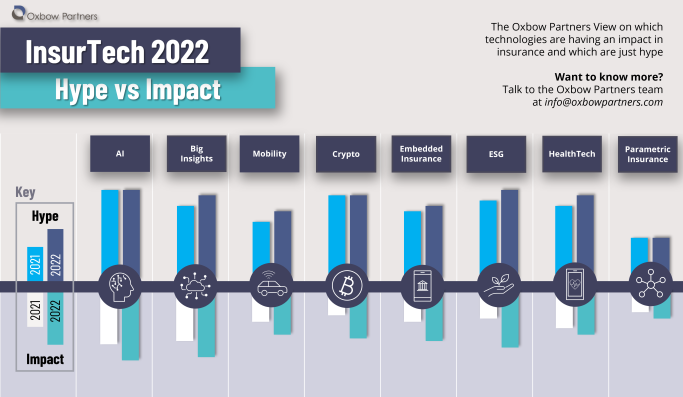

InsurTech 2022: Hype vs. Impact

18 January, 2022

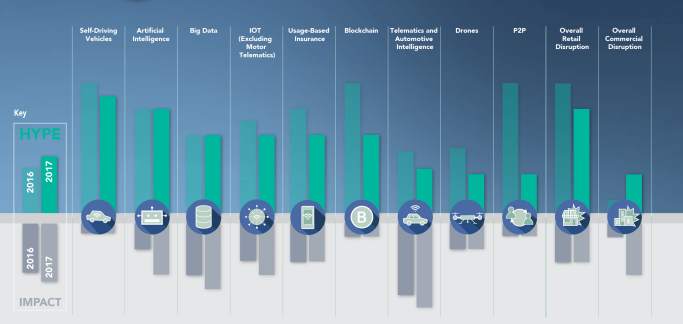

InsurTech is no stranger to hype but with 2020 and 2021 bringing far more change than anyone bargained for, the industry has seen a fresh round of predictions and speculation. In 2017 we set out to sort the substance from the sensation in our first hype vs. impact article, as shown in the infographic below. In 2022 we revisit our predictions and set out our stall for the future.

2017 vs. 2021: How did we do?

Thankfully the majority of our 2017 predictions have come to fruition with AI, big data, IoT, usage-based and telematics insurance all continuing to have an impact. As predicted, other areas have not been so lucky and have, therefore been dropped from our 2022 assessment. In particular:

Self-driving vehicles: Autonomous vehicles saw huge hype in 2017 but with predictably little impact since, given the complexity of getting to mass adoption. We are still waiting for the ‘autonomous revolution’ which we believe will come, but not in the near future. In the meantime the emphasis is on the future of mobility (see below).

Blockchain: Blockchain as a disruptive technology in insurance has not materialised in a meaningful way despite continued hype surrounding decentralised ledgers. In 2022, we turn to the hype surrounding cryptocurrencies to see if this offers more promise.

Peer to Peer: We previously commented that P2P was just too complicated for insurance and this has proved to be the case with many InsurTechs evolving closer to micro-mutuals than genuine P2P or pivoting away from the model altogether, as Lemonade did in 2017.

Drones: We did not expect drones to become mass market in 2017 and while commercial drone use has increased it remains a niche area for the industry covered by insurers such as 2018 InsurTech Impact 25 member, Flock.

Retail and commercial disruption: In 2017 innovation was much more segmented by market segment. We no longer see this segmentation as helpful.

Our 2021 assessment

Artificial Intelligence (AI)

Since we reviewed AI in 2017, hype and impact alike have shown little sign of diminishing. AI is being employed in a variety of ways by insurers, most notably in claims management and data analysis. Tokio Marine is using an AI-based vision system to automate vehicle damage appraisal and US insurer Root employs AI in its data analysis of claims to detect potentially fraudulent discrepancies. AI is proving to be a useful efficiency savings tool for insurers which ultimately means more competitive premiums for customers. Moreover, AI processing is a key aspect of several other trends assessed here.

However, there is growing backlash against algorithms’ potential to mechanically profile and discriminate against individuals, giving rise to speculation within the industry and the possibility of tougher regulations.

Our recommendations: Start to drive scale in your use of AI where most relevant to your business (e.g. customer experience, data insight).

Big Insights

In 2017, managing big data was the critical legacy issue plaguing insurers. However, as our 2020 benchmark survey revealed, insurers have now shifted from small scale trials to improved core management of data through technology and governance. For 2022, focus has shifted from data capture to producing insights which can augment product creation and underwriting. AI is a major tool being used by insurers and solution providers to analyse thousands more variables and data points than traditional methods. The so-called “bionic underwriter” appears to be a next step in the evolution of insurance data, one which will enable not just improved underwriting but faster scaling up of products. Add to this the impending implementation of Open Finance and insurers should expect to be analysing ever-larger amounts of non-proprietary data. Good data management will still be critical but we believe proprietary insight trumps proprietary data and analysis capabilities will come to be an essential differentiator in 2022 and beyond.

Our recommendations: Make sure your business is set up to get maximal value from your data. Do you have the right infrastructure, people and decision making frameworks to make this happen?

Future of Mobility

Despite self-driving cars still being a long way off, the world of mobility since 2017 has changed and insurers have responded to a plethora of developments in both demand and technology. 2021 was a record year for electric vehicle (EV) sales with 18.5% of all new vehicles (305,000) being electric or hybrid. Incumbents, including Aviva and Direct Line, have been quick to respond – now offering standard EV cover. However, EVs are also a prime example of greater use of IoT in insurance. Tesla has recently employed its cars’ connected features to offer insurance that includes both “real-time” telematics and usage-based premiums.

Telematics in general has seen a drastic reduction in set up costs thanks to mobile devices and dongles replacing expensive ‘black-box‘ technology and is now reportedly used by 51% of UK fleets. Usage-based (UBI) and temporary covers have also seen considerable growth with rising demand spurred on by COVID’s disruption to the world of work. As mentioned in our recent article on flexible insurance, a flurry of new products have launched over the past two years. 2021 alone saw the RAC launch temporary car insurance and Lemonade agree to acquire UBI InsurTech Metromile. We expect these developments to continue into 2022 as cars become increasingly connected and demand for more dynamic styles of motor insurance grows.

Our recommendations: Ensure you have appropriate products in place to take advantage of the changing motor landscape, whether this is EV cover, telematics or flexible insurance. Also, consider whether you are prepared for the data implications of greater IoT connectivity in cars.

New hype in 2022

Cryptocurrency

Despite peaks and troughs in the value of Bitcoin, cryptocurrency has seen an inexorable rise over the past few years and insurance hype has followed this trend. While it is doubtful we will see a ‘big bang’ transformation to the industry that some predict in the short-term, the industry’s forays into the world of crypto have been increasing (if cautious). As observed in our most popular article of 2021, 96% of crypto assets remain uninsured leaving a huge protection gap and consequent opportunity. Lloyd’s syndicate Atrium has recently launched a product with Coincover to insure online crypto wallets against theft and AXA Switzerland is now accepting Bitcoin as payment. Moreover, decentralised platforms like Nexus Mutual (founded in 2017) continue to offer an alternative vision of risk sharing to traditional insurance. However, crypto’s overall impact on the industry still has a way to go in 2022.

Our recommendations: Identify the opportunity and relevance for cryptocurrency to your business and take practical steps if relevant. Familiarity will be key to future success.

Embedded Insurance

Rapid digitisation has allowed insurers to seamlessly integrate their products into the customer journeys of partners using APIs. InsurTechs, such as Zego, have integrated their proposition with well-known brands including Uber and Deliveroo. Similarly, challenger bank Starling has partnered with Direct Line and Anorak to offer their products alongside bank accounts. We have previously looked at 14 solution providers making this possible.

However, while the temptation might be to repackage standard products in a digital format, InsurTechs will generally design more dynamic offerings. The embedded market is still small (around 2% globally in P&C) but as a more interactive distribution channel, embedded insurance plays into the trend of increased customer data sharing which will enable greater product personalisation in the long run.

Our recommendations: Explore partnerships that would complement product sets, ensuring these are designed to take full advantage of the data sharing implications of embedded insurance.

Environmental, Social & Governance (ESG)

At its core, ESG is a method of judging the ethics and sustainability of a company and its investments. It has rapidly come to dominate industry discourse with many insurers, such as Aviva, Zurich and Swiss Re, recently making net-zero or carbon divestment pledges. Divestment is one strategy but actively ensuring renewable energy and providing climate finance is another, exemplified by specialist insurer Parhelion. As we mention in our 10 ESG trends for 2022, not being able to prove ethical credentials will come under increasing public and regulatory pressure. There is of course both risk and opportunity to ESG but with institutions such as Lloyd’s announcing new ESG measures for 2022 – the topic is here to stay.

Our recommendations: Set out a clear ESG strategy around embedding, make robust choices about where to act and where not to while being prepared for future regulatory disclosures.

HealthTech

HealthTech became a hot topic during COVID-19 but its investment has historically lagged behind that of GI InsurTechs. However, according to Mobi Health, global HealthTech investment reached a record £38 billion in 2021 as we have previously highlighted in 9 case studies. COVID-19 has been one catalyst but advancements in technology, especially AI-driven diagnostic tools, have been equally critical to enabling this ‘healthcare revolution’. Impact is already being felt, with health insurers such as Ping An employing technology to reduce the frequency and cost of claims which should allow them to remain more competitive.

Our recommendations: For health insurers, a HealthTech partnership could be a useful differentiator for consumers seeking more dynamic health products in the aftermath of COVID.

Parametric Insurance

Despite being around since the 90s, parametric insurance is experiencing something of a renaissance due to climate change and the increasing use of insurance IoT devices. It has been hyped as a solution to the growing protection gap caused by climate volatility which traditional property covers are ill-equipped to deal with.

Parametric insurance has its drawback as we have previously commented on. However, it generally offers a more transparent and quicker method of claims. In the UK this is primarily being seen in the commercial property space. For example, InsurTech FloodFlash which covers landlords and businesses using flood depth sensors has recently received backing from Munich Re.

Our recommendations: The impact of parametric insurance still feels relatively limited to commercial property cover and CAT insurers. Wait for further use cases to emerge before rushing to adopt.

Final word & runners up

One consistent theme throughout all these trends is the importance of partnerships and collaboration which we believe will continue to be a differentiator in 2022. The InsurTech landscape is now a hive of overlapping trends with cloud computing, general IoT connectivity and automation all strong contenders for this list. But remember, trends are only as good as their execution and rushing to adopt hype for fear of missing out is likely to be a misstep.

Get market insights straight to your inbox