of the Interactive Guide. It is the first release following the JV between Lloyd’s, the International Underwriting Association (IUA), DXC and is supported by the LMA. The Oxbow Partners team has gone through the 175-slide guide and summarised it for those short of time.

How did we get here?

The second Interactive Guide comes seven months after the first Interactive Guide was published and fourteen months after the release of Blueprint Two. When Blueprint Two was released it narrowed the scope of the initial transformation programme announced in Blueprint One. The focus concentrated on modernising open market risk placement, DA facility and risk placement and claims processing journeys.

To refresh your memory of Blueprint Two, read our synopsis and the Oxbow Partners View.

Since the announcement of Blueprint Two, work has gone into a few key areas including the first iteration of the Core Data Record (CDR) for North American property, as well as the first release of the Delegated Contract and Oversight Manager (DCOM) and first iteration of the Claims Bordereaux status tracker pilot, part of the Faster Claims Payments (FCP) capability.

The first Interactive Guide released in May 2021 was Lloyd’s first attempt to advise managing agents and other market participants on what they should do to prepare their organisations for the solutions being delivered by Future at Lloyd’s. This second guide focuses on what Blueprint Two will be doing over the coming two years of delivery.

Summary of Blueprint Two: From Lloyd’s to London Market

This guide provides updates on two main topics:

- Solutions: an overview of the solutions being built

- Roadmap: a roadmap for delivery through to 2024

The overall focus remains on Open Market, Delegated Authority, Claims and Digital Accounting.

Whilst there are no great surprises, this is the first major update to not mention the ‘Future at Lloyd’s’ in any of its 175 pages. We take this as a sign that the transformation programme is repositioning as a London Market (rather than Lloyd’s) initiative. This is supported by the wide range of participants in the ‘voice of the market’ section.

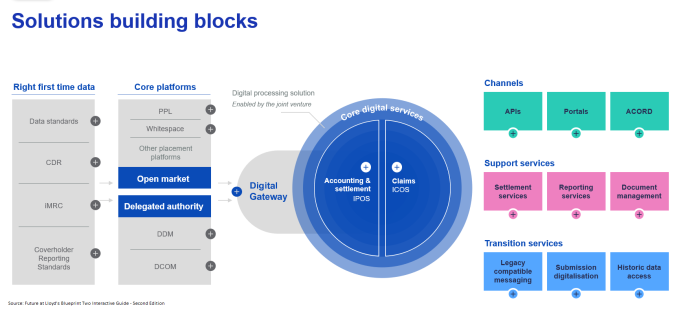

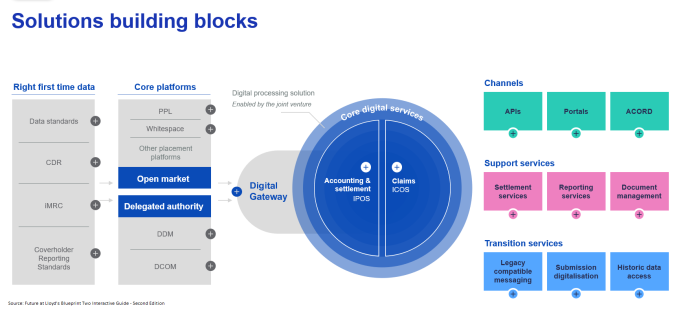

Solutions

This update tries to simplify how the solutions are presented by moving presentation from process flows to capability building blocks. Simplistically there are four main building blocks:

- Data: focused on data standards including the CDR and iMRC

- Core platforms: including open market placement platforms such as PPL and Whitespace as well as delegated authority platforms such as DDM (Delegated Data Manager) and DCOM (Delegated Contract Oversight Manager)

- Core digital services: the core digital services such as ICOS (core solution for open market and delegated authority claims processing) and IPOS (digital solution for open market and delegated authority accounting and settlement) and the focus of DXC’s efforts over the next 2+ years

- Digital gateway: the connection between market participants and core digital services

Click to enlarge

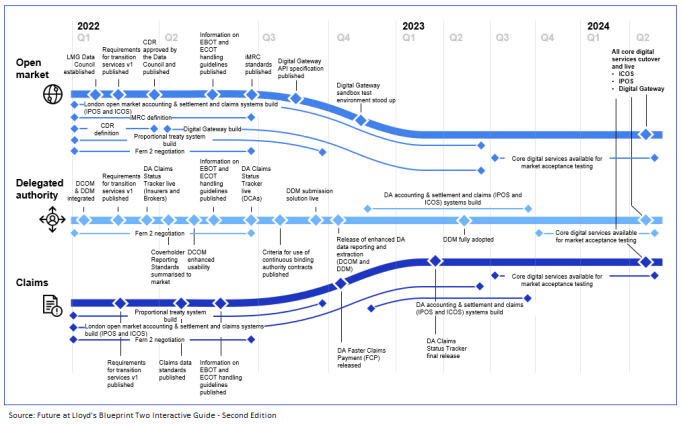

Roadmap

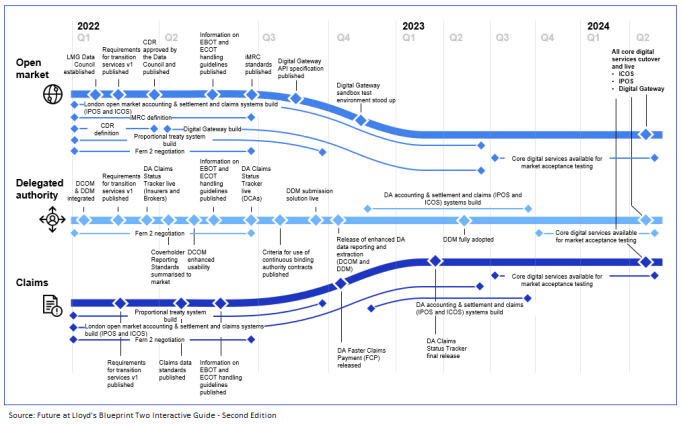

A major contribution of the latest update is an explicit delivery roadmap spanning from Q2 2022 to Q2 2024 and laying out key market milestones and the programmes of work leading up to them. These cover the three areas of focus: open market, delegated authority and claims. The intention is to move to fully digital services in Q2 2024.

This 2024 milestone implies that all market participants need to be migrated by this date. However, there is reference to ‘transition services’ for laggards, which include updates to Lloyd’s messaging, replacement of user interfaces or portals (e.g. LIDS, POSH etc) and some changes to reporting content and user credentials.

The roadmap also sets out interim milestones which include:

2022

- CDR (Core data record) approved by the Data Council – Q1 22

- iMRC (intelligent market reform contract) standards published – Q2 22

- Digital gateway sandbox test – Q2 22

- Claims data standards published – Q2 2022

- DDM submission solution live – Q3 2022

- Enhanced DA reporting on DDM and DCOM – Q4 2022

- DA Faster Claims Payments (FCP) released – Q4 2022

2023

- DA Claims Status Tracker final release – Q 2023

- DDM fully adopted – Q2 2023

- DA accounting and settlement systems built (IPOS and ICOS) – Q3 2023

- ICOS and IPOS build complete ready for market acceptance testing – Q3 2023

Click to enlarge

The Oxbow Partners team will be considering this document in further detail over the next few days and will publish an analysis piece. Subscribe using the button below to receive it straight to your inbox.